Key Takeaways

- RIVER has surged over 131% in 7 days and more than 1,400% in 30 days, driven by strong fundamentals and liquidity expansion.

- Strategic backing and major spot and perpetual listings have pushed RIVER’s trading volume to global top rankings.

- The 4H chart shows a Bullish Butterfly harmonic pattern, which may lead to a short-term bearish CD leg.

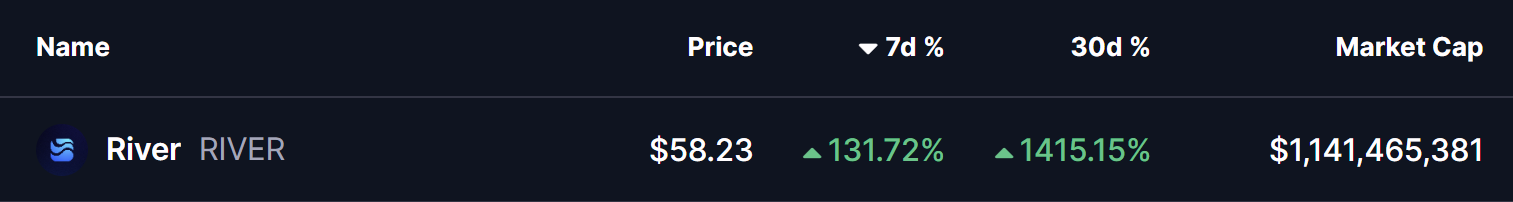

The River (RIVER) token has been one of the standout performers in the crypto market this recently. According to CoinMarketCap data, RIVER is currently trading near $58.79, posting an eye-catching 131% gain over the past 7 days and an even more staggering +1,415% surge over the last 30 days.

This explosive move has pushed its market capitalization to approximately $1.15 billion, firmly placing RIVER among the market’s fastest-rising assets.

What’s Fueling RIVER’s Explosive Rally?

Several strong catalysts have aligned perfectly to drive RIVER’s recent price action.

One of the biggest confidence boosters came from high-profile strategic investments. RIVER secured an $8 million investment led by Justin Sun, the founder of TRON, alongside TRON DAO, with additional backing from well-known players such as Maelstrom (Arthur Hayes’ fund) and Spartan Group. Reports suggest total funding rounds have reached close to $12 million, providing not only capital but strong validation and ecosystem support.

At the same time, exchange listings and liquidity expansion acted as rocket fuel for the rally. RIVER’s spot listing on Coinone, a major South Korean exchange, triggered a surge in retail demand. This was quickly followed by the launch of perpetual and futures trading across top platforms including Binance, OKX, Bybit, HTX, Bitget, and Kraken. As a result, RIVER’s 24-hour perpetual trading volumes exploded into the billions, at times ranking just behind Bitcoin and Ethereum globally.

Could This Pattern Trigger a Break in the Rally?

While momentum remains strong, the 4-hour chart is beginning to flash early caution signals.

RIVER appears to be forming a Bullish Butterfly harmonic pattern. Despite its bullish name, this structure often involves a bearish CD leg before price reaches the Potential Reversal Zone (PRZ). After completing the X-A-B structure, RIVER faced a rejection near $63.46, which is now shaping up as a potential C point.

Currently trading around $58.30, price action suggests the market may be entering the early stages of the CD leg. From here, two key scenarios emerge.

If RIVER manages to reclaim and hold above the A-point near $69.74, the bearish harmonic setup would be invalidated, opening the door for continued upside momentum and renewed trend expansion.

However, failure to hold support could shift the narrative. A break below the 0.382 Fibonacci support near $49.32 would confirm bearish continuation within the pattern. In that case, downside momentum could accelerate, with the first major target aligning near $16.28, corresponding with the 1.0 Fibonacci extension on the chart.

For now, RIVER remains at a critical inflection point — caught between powerful bullish fundamentals and a technical structure that warns the rally may need to cool off before the next major move.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.