- The total memecoins market cap has fallen by 5.06% to $45.24 billion, with major tokens like Dogwifhat down 13.23% and Popcat declining 16.96%.

- Bitcoin's failure to break through $71K resistance and subsequent pullback to $63,500 has created market uncertainty affecting altcoin prices.

- Mt. Gox moved 33.96K BTC ($2.25B) to BitGo addresses for creditor repayments, creating potential selling pressure concerns.

- US Bitcoin spot ETF outflows of $18.3 million on July 30 and the Federal Reserve keeping rates unchanged at 5.25%-5.50% contributed to market decline.

Date: Thu, August 01, 2024, 06:31 AM GMT

Today, the cryptocurrency market is seeing a significant decline, with major memecoins experiencing sharp drops in their prices. The total memecoins market cap has fallen by 5.06% to $45.24 billion, following Bitcoin’s (BTC) price rejection from the $70K resistance level. Currently, Bitcoin is trading at $64,205, down by 3.25%.

Top memecoins are feeling the impact today:

- Pepecoin (PEPE) is down by 7.40%.

- Dogecoin (D0GE) is declined by 6.64%.

- Shiba Inu (SHIB) is down by 3.71%.

- Dogwifhat (WIF) is down by 13.23%.

- Bonk (BONK) is down by 10.22%.

- Book of Meme (BOME) is down by 13.72%

- Brett ($BRETT) is down by 5.82%.

- Mog Coin ($MOG) is down by 11.58%.

- Popcat ($POPCAT) is down by 16.96%.

- Cats in Dogs World ($MEW) is down by 2.73%.

- Ponke ($PONKE) is down by 10.22%.

- Turbo ($TURBO) is down by 8.55%.

Here’s Why Memecoins are Down Today:

1) Bitcoin Failed to Give Breakout:

Recently, Bitcoin had the opportunity to break out from a Bull Flag—a bullish continuation pattern, normally indicating further price increases. Despite the optimism presented in this technical setup, the price of Bitcoin couldn’t break through the crucial resistance level of $71K, but pulled back to $63,500, instead of an upward surge toward $80K. This inability to break out of the level has cast some uncertainty into the market, which in turn affected the prices of altcoins.

2) FOMC Meeting Impact:

Bitcoin price appears to have encountered significant selling pressure following the recent U.S. FOMC meeting wherein the Federal Reserve kept interest rates unchanged at 5.25%-5.50%

3) Mt. Gox Bitcoin Transactions:

Data from Arkham Intelligence shows that a Mt. Gox address moved 33.96K BTC ($2.25B) to addresses most likely BitGo for repayments for creditors. BTC could come under selling pressure if Mt. Gox creditors decide to sell their BTC to lock in sizeable profits This large-scale movement of Bitcoins is causing uncertainty and contributing to the market downturn.

4) ETF Outflows:

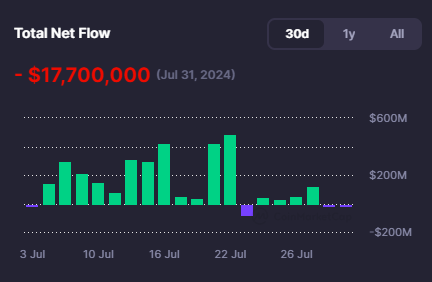

Recent US BTC-spot ETF market flow trends raised concerns about BTC-spot ETF demand.

On Tuesday, July 30, the US BTC-spot ETF market saw total net outflows of $18.3 million,

These factors are contributing to the current downturn in the cryptocurrency market, affecting not only Bitcoin but also various memecoins.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and carry risks. Always conduct your own research and consult with a professional financial advisor before making any investment decisions.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.