Date: Fri, Nov 01, 2024, 04:59 AM GMT

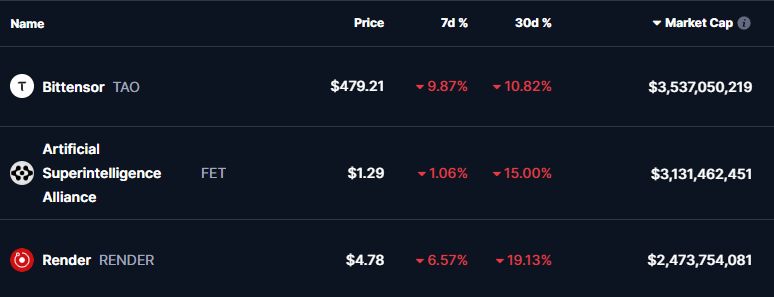

As we kick off November, the cryptocurrency market has shown a clear split between Bitcoin’s strong performance and the decline in altcoins. Last month, Bitcoin (BTC) surged by an impressive 13%, driving its dominance up to 60% of the market. This rise in BTC dominance had a major impact on leading AI tokens, including Bittensor (TAO), Artificial Superintelligence Alliance (FET), and Render (RENDER), which all saw significant corrections in last month.

Let’s dive into the technical analysis to see if a recovery rally might be on the horizon for these tokens.

Bittensor (TAO)

TAO has undergone a substantial correction but appears to be establishing support around the $470–$512 level, as indicated by the recent price action. This level aligns with a historical support zone, which previously triggered buying interest in the market.

If this support holds, we could see TAO bouncing back toward its resistance zone near $680. Breaking through this resistance would likely confirm a bullish reversal and may push TAO higher, potentially reaching up to $700 by the end of November. However, a failure to hold this support might expose TAO to further decline to $434.

Artificial Superintelligence Alliance (FET)

FET has broken down from its descending trendline, but it’s currently testing a critical support level at around $1.25. This support level aligns with previous accumulation zones, suggesting potential buyer interest.

If FET manages to sustain above this level, a recovery to the next resistance at around $1.70 is possible. A break above $1.70 could open doors to a broader recovery, with the next target near $2.15 However, if selling pressure increases, FET might drop to its next support level around $1.10.

Render (RENDER)

Render has faced a sharp correction, but it’s now hovering around a strong support level at approximately $4.47. This level has historically been an accumulation area, which could attract buyers.

If RENDER rebounds from here, we might see a rally up to the next resistance level at $7.00. A breakout above this resistance could signal a potential trend reversal and further upside toward $8.00. However, if RENDER fails to maintain this support, it might see additional downside to around $4.33.

Is a Recovery Rally Possible This Month?

Historically, November tends to be a bullish month for the cryptocurrency market, often delivering positive price movements across many assets. However, this year, the upcoming U.S. elections could inject some additional volatility, impacting market sentiment and potentially affecting a recovery rally for these AI tokens. With BTC dominance high and altcoins under pressure, the key levels highlighted for TAO, FET, and RENDER could serve as significant turning points.

If the support zones hold, these tokens could start recovering, particularly if overall market sentiment improves. But investors should watch for any macroeconomic developments or election-related news that could sway the market in either direction.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.