- Bitcoin fell 1.33% to just above $98,000, triggering a broader cryptocurrency market correction that pulled major altcoins into the red.

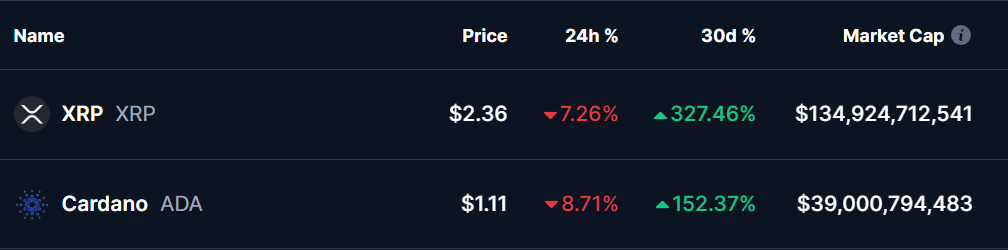

- XRP declined over 7% and ADA dropped more than 8%, despite impressive recent rallies of 300% and 150% respectively over the past 30 days.

- XRP is testing crucial support at $2.33 within a falling wedge pattern, while ADA broke below its major support trendline at $1.20 and fell to $1.11.

- Both tokens are at pivotal correction points where holding current support levels could enable recovery, but failure may lead to further declines toward $2.25 for XRP and $1.05-$0.97 for ADA.

Date: Mon, Dec 09, 2024, 11:30 AM GMT

The cryptocurrency market kicks off the new week with a noticeable correction, as Bitcoin (BTC) fell by 1.33%, settling just above the $98,000 mark. This dip has triggered a broader market decline, pulling major altcoins into the red after a month of impressive gains.

Among the hardest hit are XRP and Cardano (ADA), each posting over a 7% and 8% loss today respectively. This correction comes on the heels of remarkable rallies, with XRP soaring over 300% and ADA climbing more than 150% in the last 30 days.

Xrp (XRP)

XRP, which has been consolidating within a falling wedge pattern, has seen its price retreat from a recent high of $2.9. Earlier in the day, XRP tested its minor support level at $2.33, briefly bouncing back to current price of $2.37.

This support level is crucial for XRP’s short-term prospects, as holding above it could propel the price toward its next resistance level of $2.50.

If XRP fails to maintain this level, it may revisit the $2.25 mark, which serves as a stronger support within the wedge pattern.

Cardano (ADA)

Cardano (ADA) has faced a sharper decline, breaking below its major support trendline at $1.20, which had been a key support ,throughout its recent rally. The breach has resulted in ADA dropping to $1.11 today, which is a minor key support zone.

If ADA stabilizes here, it could recover toward $1.20, which now acts as a resistance level.

However, if this support fails, the price could slide further to $1.05 or even $0.97 if bearish sentiment continues to dominate.

What To Expect Ahead?

Both XRP and ADA are at pivotal points in their respective corrections. While the long-term bullish outlook remains intact for both tokens, their short-term movements will depend heavily on their ability to hold key support levels.

XRP’s $2.33 and ADA’s $1.11 are the immediate levels to watch, as their loss could lead to further declines. On the flip side, a strong bounce from these levels might signal the start of a recovery, allowing them to regain lost momentum.

As the market adjusts after a month-long rally, investors should prepare for potential correction.

Disclaimer: This article is intended for informational purposes only and does not provide financial advice. Always conduct your own research and consult with a financial professional before making investment decisions.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.