Date: Mon, Nov 11, 2024, 10:21 AM GMT

The crypto market is off to a roaring start this week, maintaining the bullish momentum ignited by Donald Trump’s election victory on Nov 5. Since then, Bitcoin (BTC) has been hitting new all-time highs almost daily, with the latest peak at a stunning $82,371. This rally has fueled gains across major crypto assets and even driven up prices in altcoins.

Meanwhile, Lido DAO (LDO) has experienced a significant decline, dropping over 7% in the past 24 hours. This comes after an impressive rally of 30% over the last week, with LDO currently trading at $1.26

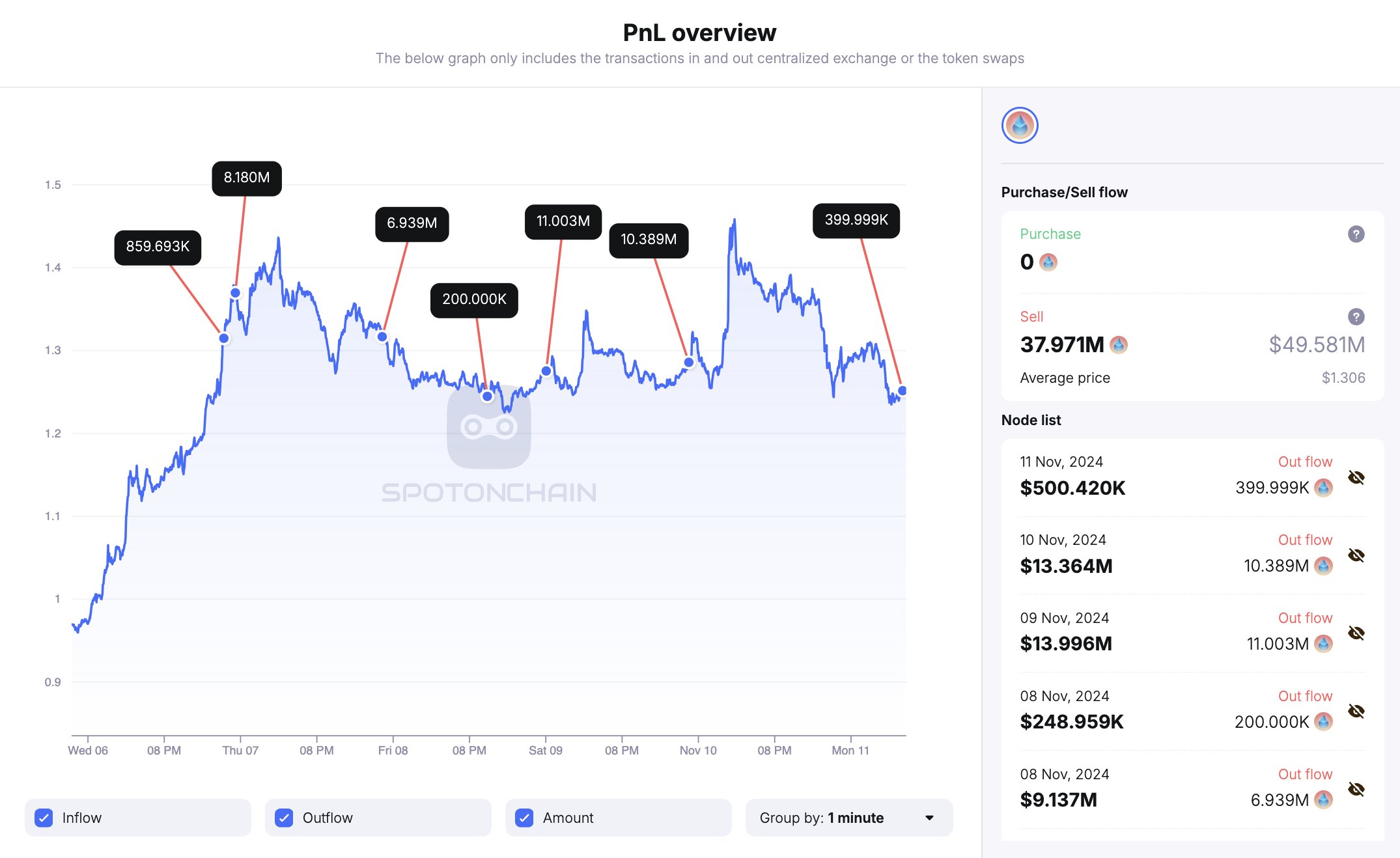

$50M Sell-off

One of the primary factor behind LDO’s recent pullback is a massive sell-off by three of the original Lido DAO members. As reported by Spotonchain, these members collectively sold nearly $50 million worth of LDO, putting downward pressure on the price. Here’s a breakdown of the sell-off:

- Paradigm deposited 36.51M LDO ($47.7M) to Coinbase Prime, reducing their holding to 33.49M LDO ($41.9M).

- Delphi Digital transferred 859,703 LDO ($1.13M) to Wintermute Trading four days ago.

- KR1 plc moved 600K LDO ($749K) to Kraken, currently holding 11.3M LDO ($14.25M).

This large sell-off during last week’s rally led to increased selling pressure, contributing to the recent price decline.

Is Recovery Ahead?

Despite the drop, LDO’s technical setup suggests that a recovery could be on the horizon. After breaking out above the key psychological level of $1.00, LDO surged to a high of $1.49, encountering resistance at this level. The subsequent rejection brought LDO back down to $1.27, with the price now hovering above a minor support level at $1.22.

If LDO continues to hold above this $1.22 support, it may signal buyer interest and a potential for a quick recovery. The price action suggests that LDO could attempt to retest the $1.49 resistance level in the short term. A breakout above $1.49 would indicate renewed bullish momentum, potentially pushing LDO toward the $1.80-$2.00 range, where the next significant resistance levels lie.

Key Technical Levels

- Support at $1.22: This level has acted as a buffer for the recent decline. Holding above this level may provide a foundation for a potential bounce.

- Resistance at $1.49: A key resistance level that previously capped the rally. A break above $1.49 could set LDO up for further gains.

- Upside Target Range ($1.80 – $2.00): If LDO breaks above $1.49 with strong volume, the next resistance levels are around $1.80 and $2.00, which would mark a substantial recovery.

Conclusion

While the recent $50M sell-off caused a temporary setback, LDO’s price action indicates that a recovery may be in store. As long as it maintains support above $1.22, the potential for a rally toward $1.49 and possibly higher remains intact. However, a break below $1.22 could signal further downside.

Investors should keep an eye on the $1.49 resistance level and look for volume increases to confirm any breakout. With BTC leading a market-wide rally, LDO might still benefit from bullish sentiment across the crypto space.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.