- Real-World Assets (RWAs) represent tangible assets like bonds, real estate, and commodities digitally on blockchain, with major institutions like BlackRock and Goldman Sachs entering the tokenization space.

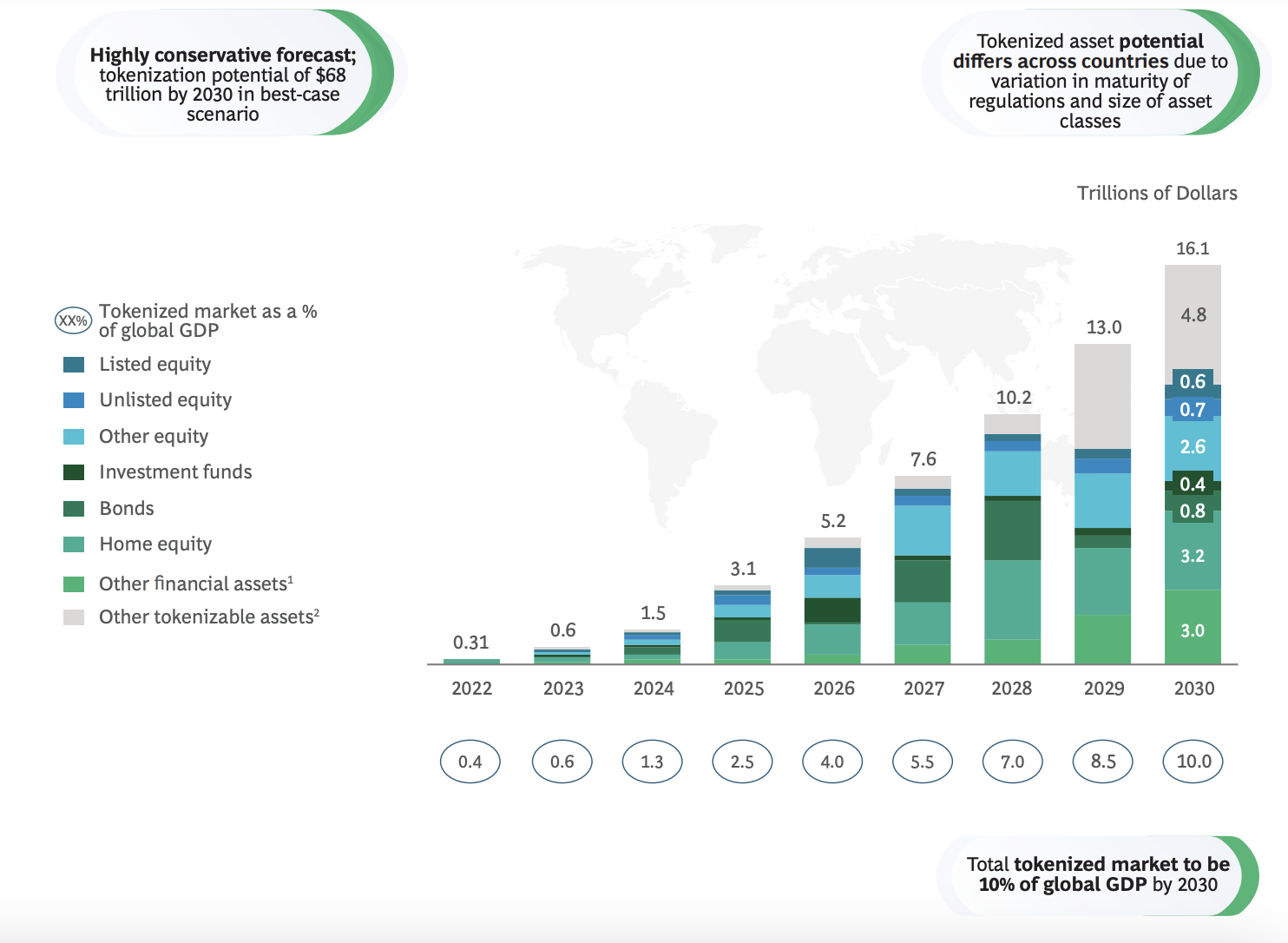

- Asset tokenization is predicted to grow 50 times to $16.1 trillion by 2030, representing 10% of global GDP according to ADDX and BCG research.

