Key Takeaways

- Bitcoin fell below $93,000 while Ethereum slipped under $3,200 amid rising global uncertainty.

- Nearly $864 million in crypto positions were liquidated in 24 hours, with longs taking the biggest hit.

- The sell-off was triggered by escalating US–EU trade tensions, not weak crypto fundamentals.

- Risk-off sentiment spread across global markets, amplifying losses in high-beta assets like crypto.

- Despite short-term volatility, Bitcoin hash rate and Ethereum on-chain activity remain strong.

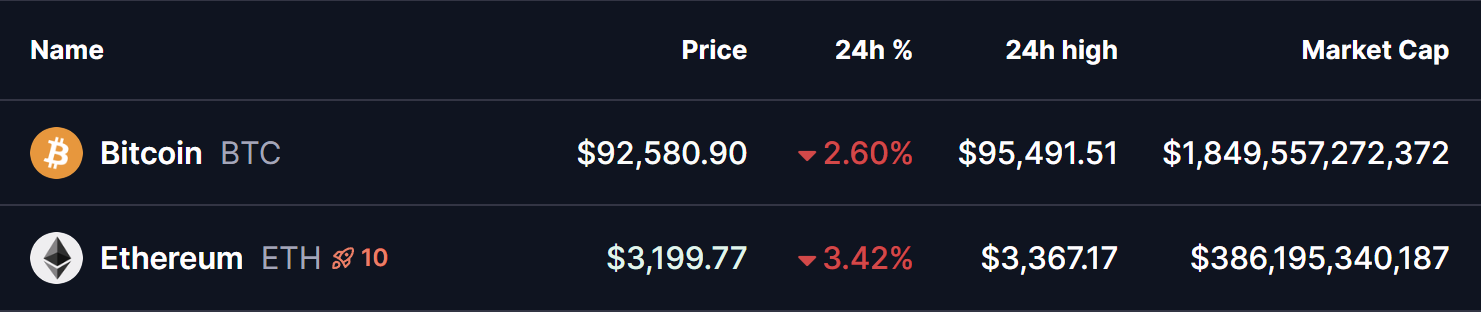

If your crypto portfolio is flashing red today (January 19, 2026), you’re far from alone. Bitcoin (BTC) has slipped to around $92,580, down roughly 2.60% over the past 24 hours, while Ethereum (ETH) is trading near $3,200 after a 3.42% decline.

The total crypto market capitalization is off by nearly 2.8%, and liquidation data paints a painful picture: close to $864 million wiped out in a single day — with long positions accounting for an overwhelming $784 million of that damage.

At first glance, this may look like just another routine crypto pullback. But today’s sell-off wasn’t random.

This Wasn’t “Just Crypto Being Crypto”

It’s easy to blame whale games, profit-taking, or speculative excess. However, the underlying health of the crypto ecosystem hasn’t suddenly deteriorated. Bitcoin’s hash rate remains near record highs, Ethereum’s layer-2 networks continue to see strong usage, and institutional interest hasn’t vanished overnight.

In short, this move wasn’t driven by weak fundamentals or internal crypto issues.

The real culprit lies outside the crypto market.

The Real Catalyst: Rising US–EU Trade Tensions

Today’s downside was sparked by a sudden flare-up in global geopolitical risk — specifically, escalating trade tensions between the United States and Europe.

Over the weekend, U.S. President Donald Trump announced a new 10% tariff on imports from eight European allies, including Germany, France, and the UK. The move followed opposition from these countries to his proposal involving Greenland, reigniting diplomatic and economic friction across the Atlantic.

In response, reports suggest the European Union is preparing a massive retaliation package worth up to $100 billion, potentially targeting key U.S. exports such as technology, agriculture, and automobiles. The possibility of a renewed transatlantic trade war instantly rattled global markets.

How Markets Reacted

The reaction was swift and unforgiving:

- U.S. stock futures opened sharply lower, with the Dow down over 1% and the Nasdaq sliding more than 1.5%.

- Risk-off sentiment spread rapidly across global markets.

- High-volatility assets like cryptocurrencies magnified the downside.

- Bitcoin plunged nearly $3,000 in a matter of hours as traders rushed to reduce exposure.

- Over-leveraged long positions were aggressively liquidated, accelerating the sell-off.

Once liquidation cascades begin, crypto markets tend to move fast — and today was a textbook example.

Bottom Line

This downturn has little to do with Bitcoin or Ethereum losing their long-term appeal. Instead, it reflects broader macro uncertainty, rising geopolitical risk, and a brutal leverage flush triggered by external headlines.

If trade tensions continue to escalate, further volatility could follow, with BTC potentially testing lower support zones near $91,450. On the flip side, any signs of de-escalation or diplomatic cooling could quickly shift sentiment — turning today’s sell-off into a familiar dip-buying opportunity.

For now, geopolitics is firmly in the driver’s seat, while crypto fundamentals take a temporary back seat.

Frequently Asked Questions (FAQ)

Why is the crypto market down today?

The crypto market is down due to rising US–EU trade tensions, which triggered a global risk-off move across financial markets and caused heavy liquidations in leveraged crypto positions.

Is this crash related to Bitcoin or Ethereum fundamentals?

No. Bitcoin’s hash rate and Ethereum’s network activity remain strong. The drop is driven by macro and geopolitical factors, not internal crypto weakness.

How much was liquidated in today’s crypto sell-off?

Around $864 million worth of crypto positions were liquidated in the last 24 hours, with over $784 million coming from long positions.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.