- Bitcoin recovered from $92,000 to above $98,000 with over 4% gains, driving positive momentum across the cryptocurrency market.

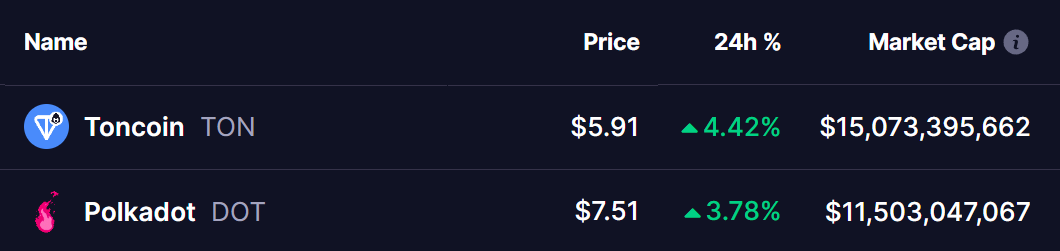

- Toncoin (TON) is trading near $5.91 and approaching a breakout from a falling wedge pattern, with potential upside targets of $6.50 and $7.22 representing over 23% gains.

- Polkadot (DOT) is trading at $7.51 and similarly positioned for a breakout from its falling wedge, with potential rally targets of $9.33 and $11.65 offering over 55% upside.

- Both tokens show bullish MACD indicators with positive crossovers, but investors should wait for clear confirmation above key resistance levels before making trading decisions.

Date: Wed, Dec 25, 2024, 09:50 AM GMT

Over the past 24 hours, the cryptocurrency market has shown encouraging signs of recovery following recent corrections. Bitcoin (BTC), which briefly fell to $92,000, has regained strength, climbing above $98,000 with an impressive gain of over 4%.

This positive momentum has extended into altcoins like Toncoin (TON) and Polkadot (DOT), both of which have surged with noticeable gains and are now approaching key breakout levels. This could signal further upward moves.

Toncoin (TON)

Toncoin (TON) is currently trading near $5.91 and appears to be following a bullish trajectory. On the 4-hour chart, TON has formed a falling wedge pattern, a classic bullish reversal structure. It is now testing the wedge’s upper boundary, hinting at an imminent breakout.

If TON manages to close above this resistance, it could target the next resistance levels of $6.50 and $7.22, offering a potential upside of over 23% from the current price.

The MACD indicator on the 4-hour timeframe is also showing positive momentum. The MACD line is crossing above the signal line, with growing bullish histogram bars—confirming the increasing strength of buyers.

Polkadot (DOT)

Polkadot (DOT) is mirroring TON’s bullish behavior. It is trading at $7.51 and is approaching the upper resistance of its falling wedge pattern on the 4-hour chart. This setup suggests that DOT is also gearing up for a breakout.

If DOT breaks above its immediate resistance, it could rally toward $9.33 and $11.65, representing an upside potential of over 55% from the current price.

The MACD indicator aligns with this bullish outlook. It has recently flipped positive, with the MACD line crossing above the signal line and bullish momentum gaining traction. This aligns with increasing buyer interest in DOT at its current price levels.

Conclusion

Both Toncoin (TON) and Polkadot (DOT) are at crucial junctures in their respective price trajectories. As the broader crypto market stabilizes and sentiment improves, these tokens are well-positioned for potential breakouts. The formation of bullish patterns, combined with favorable MACD readings, reinforces the likelihood of upward moves.

However, failure to break out above key resistance levels could result in continued consolidation or even a bearish pullback.

However, investors should remain cautious and wait for clear confirmation of breakouts above key resistance levels before making trading decisions. Remember, the cryptocurrency market is highly volatile, and risk management is essential.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research and consider consulting with a financial advisor before investing in cryptocurrencies.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.