Key Takeaways

- NEAR is forming a potential double bottom pattern near the $1.40 support zone.

- Holding above $1.40 keeps the bullish reversal scenario intact.

- A breakout above $1.87 could confirm the pattern and trigger a stronger recovery.

The broader cryptocurrency market has once again slipped into a corrective phase after a strong start to the year. Bitcoin (BTC), which recently surged above the $95,000 mark, has pulled back sharply and is now trading below $88,000. Ethereum (ETH) has faced even heavier pressure, sliding nearly 10% over the past week — a move that has weighed on major altcoins across the board.

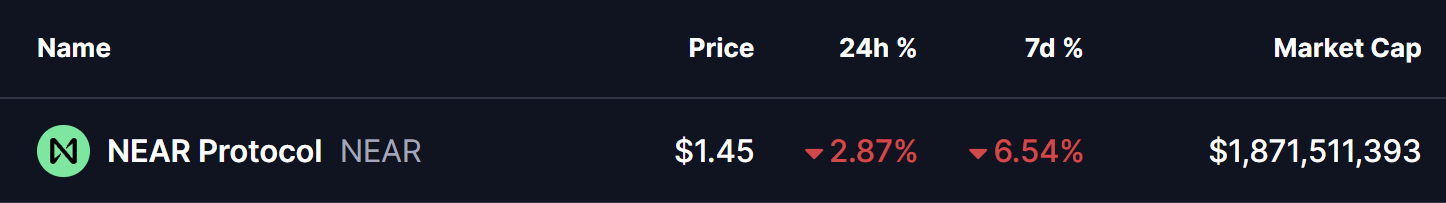

Near Protocol (NEAR) hasn’t been spared either. The token is currently down around 6% on the week. However, beneath the surface, NEAR’s price action is beginning to show a familiar and potentially bullish setup — one that could hint at a bounce back if key levels hold.

Double Bottom Pattern in Play?

On the daily timeframe, NEAR appears to be forming a potential double bottom pattern, a well-known bullish reversal structure that often emerges near the end of extended downtrends.

The first bottom formed when NEAR dropped toward the $1.40 region, followed by a recovery attempt that pushed price back toward the neckline resistance around $1.87. That move, however, faced rejection, sending NEAR back down to retest the same $1.40 support zone.

What stands out is that buyers stepped in once again at this level. NEAR has so far held above this support and is currently trading near $1.45, signaling that selling pressure may be weakening. Adding to this setup, the MACD indicator is beginning to hint at a possible bullish crossover — often an early signal that momentum could start shifting in favor of the bulls.

What’s Next for NEAR?

For this bullish structure to gain traction, NEAR needs to reclaim the 50-day moving average, which sits near $1.6169. A sustained move above this level would mark an important shift in short-term momentum and increase the odds of a continued recovery toward the neckline resistance at $1.87.

A decisive breakout above that neckline — ideally followed by a successful retest — would confirm the double bottom pattern and potentially open the door for a stronger upside move.

On the downside, the $1.40 support zone remains the most critical level to watch. A failure to hold this area would invalidate the bullish setup and expose NEAR to deeper downside risk.

Overall, NEAR’s structure appears constructive. The repeated defense of identical lows, the developing double bottom, and price hovering near the 50-day moving average suggest that the token could be approaching a pivotal moment — one where accumulation transitions into a potential recovery phase if broader market conditions stabilize.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.