Date: Tue, July 15, 2025 | 06:06 PM GMT

The cryptocurrency market is deep in bullish territory, with Bitcoin (BTC) skyrocketing to a new all-time high and Ethereum (ETH) riding close behind with an 18% gain this week — now approaching the $3,100 mark. This strong uptrend is spilling over into the major memecoins, and Shiba Inu (SHIB) is starting to grab attention.

SHIB has jumped 15% over the past week, adding to its growing momentum. But it’s not just the price action that’s turning heads — a harmonic Cypher pattern on the daily chart may be signaling that SHIB still has plenty of room to run.

Harmonic Pattern Hints at Bullish Continuation

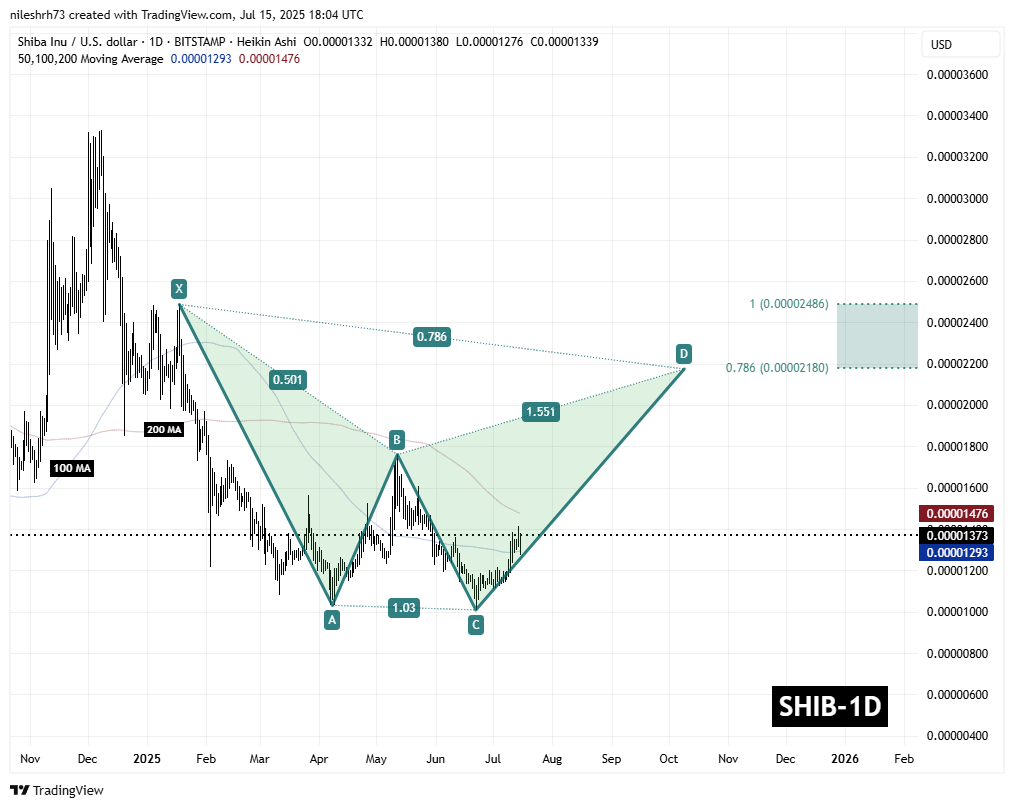

On the daily timeframe, SHIB is forming a Bearish Cypher harmonic pattern, a setup that often points to strong bullish moves during its CD leg — which is currently unfolding.

This pattern began at point X near $0.00002486, then fell to point A, rebounded to point B, and dropped again to point C around $0.00001009. Since hitting that low, SHIB has reversed course and is now trading around $0.00001373, knocking on the door of its 200-day moving average at $0.00001476 — a crucial resistance level.

According to harmonic principles, the CD leg could push SHIB into the Potential Reversal Zone (PRZ) between $0.00002180 and $0.00002486 — corresponding with the 0.786 and 1.0 Fibonacci extensions. If this pattern plays out, it could mean a gain of more than 80% from current levels.

What’s Next for SHIB?

To maintain this bullish momentum, SHIB will need to break and hold above the 200-day MA with increasing volume. That breakout could spark accelerated buying and lead to a full completion of the harmonic pattern, targeting the $0.00002486 region.

On the downside, it’s also important for SHIB to hold support around the 100-day MA at $0.00001293, which serves as a key level to prevent a breakdown of the structure.

Disclaimer: This article is for informational purposes only and reflects the writer’s personal views. It should not be considered financial advice. Always conduct your own research before investing in cryptocurrencies.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.