- Polygon (POL) has dropped 20% over the past week and 5% in 24 hours, currently trading at $0.52 amid broader crypto market bearishness.

- Whales have sold over 80 million POL tokens worth approximately $50 million in the past 48 hours, adding significant downward pressure.

- POL is trading in a descending triangle pattern since 2021 and was recently rejected at $0.76 resistance on December 6.

- The token's future depends on holding $0.49 support level, with potential upside to $0.58 or downside risk to $0.44 if support fails.

Date: Thu, Dec 19, 2024, 05:26 AM GMT

The cryptocurrency market today is grappling with bearish momentum as Bitcoin (BTC) experiences a sharp 2.82% decline, bringing its price down to $101K from its recent all-time high of $108K. This downturn follows the Federal Reserve’s recent rate cut of 0.25%, accompanied by remarks from Chairman Jerome Powell clarifying that the central bank cannot own Bitcoin.

As Bitcoin’s decline pressures the broader market, Polygon (POL) has been one of the worst-hit altcoins. POL, already on a bearish trajectory, has dropped by 20% over the last week and is down over 5% in the past 24 hours. It is currently trading at $0.52, with a market capitalization of $4.37 billion.

80M Token Sell-off by Whales

Polygon’s recent bearish performance has dampened sentiment among traders and whales. While many old-school altcoins such as XRP, ADA, XLM, and HBAR have posted rallies, POL has struggled to keep pace.

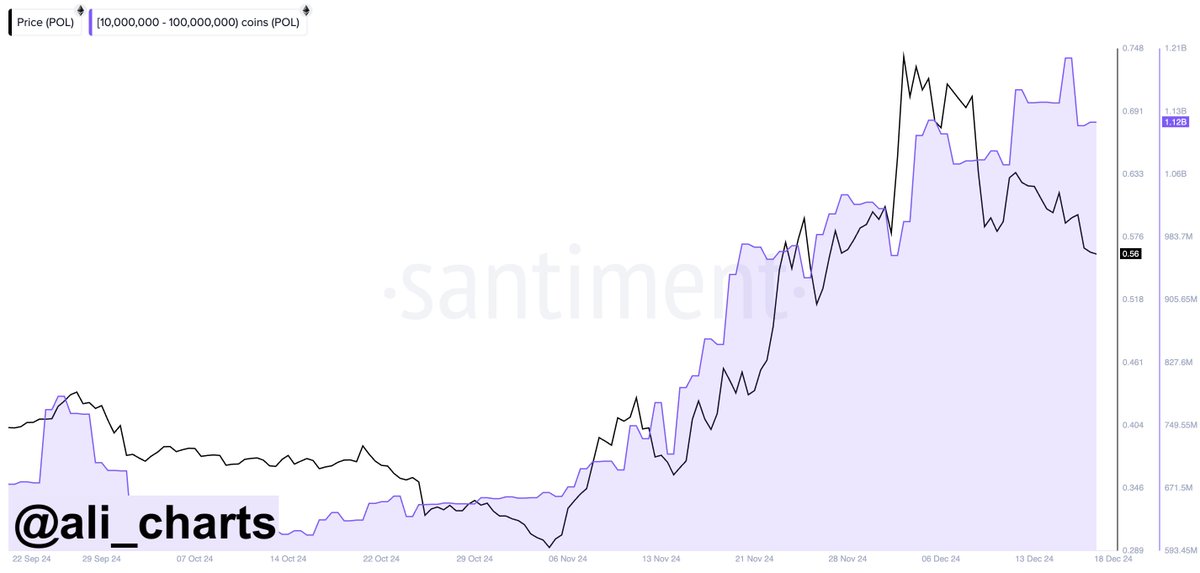

According to a report by crypto analyst @ali_charts, whales have offloaded over 80 million Polygon tokens in the past 48 hours, valued at approximately $50 million based on an average price of $0.62. This massive sell-off has exerted additional downward pressure on the asset.

Technical Analysis

Polygon has been consolidating within a descending triangle pattern since the bull run of 2021. On December 6, POL was rejected at the upper trendline resistance of $0.76, triggering its recent decline.

Currently, POL is trading at $0.52 after bouncing off a minor support level at $0.49 [Marked in blue line]. If this level holds, the token could stage a recovery, targeting the next resistance at $0.58. However, if the $0.49 support fails, POL risks falling further to its bottom support level of $0.44, which could test the patience of long-term holders.

What’s Next?

Polygon’s immediate future hinges on its ability to hold support at $0.49 and navigate through broader market bearishness. A bounce from this level could instill confidence and attract buyers back into the market, potentially sparking a rally toward $0.58. Conversely, a break below $0.49 could usher in further downside, leaving $0.44 as the next critical level to watch.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.