(Friday 16 August 2024, 02:58 AM GMT):

Today, the cryptocurrency market is experiencing a downturn, with Bitcoin (BTC) leading the charge by falling 2.43% in the past 24 hours, dipping below the $58,000 mark. This has triggered a ripple effect across the market, leading to a 2.73% decrease in the global crypto market cap, now standing at $2.0 trillion. The memecoin sector has been hit especially hard, with the total memecoins market cap plunging by 6.2% to $38.00 billion.

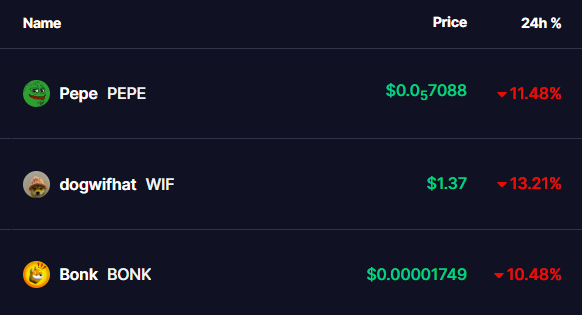

Let’s take a closer look at how some of the most popular memecoins have performed in the last 24 hours:

- Pepecoin (PEPE): Down by 11.48%

- Dogwifhat (WIF): Down by 13.21%

- Bonk (BONK): Down by 10.48%

What’s Behind the Drop?

The recent decline in memecoin prices can be attributed to a few key factors, as outlined by the popular crypto channel Crypto Banter on X (formerly Twitter). Here’s what’s driving the downturn:

1) Fed’s Uncertainty on Rate Cuts: The Federal Reserve is holding off on cutting interest rates as they await more economic data. While inflation is showing signs of cooling, the uncertainty surrounding the Fed’s next move is causing unease in the market.

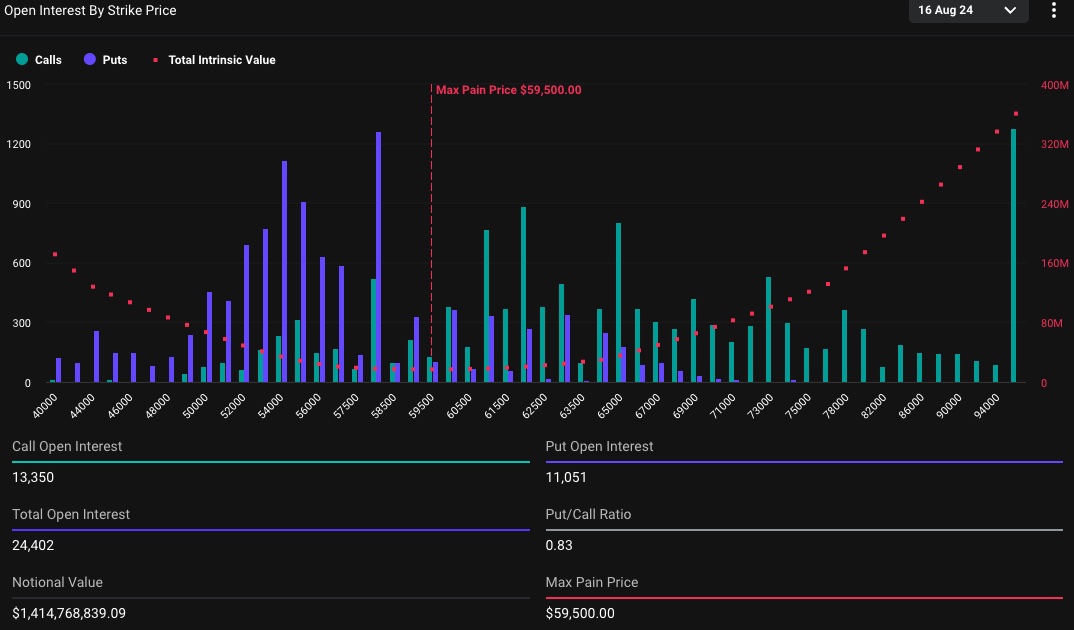

2) Bitcoin Options Expiry: A significant $1.4 billion in Bitcoin options is set to expire soon, with BTC prices hovering around a critical support level. This situation is adding pressure to the market, leading to increased volatility.

3) Rising Mining Costs: The International Monetary Fund (IMF) has suggested an 85% increase in electricity costs for crypto miners as a measure to curb emissions. This has raised concerns about the future of crypto mining, particularly for Bitcoin, and is causing ripples across the entire cryptocurrency market.

These factors combined have contributed to the sharp decline in the value of popular memecoins like PEPE, WIF, and BONK. As the market reacts to these developments, investors are bracing for potential further volatility.