Date: Thu, June 19, 2025 | 06:56 AM GMT

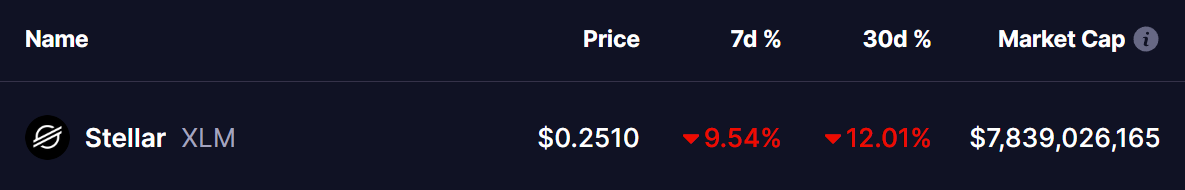

The cryptocurrency market continues to wobble amid rising geopolitical tensions between Israel and Iran. Ethereum (ETH) has taken a sharp 8% hit in the past 7 days, now hovering near $2,500. Altcoins have followed suit, and Stellar (XLM) is among those seeing a pullback.

XLM has dropped 9% over the week, extending its monthly losses to around 11%. But if you look closer, the recent decline might just be setting the stage for something bullish — a setup that closely mirrors Avalanche’s (AVAX) explosive recovery from late 2024.

Fractal Suggests Bullish Reversal Ahead

In 2024, AVAX was stuck in a long-term downtrend, gradually forming a textbook falling wedge pattern — a bullish reversal formation. Once it broke out, the price entered a brief consolidation within a descending channel before exploding upwards for a 132% rally.

Now, XLM appears to be walking the same path. It too completed a falling wedge breakdown, followed by a breakout and is currently consolidating within a smaller falling wedge or bull pennant. Importantly, it’s testing a critical multi-touch support level marked in the yellow zone — the same type of structure AVAX respected before its rally.

Both the chart structure and the post-breakout behavior of XLM line up well with AVAX’s historical playbook, adding weight to the possibility of a bullish continuation.

What’s Next for XLM?

If the fractal holds true, Stellar may be gearing up for a significant move. A confirmed breakout from the current consolidation phase — ideally with a surge in volume — could push XLM toward the $0.54 zone, which aligns with the descending trendline and the measured move target from the earlier breakout.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before making investment decisions in cryptocurrency.