Date: Mon, April 21, 2025 | 07:44 PM GMT

The cryptocurrency market has been under intense selling pressure recently, with Ethereum (ETH) posting its worst Q1 since 2018, sliding more than 45%. That bearish wave swept across the major altcoins — and the AI narrative token Near Protocol (NEAR) wasn’t spared either.

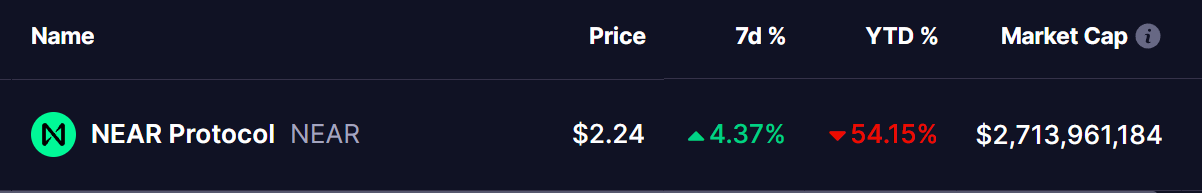

But there’s a shift in momentum brewing. NEAR has managed to stage a rebound with a noticeable 4% weekly gain, narrowing its year-to-date drop to 54%. And interestingly, a classic harmonic pattern now hints that this recovery could continue further.

Harmonic Pattern Signals More Upside Move

The 4-hour chart for NEAR reveals the formation of a Bearish Gartley pattern — a classic harmonic setup that usually predicts a strong bullish rally before facing significant resistance.

The sharp decline began around late March, after NEAR failed to sustain above the $3.09 resistance (marked as point X). From there, the altcoin slid nearly 41%, bottoming out near $1.83 on April 9 (point A).

Following this low, NEAR posted a strong rebound from $1.92 (point C), carving out the CD leg of the pattern. At the time of writing, NEAR is trading near $2.24, still moving steadily upward within the structure.

According to the harmonic setup, NEAR has room to climb toward the pattern’s final target (point D) — located near $2.82 — implying about a 25% upside from current levels if the pattern plays out cleanly.

Importantly, this D-point also aligns with the 0.786 Fibonacci retracement of the major X-A move, adding more confluence to the potential resistance zone.

What’s Next for NEAR?

If buyers maintain momentum, NEAR could push toward the $2.82 level in the coming days, completing the Bearish Gartley structure. This zone would likely act as a strong resistance point, where traders may begin locking in profits or anticipating a corrective pullback.

On the downside, the $2.31 region (corresponding to the 38.2% Fibonacci retracement) is acting as an intermediate resistance. A clean break above this could accelerate the move toward $2.82.

However, traders should remain cautious. Harmonic patterns often result in sharp reversals after the D-point is hit — so while the short-term outlook appears bullish, it’s essential to watch for signs of exhaustion as NEAR approaches its target zone.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.