Date: Mon, Oct 21, 2024, 09:12 AM GMT

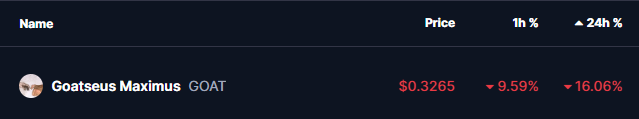

In today’s cryptocurrency market, the newly launched memecoin Goatseus Maximus ($GOAT) — which had surged by a whopping 237% over the past seven days — hit a rough patch. The token’s price dropped by almost 10% within the past hour and experienced a total 16% decline in the last 24 hours, sparking buzz among traders and investors.

Mixed Whale Activity: Profit-Taking Meets New Buys

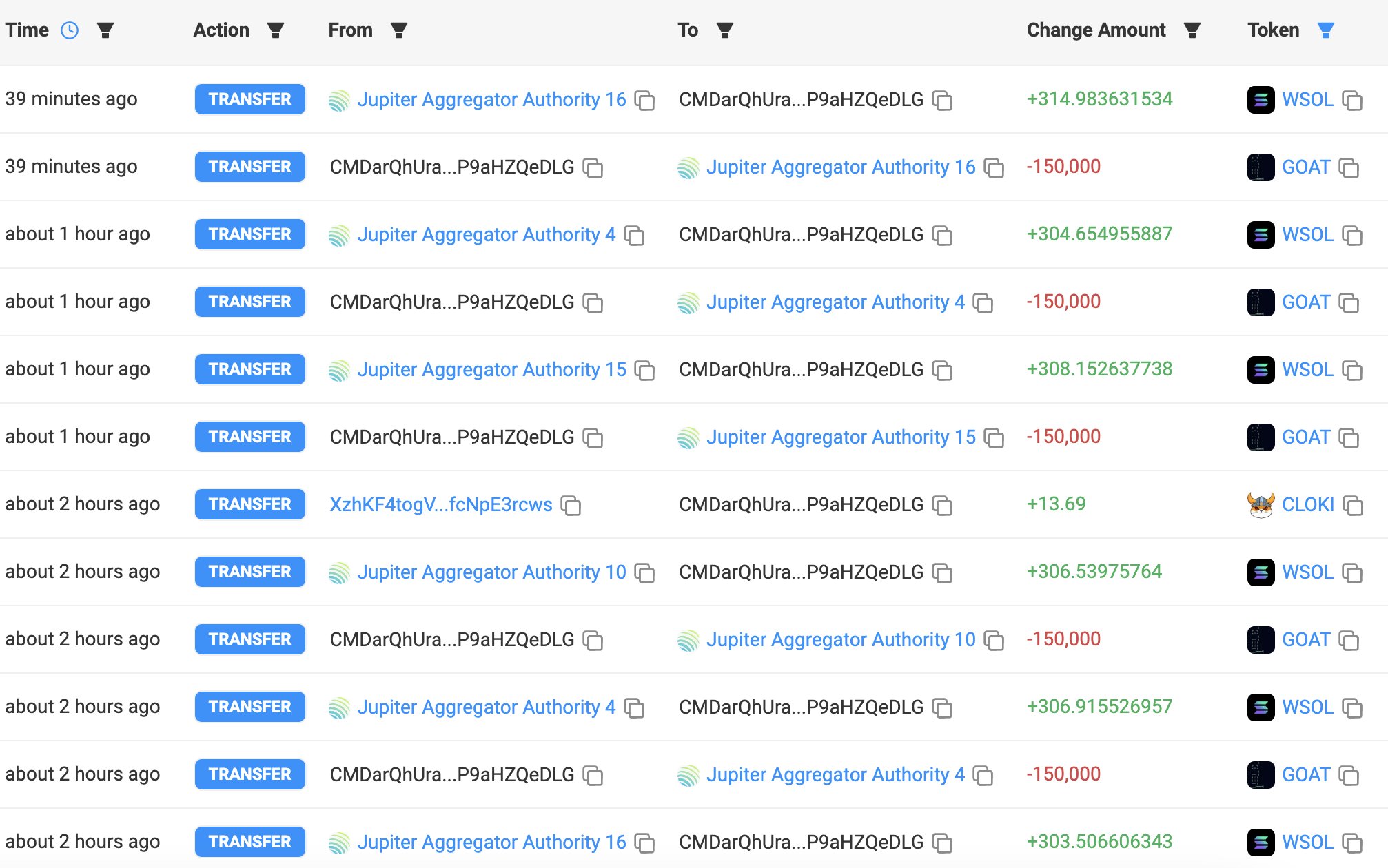

After an impressive rally, where several whales aggressively bought $GOAT, some large investors have started to cash out and lock in profits. According to data from Lookonchain, one major whale who previously accumulated $GOAT is now offloading his holdings.

