- Bitcoin has retraced from its all-time high of $108,000 to $93,000, impacting major altcoins including XRP and ADA in a significant market correction over the past two weeks.

- XRP is consolidating within a symmetrical triangle pattern and has found support at $2.04, with potential to test upper resistance at $2.48 if the support holds.

- Cardano (ADA) is forming a bullish falling wedge pattern and has repeatedly tested critical support at $0.86, currently trading at $0.87 with potential to rally toward $1.00.

- Both tokens show oversold RSI conditions and fading bearish momentum on MACD, suggesting a potential rebound may be brewing if key support levels continue to hold.

Date: Mon, Dec 30, 2024, 06:17 AM GMT

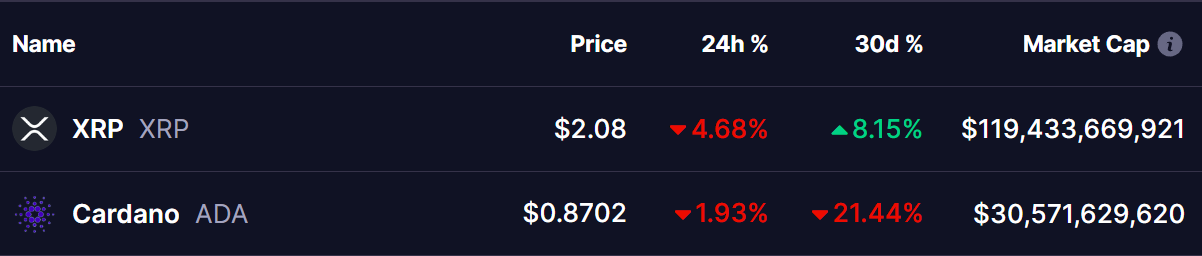

In the cryptocurrency market, the past two weeks have seen a significant correction, with Bitcoin (BTC) retracing from its all-time high of $108,000 to the current level of $93,000. This bearish sentiment has also impacted major altcoins like XRP and ADA, which have experienced pullbacks in recent weeks. XRP’s monthly gains have shrunk to 8%, while ADA is currently in negative territory.

Despite these challenges, both tokens are showing resilience by holding critical support levels.

XRP

Amid the ongoing market correction, XRP is consolidating within a symmetrical triangle pattern. As of now, XRP has found support at the lower trendline of the triangle, around $2.04, and is trading slightly above it at $2.08.

Historically, this support zone has triggered rebounds, and if XRP follows this trend, it could test the upper resistance trendline, which is positioned at approximately $2.48. A breakout above this resistance could pave the way for further upward movement.

Technical indicators such as the Relative Strength Index (RSI) show signs of bottoming out, hinting at a potential rebound.

Cardano (ADA)

Cardano (ADA) is exhibiting a similar pattern, consolidating within a falling wedge—a bullish reversal setup. Over the past week, ADA has repeatedly tested its critical support level of $0.86, demonstrating its resilience. Currently, ADA is trading slightly above this support, at $0.87.

If the $0.86-$0.87 support zone holds, ADA has the potential to rally and break out to the upside, which could signal a trend reversal. Such a move could drive the token’s price toward the $1.00 level, a psychological resistance. However, failure to hold this support could see ADA dip to lower levels within the wedge, delaying any potential recovery.

Is a Rebound Brewing?

Both XRP and ADA are at pivotal points, trading near critical support levels within their respective technical patterns. The current RSI readings for both tokens indicate oversold conditions, while MACD convergence suggests that bearish momentum is fading. This combination of factors raises the possibility of a rebound in the near term.

For confirmation of an upward move, traders should watch for increased trading volume and decisive price action. A breakout above the resistance levels in their respective patterns would indicate a shift in market sentiment and could lead to substantial gains.

Conclusion

While the market correction has weighed heavily on XRP and ADA, their resilience at key support levels offers hope for a potential rebound. However, investors should exercise caution and wait for confirmation of a breakout or breakdown before making significant trading decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please conduct your own research before making investment decisions.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.