Key Takeaways

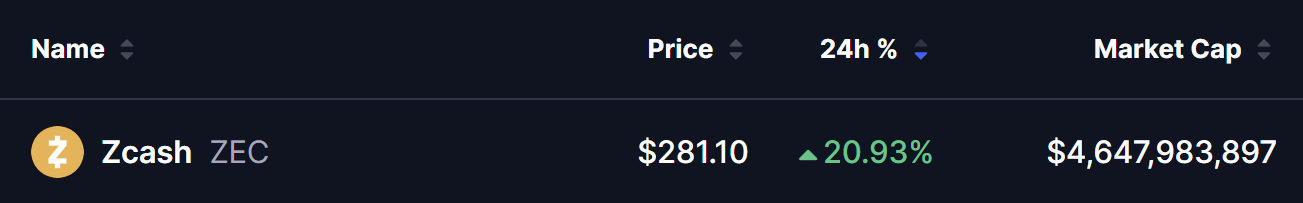

- ZEC surged ~20% as the broader crypto market bounced.

- Price rebounded from $184.88 and reclaimed the 200-day MA near $277.

- A falling wedge pattern hints at a potential bullish trend reversal.

- A breakout above $316 could open the door toward $753.5.

- Failure at resistance may lead to consolidation before the next move.

The broader crypto market is finally showing signs of relief after the recent sell-off. Bitcoin has reclaimed the $70,000 level with roughly a 5% daily gain, while Ethereum surged about 7% to move back above $2,100.

Following this recovery, altcoins are also waking up — and privacy-focused token Zcash (ZEC) is among today’s top performers, jumping above 20%. More importantly, the latest chart structure suggests this move may only be the beginning.

Let’s take a closer look.

Falling Wedge Pattern in Play

On the daily timeframe, ZEC appears to be forming a falling wedge — a classic bullish reversal pattern that often develops during extended corrective phases.

Price recently swept the lower boundary of the wedge near $184.88, where buyers stepped in aggressively and defended support. That reaction triggered the current rebound, pushing ZEC back toward the $281 zone.

Even more encouraging, ZEC has now reclaimed its 200-day moving average around $277 — a key technical milestone that often signals improving medium-term momentum.

This price behavior fits the textbook falling wedge setup: sellers begin to lose control near the lower trendline, volatility expands, and price starts rotating higher inside the structure.

What’s Next for ZEC?

If bullish momentum continues, ZEC could soon challenge the upper wedge resistance near $316.

A clean breakout — ideally followed by a brief retest holding above this area — would strongly validate the bullish reversal thesis and likely attract breakout traders. In that scenario, the pattern’s measured move points toward a longer-term upside target around $753.5.

That would represent a substantial move from current levels.

However, it’s important to stay grounded: for now, this remains a technical bounce.

If ZEC fails to push through the upper wedge boundary, price could slip back into consolidation or attempt another pullback toward mid-range support before making its next major move.

Big Picture

With Bitcoin back above $70K and risk appetite slowly returning to the market, ZEC’s bounce off key support arrives at a critical moment.

The falling wedge suggests Zcash may be entering a volatility expansion phase, where sharper moves — especially to the upside — become more likely.

For now, bulls will be watching closely to see whether ZEC can reclaim $316 and confirm the reversal. Until then, expect some choppy price action — but the technical groundwork for further gains is clearly starting to take shape.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.