This whale originally spent 602.64 SOL to buy 10.71 million $GOAT. He has now sold 9.25 million $GOAT for 19,669 SOL, achieving an incredible profit of 19,067 SOL (roughly $3.2 million) — a 32x return on his initial investment. The whale isn’t done, though, as he still holds 1.46 million $GOAT tokens, valued at around $506,000.

For more details on the transactions, you can view them here on Solscan.

Dips Attract Whales

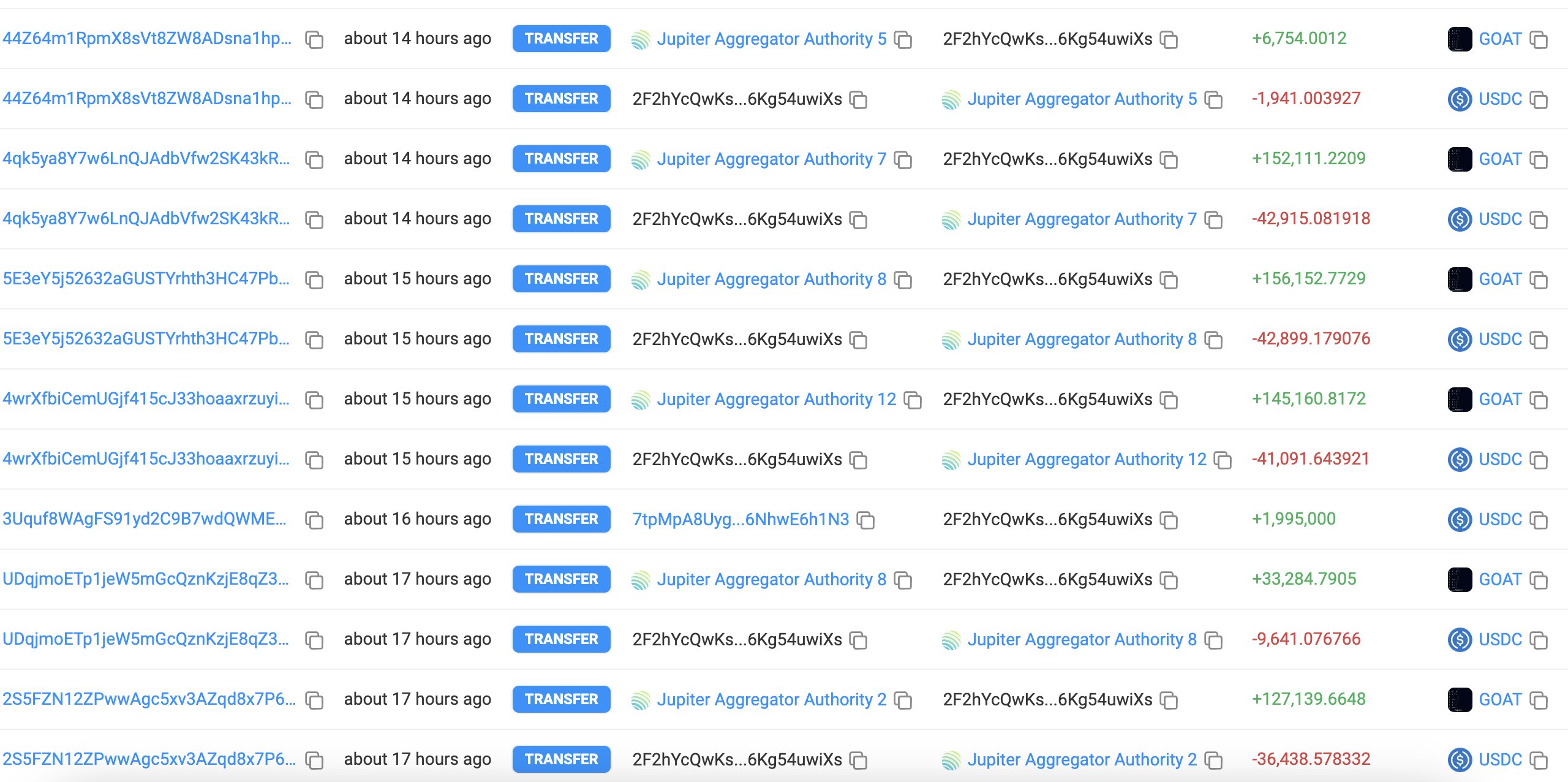

While some whales are booking profits, others seem to view the dip as an opportunity to buy more $GOAT. Earlier today, Lookonchain reported that another whale withdrew 2 million USDC from Binance to purchase additional tokens, doubling down on $GOAT.

Over the past four days, this whale has spent $7.14 million to acquire 21.39 million $GOAT tokens at an average price of $0.3338, spread across four wallets. The whale’s buying spree is still ongoing, which might hint at potential stability or further upside in $GOAT’s price.

What’s Next?

With whales both selling for profits and buying on the dip, the near future of Goatseus Maximus ($GOAT) could see some price stabilization. If buying continues, it could balance out the impact of the recent sell-off, giving traders reason to stay optimistic.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making any investment decisions.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.