Date: Wed, Jan 07, 2026 | 05:26 AM GMT

The broader cryptocurrency market continues to show strong New Year momentum, with Bitcoin (BTC) up around 5% and Ethereum (ETH) posting gains of more than 9% on a weekly basis. While several altcoins have already accelerated higher, the privacy-focused cryptocurrency Monero (XMR) has moved at a more measured pace.

That said, XMR’s recent price behavior on the daily chart tells a more constructive story. Despite relatively modest weekly gains, the structure suggests that Monero is undergoing a healthy bullish retest — often a critical phase before the next leg higher.

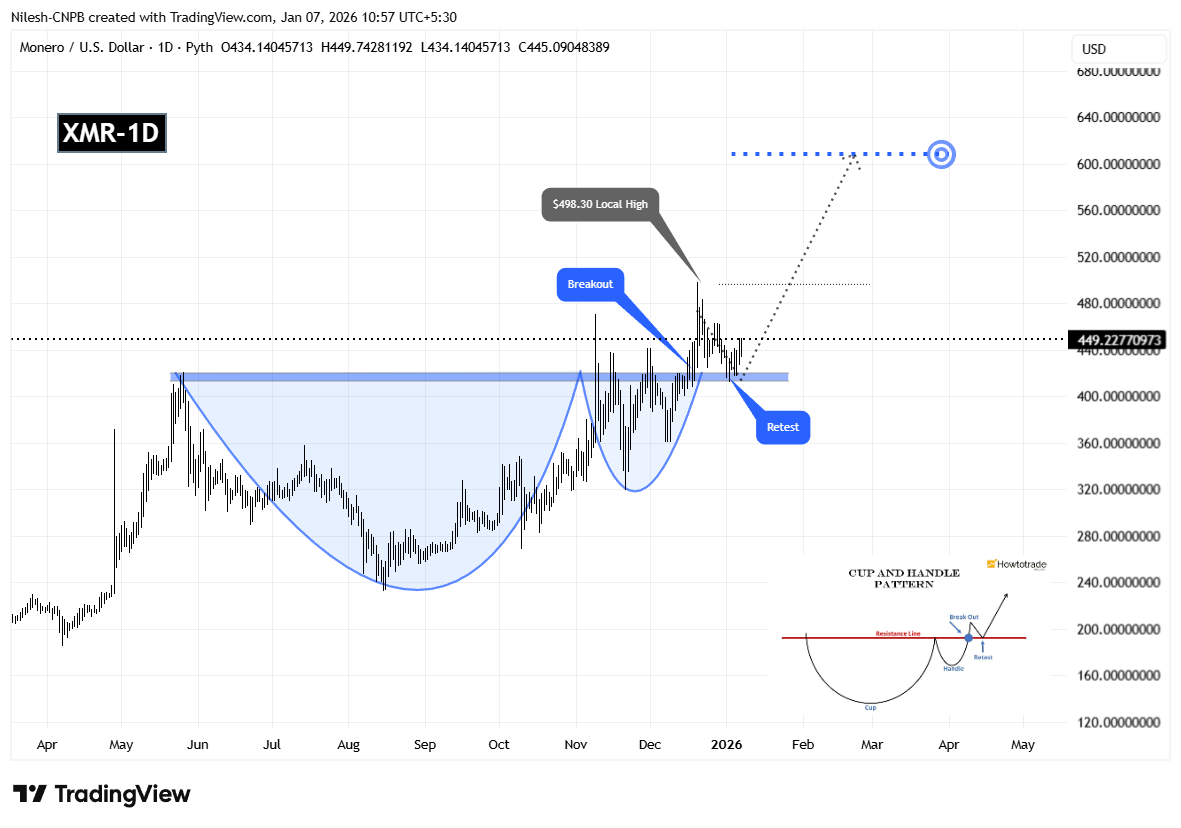

Retested Cup and Handle Breakout

On the daily timeframe, XMR had been consolidating within a well-defined Cup and Handle formation, a classic bullish continuation pattern that typically forms after an extended accumulation phase.

The pattern resolved to the upside when buyers decisively pushed price above the $412–$420 neckline resistance. This breakout sparked a sharp rally of nearly 20%, sending XMR to a local high around $498.30 and confirming a clear shift in market structure toward bullish control

As expected after such a strong breakout, price then pulled back to retest the former resistance zone. XMR dipped back into the $412–$420 area, allowing the market to validate this region as new support. This retest has so far been successful, with price rebounding and currently trading near the $449 level. The ability to hold above the breakout zone reinforces the strength of the underlying trend and suggests growing acceptance at higher prices.

What’s Next for XMR?

As long as buyers continue to defend the $412–$420 support area, the broader bullish structure remains firmly intact. A sustained move back above the recent swing high near $498 would likely signal renewed upside momentum and open the door for continuation of the breakout trend.

Based on the depth of the cup formation, the technical upside projection points toward the $608 region. Reaching this level would imply a potential upside of roughly 35% from current prices, consistent with the measured-move expectations of this pattern.

On the downside, a failure to hold the $412–$420 zone could temporarily slow bullish momentum and lead to additional consolidation. However, unless price slips back toward the lower portion of the cup, the broader structure would still remain constructive.

From a technical perspective, XMR’s current behavior reflects a textbook breakout-and-retest scenario. If market conditions remain supportive, this structure suggests Monero could be positioning itself for another meaningful move higher in the weeks ahead.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.