- Top RWA tokens include Ondo (ONDO) at $871M market cap, Mantra (OM) at $836M, and MakerDAO (MKR) leading at $1.48B market cap.

- The RWA sector encompasses various approaches from yield tokenization (Pendle) to cross-chain infrastructure (Axelar) and decentralized asset financing protocols (Centrifuge).

Updated On: Tue, Sept 10, 2024, 08:51 AM GMT

Real-World Assets (RWAs) are tangible assets like bonds, real estate, commodities, and machinery, represented digitally on the blockchain. This growing trend of tokenizing physical and traditional financial assets aims to make transactions more efficient and expand the blockchain market’s potential significantly.

BlackRock, the world’s largest asset manager, has made a notable entry into the RWA tokenization space with its tokenized fund, BUIDL, on the Ethereum network. This move, alongside Goldman Sachs’ upcoming launch of three new tokenization products, underscores the increasing interest and validation of RWAs in the crypto market.

According to a research report by ADDX and BCG, asset tokenization is predicted to grow 50 times to $16.1 trillion by 2030, representing 10% of the global GDP.

Top Real World Asset Tokens To Invest For Long Term

1) Ondo (ONDO)

Ondo Foundation aims to merge traditional and decentralized finance on public blockchains.

- Price: $0.6269

- Market Cap: $871M

2) Mantra (OM)

Mantra is a security-first RWA Layer 1 Blockchain that adheres to real-world regulatory requirements.

- Price: $0.9933

- Market Cap: $836M

3) Pendle (PENDLE)

Pendle Finance enables the tokenization and trading of future yield.

- Price: $3.06

- Market Cap: $483M

4) Hedera Hashgraph (HBAR)

Hedera Hashgraph facilitates secure and fractionalized ownership of RWAs through tokenization on its public network.

- Price: $0.05046

- Market Cap: $1.86B

5) Quant (QNT)

Quant provides the infrastructure for RWA platforms to connect traditional finance and blockchain securely

- Price: $75.33

- Market Cap: $885M

6) XDC Network (XDC)

XDC coin specializes in Real-World Asset (RWA) tokenization, offering a hybrid blockchain architecture, smart contracts, cross-chain interoperability, regulatory compliance, scalability, low fees, and enhanced security, making it an attractive solution for trade finance, supply chain finance, and other RWA applications.

- Price: $0.02633

- Market Cap: $392M

7) MakerDAO (MKR)

MakerDAO integrates RWAs as collateral for their DAI stablecoin, allowing users to borrow DAI against assets like real estate or invoices.

- Price: $1,589

- Market Cap: $1.48B

8) Axelar (AXL)

Axelar is a crucial player in the burgeoning world of Real-World Assets (RWAs). It’s not an RWA itself, but rather a platform that connects different blockchains, making it essential for the smooth transfer and trading of tokenized real-world assets.

- Price: $0.5046

- Market Cap: $392M

9) Centrifuge (CFG)

Centrifuge is a decentralized asset financing protocol that connects DeFi with RWAs.

- Price: $0.3458

- Market Cap: $172M

10) Polymesh (POLYX)

Polymesh is a security-focused platform for creating and managing RWA tokens.

- Price: $0.22

- Market Cap: $193M

12) Reserve Rights (RSR)

Reserve Rights is a decentralized platform for tokenizing RWAs, focusing on DeFi applications.

- Price: $0.005665

- Market Cap: $289M

These tokens represent a diverse range of opportunities in the RWA space, each contributing to the growing sector of blockchain and traditional finance integration. Investing in these tokens could potentially offer significant returns as the market for RWAs continues to grow.

Disclaimer

The information provided in this article is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments are highly volatile and carry significant risk. Always conduct your own research and consult with a professional financial advisor before making any investment decisions.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.