Key Takeaways

- Pump.fun (PUMP) is showing early signs of a bullish reversal despite recent market volatility.

- Strong on-chain performance supports the technical setup, with Pump.fun ranking among the top revenue-generating crypto protocols over the past 30 days.

- A rounding bottom pattern is forming on the daily chart, indicating gradual accumulation after a prolonged downtrend.

The crypto market has turned green again, largely driven by easing geopolitical tensions after U.S. President Donald Trump stepped back from Greenland-related tariff threats following a productive meeting. This de-escalation sparked a risk-on mood across global markets, helping Bitcoin regain strength and lifting sentiment across altcoins.

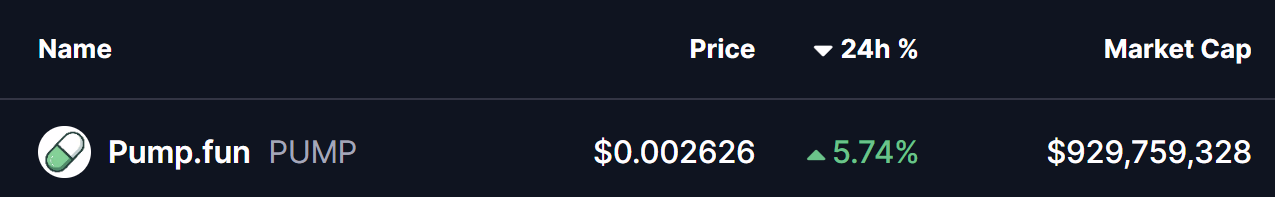

Amid this recovery, Pump.fun (PUMP) has quietly begun to stand out. While the token is up nearly 5% on the day, the more compelling story lies beneath the surface — where strong fundamentals and a improving technical structure are starting to align, hinting that a larger move could be forming.

Strong On-Chain Metrics Support the Case

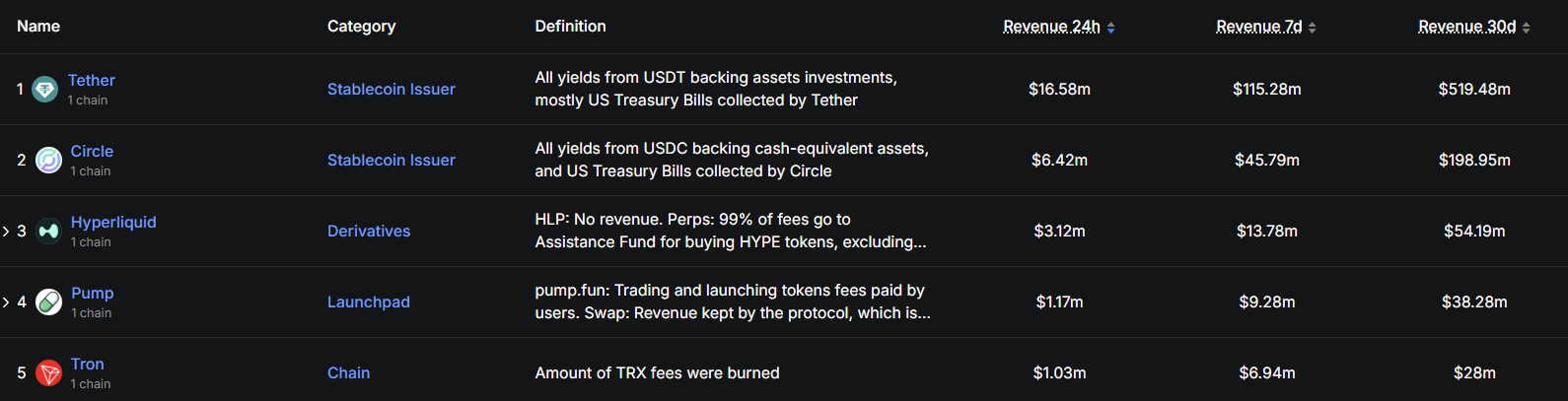

Beyond short-term price fluctuations, Pump.fun’s on-chain performance remains a major positive. According to DefiLlama, Pump.fun ranked as the fourth-highest revenue-generating crypto protocol over the past 30 days, pulling in approximately $38.28 million in fees.

This places the platform ahead of major networks like Tron, and just behind heavyweights such as Tether, Circle, and Hyperliquid. Consistent fee generation at this scale reflects sustained user activity, strong demand for the protocol, and growing relevance within the broader crypto ecosystem — factors that often act as early signals ahead of longer-term price expansions.

Rounding Bottom Formation Takes Shape

From a technical perspective, the daily chart paints an increasingly constructive picture. PUMP appears to be forming a classic rounding bottom pattern, a bullish reversal structure that typically develops after a prolonged downtrend.

This pattern represents a gradual shift in market psychology. Instead of sharp V-shaped reversals driven by panic buying, rounding bottoms reflect steady accumulation, where selling pressure fades slowly and buyers begin to step in with increasing confidence.

Back in late October, PUMP faced heavy rejection near the $0.005475 neckline, triggering a sharp sell-off that extended for several weeks. That decline ultimately found a floor around $0.00170, a level that has since acted as a strong demand zone. Multiple defenses of this area prevented further downside, allowing the base of the rounding structure to form.

Since then, price action has begun to curve higher in a smooth arc — a key hallmark of a healthy bottoming process. The recent reclaim of the $0.0026 area further reinforces the idea that accumulation is underway and that market participants may be positioning ahead of a broader breakout.

What’s Next for PUMP?

For the bullish structure to gain stronger confirmation, PUMP needs to reclaim the 100-day moving average, currently sitting near $0.00304. A sustained close above this level would mark a clear shift in short-term momentum and signal that buyers are regaining control after months of corrective price action.

Looking further ahead, the most critical resistance remains the neckline near $0.005475. A decisive breakout above this zone would validate the entire rounding bottom formation and could open the door to a much broader bullish expansion. Such a move would likely attract momentum traders who have stayed on the sidelines during the prolonged downtrend.

Until then, some consolidation or minor pullbacks are possible, especially as price interacts with the 100-day moving average. However, as long as higher lows continue to form and the rounded base remains intact, the broader bullish structure stays valid.

Bottom Line

Pump.fun (PUMP) is quietly building a compelling recovery setup. Strong protocol revenues, combined with a textbook rounding bottom pattern on the daily chart, suggest that downside pressure may be fading and accumulation is taking place. While confirmation still hinges on reclaiming key resistance levels, the overall structure points toward increasing upside potential if broader market conditions remain supportive.

For now, PUMP looks less like a fading meme token — and more like a project preparing for its next meaningful move.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.