Date: Tue, Nov 26, 2024, 09:18 AM GMT

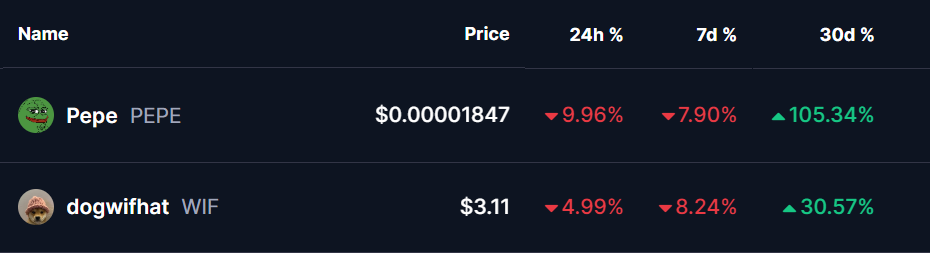

The cryptocurrency market witnessed a major correction today as Bitcoin (BTC) dropped by 4.30%, dipping near the $93,000 mark from it’s recent all time high of $99,655. This downturn has extended to the broader market, including two notable memecoins, Pepe (PEPE) and Dogwifhat (WIF). PEPE is down by 9%, and WIF is down by 5%, with both tokens already undergoing corrections since their recent Coinbase listings.

Let’s dive into the current price action, the technical patterns at play, and what could be next for these two assets.

Pepe (PEPE):

After a sharp 28% correction from its recent high of $0.00002588, PEPE has now dropped to $0.00001875, hovering within a critical support zone between $0.00001836 and $0.00001886. The price action shows a descending triangle pattern, which is typically a bearish continuation structure. This suggests that unless a significant reversal happens at the support zone, further downside could be expected.

1.Upside Potential: If PEPE bounces from this support level, the price could revisit its descending resistance trendline, which lies around $0.00002042. Breaking above this trendline would invalidate the bearish triangle and open the door to more bullish momentum.

2.Downside Risks: If PEPE breaks below the lower boundary of the triangle, it could target the next support at $0.00001480, representing a potential 20% drop from current levels.

The RSI (Relative Strength Index) for PEPE is currently near 33.63, indicating oversold conditions. This may increase the probability of a short-term bounce, but the overall bearish structure should not be overlooked.

Dogwifhat (WIF):

WIF has also seen a substantial 35% correction from its recent peak of $4.84, with its price now sitting at $3.10. Similar to PEPE, WIF is also forming a descending triangle pattern, which signals the potential for further downside if support levels are breached.

1.Upside Potential: If WIF manages to bounce from its current support zone between $3.00 and $3.17, it could climb toward the descending resistance trendline, currently at $3.41. A breakout above this level could shift momentum back in favor of the bulls.

2.Downside Risks: If the support zone fails, the next key level to watch is $2.67, which would represent a potential 14% decline from current prices.

The RSI for WIF is at 46.22, suggesting that the token is not as oversold as PEPE but still faces significant pressure due to the bearish triangle structure.

What to Expect Ahead?

Both PEPE and WIF are at critical junctures as they test their respective support levels within descending triangle patterns. These patterns often resolve to the downside in bearish market conditions, but a strong reversal could invalidate them and lead to an upside breakout.

However, their next moves could heavily depend on the broader market trend, particularly the performance of Bitcoin (BTC). BTC has shown respect to its key support at $93,000, which could serve as a springboard for a market-wide recovery. If BTC manages to hold this level and reverse upward, PEPE and WIF could potentially see rallies back toward their resistance zones.

On the flip side, if BTC fails to sustain above $93K, further downside across the crypto market is likely, placing additional pressure on PEPE and WIF. Traders should monitor these key levels and patterns closely in the coming days.

Conclusion

The descending triangle patterns observed in both PEPE and WIF indicate a cautious outlook for these tokens. While oversold conditions and proximity to support zones offer hope for a potential reversal, the broader market’s direction, particularly Bitcoin’s price action, will play a pivotal role in determining their next moves.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.