Key Takeaways

- FTX’s early 8% stake in Anthropic would now be valued at around $30 billion after the AI firm’s $380B valuation — a massive missed opportunity.

- FTX sold its Anthropic stake for roughly $1.3–$1.5 billion during bankruptcy, long before the AI boom pushed valuations higher.

- Had FTX held the investment, the unrealized gains could have more than tripled its $9B bankruptcy shortfall — potentially reshaping its financial fallout.

In one of the most poignant “what-if” stories at the intersection of cryptocurrency, bankruptcy, and artificial intelligence, the failed crypto exchange FTX’s early investment in Anthropic has become a striking symbol of lost fortunes amid the ongoing AI boom.

FTX, led by Sam Bankman-Fried, invested $500 million in the AI startup in 2021, when Anthropic carried a valuation of roughly $2.5 billion. That stake, representing approximately 8% of the company, would today be valued at around $30 billion following Anthropic’s latest funding round—delivering an extraordinary 60x return.

Anthropic’s Explosive Growth

On February 12, 2026, Anthropic announced the closing of a $30 billion Series G funding round at a $380 billion post-money valuation—one of the largest private software funding rounds ever recorded. The round was led by Singapore’s sovereign wealth fund GIC and Coatue Management, with participation from prominent investors including D.E. Shaw Ventures, Dragoneer, Founders Fund, ICONIQ, and MGX.

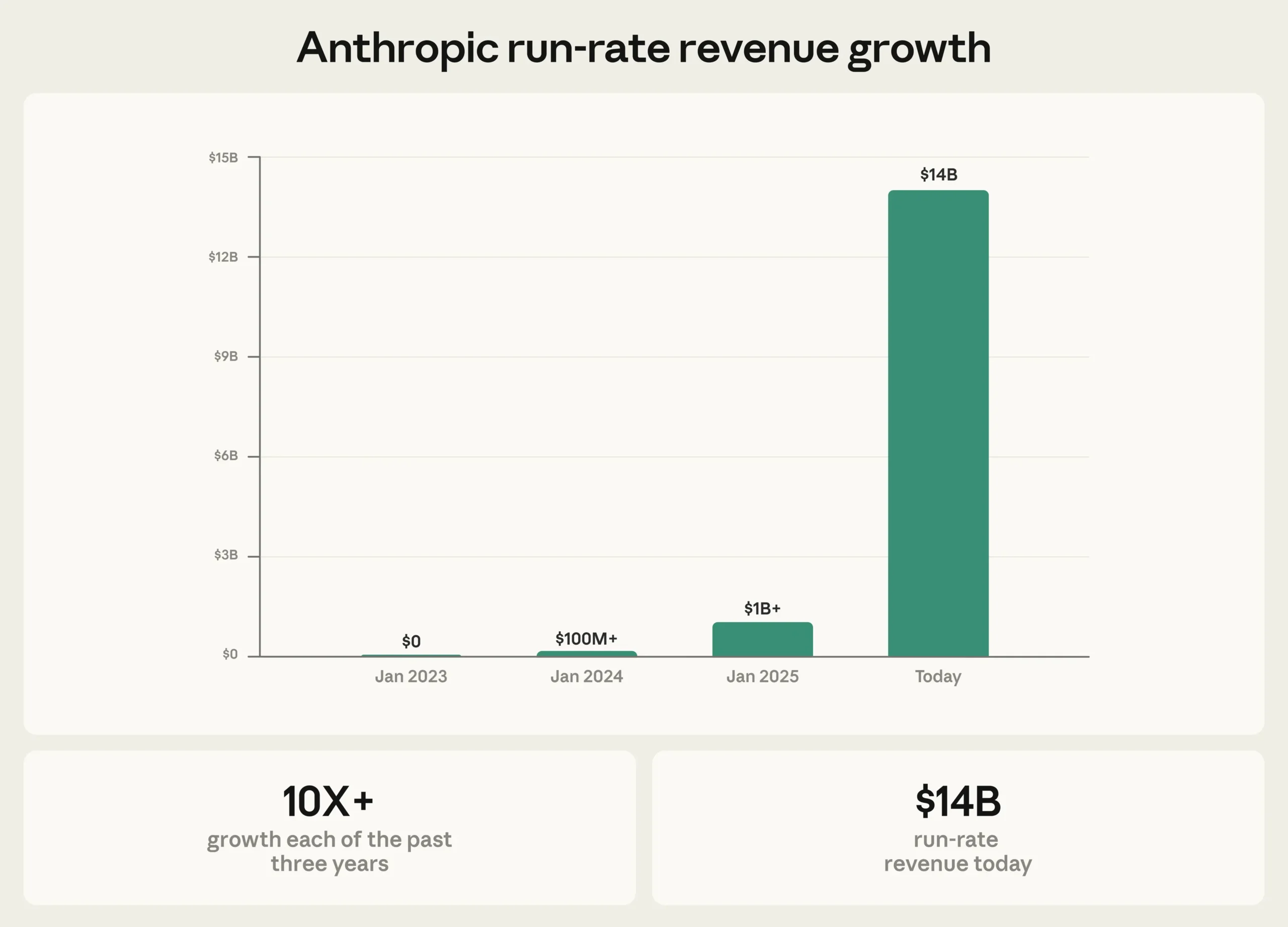

The massive capital infusion highlights Anthropic’s position as a leading enterprise AI provider, driven by its Claude family of models. The company now reports annualized revenue of $14 billion, reflecting more than 10x growth over the past three years.

The Forced Sale: Bankruptcy’s Bitter Pill

FTX’s collapse in November 2022 triggered the liquidation of its assets to repay creditors. The exchange sold its Anthropic stake in phases during the bankruptcy process. In 2024, it disposed of the majority of its holdings for $884 million to a consortium of buyers, including Abu Dhabi’s ATIC, with the total recovery from the position estimated between $1.3 billion and $1.5 billion—at a time when Anthropic’s valuation stood near $18 billion.

The timing proved devastating. Had FTX been able to retain the investment through the height of the AI market surge, the stake’s current value would have exceeded the entire $9 billion shortfall in FTX’s balance sheet by more than threefold—and approached the exchange’s peak valuation from its most successful period.

Broader Implications

Sam Bankman-Fried, currently serving a 25-year prison sentence following his conviction on fraud charges, has become a cautionary figure in both crypto and venture capital circles. While FTX’s downfall stemmed from alleged misuse of customer funds, the Anthropic position illustrates how court-ordered asset sales during financial distress can force disposals at precisely the wrong moment, erasing enormous potential recoveries.

For the broader AI sector, the latest round solidifies Anthropic’s standing as a top-tier competitor to OpenAI, with both companies now commanding similar multi-hundred-billion-dollar private valuations. For FTX creditors—who have already recovered billions through various asset sales—the mathematics of the missed Anthropic upside remains a painful reminder of what could have been.

As one industry observer summarized following the funding announcement: “This isn’t merely a missed trade. It’s a textbook example of how timing, regulatory pressure, and explosive market cycles can transform a visionary early investment into one of the costliest footnotes in financial history.”

In the final analysis, FTX’s involvement with Anthropic is less a story of brilliant foresight and more a sobering lesson in the unforgiving realities of bankruptcy amid hyper-growth technology sectors. The nearly $29 billion in unrealized gains that evaporated? It could have fundamentally rewritten the aftermath of one of cryptocurrency’s most dramatic collapses. Instead, it remains one of the starkest illustrations of opportunity forever lost.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.