- JasmyCoin (JASMY) has broken out of a 4-year descending trendline that constrained its price since its 2021 all-time high, marking a pivotal development in its long-term trajectory.

- Despite a recent 42% correction from its December 5th high of $0.059, technical analysis shows JASMY forming a cup and handle pattern indicating significant bullish potential.

- Analysts project JASMY could target key Fibonacci levels including $0.105 (50%), $0.248 (61.8%), and $0.846 (78.6%) if it successfully breaks out and confirms the move.

- The projected rally path suggests steady progression through resistance levels into mid-to-late 2025, contingent on Bitcoin and broader crypto market upward trends.

Date: Sat, Dec 28, 2024, 09:51 AM GMT

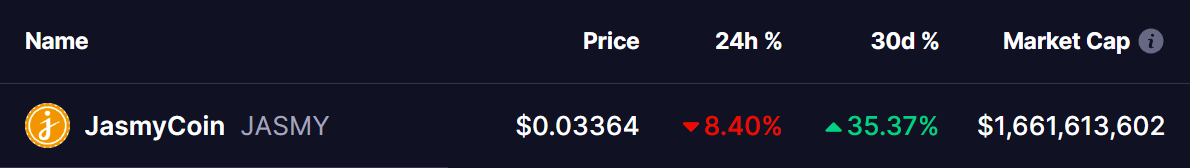

In the cryptocurrency market, we’ve observed a sharp correction over the last two weeks following bullish rallies that began in early November. Amid Bitcoin’s (BTC) retracement from its recent all-time high of $108K to $94K, JasmyCoin (JASMY) has also experienced a steep correction. Currently trading at $0.03364, JASMY has dropped 42% from its December 5th high of $0.059, with 30-day gains reduced to 35%.

However, despite the recent dip, technical analysis points to a bullish outlook for JasmyCoin.

Breaking a 4-Year Downtrend

JasmyCoin has recently broken out of a critical descending trendline that had constrained its price since its all-time high (ATH) in 2021. This breakout, highlighted by crypto analyst @EasychartsTrade, marks a pivotal development in the coin’s long-term price trajectory.

What’s Ahead?

In the analyst’s YouTube video analysis, JasmyCoin is highlighted as forming a cup and handle pattern, a classic bullish reversal setup indicating significant upside potential.

Looking ahead, analysts anticipate that JASMY could target higher retracement levels if it successfully breaks out from the neckline and confirms the move with a retest, including:

- 50% Fibonacci at $0.105: This level aligns with the historical consolidation zone and could act as a psychological target for traders.

- 61.8% Fibonacci at $0.248: Often referred to as the “golden ratio” in technical analysis, this level marks a key area of interest for long-term investors.

- 78.6% Fibonacci at $0.846: If bullish momentum accelerates, this is an ambitious but plausible long-term target based on the strength of the breakout and broader market conditions.

The projected path on the chart shows a steady progression through these resistance levels, indicating a possible rally into mid-to-late 2025.

While short-term volatility remains high, the broader structure suggests a solid foundation for JASMY to capitalize on its breakout, particularly if Bitcoin and the broader crypto market continue their upward trend in the coming months.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.