Key Takeaways

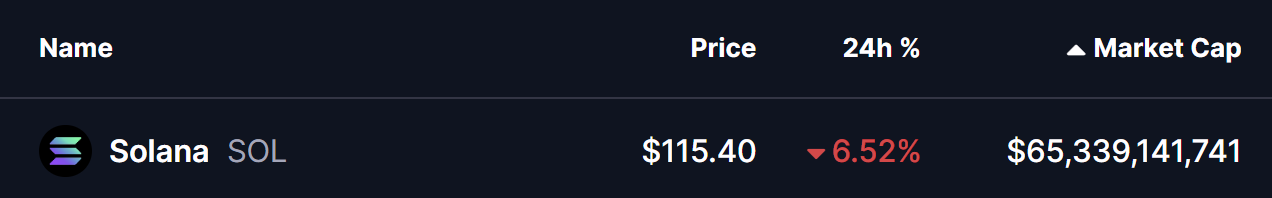

- The broader crypto market faced heavy selling, triggering $1.68B in liquidations, with Solana (SOL) down over 6%.

- SOL’s daily chart is forming a right-angled descending broadening wedge, a pattern that can precede bullish reversals if support holds.

- Price is currently defending the $112.09 support zone, where buyers have started to step in.

- The 50-day moving average near $130.32 remains strong overhead resistance.

- A reclaim of the 50-day MA could open the path toward $146.90, while a breakdown below $112.09 would invalidate the rebound setup.

The broader cryptocurrency market has come under heavy pressure over the last 24 hours, with Bitcoin (BTC) and Ethereum (ETH) sliding more than 6%, triggering a wave of forced liquidations. According to coinglass data, total liquidations surged to $1.68 billion, with $1.57 billion coming from long positions alone—a clear sign of panic-driven selling.

Unsurprisingly, altcoins were hit hard as well. Solana (SOL) dropped over 6%, triggering roughly $68.54 million in liquidations. However, while short-term sentiment remains shaky, SOL’s daily chart suggests price has reached a technically important zone, where conditions for a potential rebound may begin to take shape.

Right-Angled Descending Broadening Wedge in Focus

From a technical standpoint, SOL’s daily chart is carving out a right-angled descending broadening wedge—a structure that often develops during extended corrective phases and can precede bullish reversals if key support holds.

This pattern has been forming since SOL’s rejection from the neckline resistance near $146.90 in mid-November. Since that rejection, price has continued to post lower highs, while volatility has gradually expanded—an important characteristic of broadening formations.

Today’s intense sell pressure pushed SOL back toward the lower boundary of the wedge near $112.09. Buyers stepped in around this level, and SOL is currently hovering slightly above it near $115.60, suggesting that demand may be emerging after the sharp liquidation-driven drop.

Overhead Resistance Still Limits Upside

While the lower wedge support is holding for now, upside momentum remains capped. The 50-day moving average, currently sitting near $130.32, has flipped into firm overhead resistance. Historically, SOL has struggled to sustain rallies below this level, making it a key hurdle for any meaningful recovery.

Until price reclaims the 50-day MA, any bounce should be viewed as a relief rally within a broader consolidation, rather than confirmation of a trend reversal.

What’s Next for SOL?

As long as SOL continues to defend the $112.09 support zone, the right-angled descending broadening wedge remains technically valid. Sustained holding above this level keeps the door open for a rebound attempt—especially if price begins to form higher daily or weekly closes.

If bulls manage to reclaim the 50-day moving average, SOL could gradually work its way back toward the upper boundary of the wedge near $146.90, a move that would mark a significant recovery from current levels.

On the flip side, a decisive breakdown below $112.09 would invalidate the bullish wedge structure and likely expose SOL to another leg lower or a prolonged consolidation phase.

For now, SOL sits at a critical inflection point, where how price reacts around support may define the next major move.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.