Key Takeaways

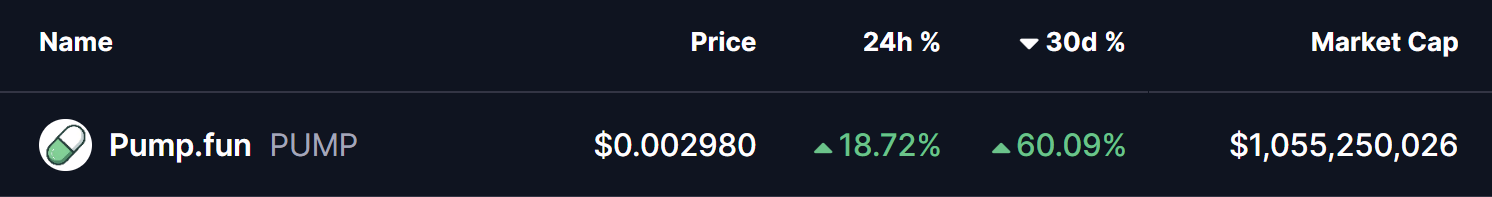

- Pump.fun (PUMP) has surged over 18% recently, extending its monthly gains to nearly 60%.

- The daily chart shows a clear inverse head and shoulders pattern, a classic bullish reversal setup.

- PUMP has reclaimed the 50-day moving average, which is now acting as key short-term support.

- The $0.003025 neckline resistance is the critical breakout level to watch.

- A confirmed breakout could target $0.004612, implying a potential 53% upside.

Pump.fun (PUMP), the native token of the popular Solana-based launchpad protocol, is quietly gaining traction in the crypto market. After posting a sharp 18%+ rally, PUMP has now extended its monthly gains to nearly 60%. While the price surge has caught traders’ attention, a closer look at the daily chart structure suggests this move could be part of a larger bullish setup — provided a key resistance level is cleared.

Inverse Head and Shoulders Pattern Takes Shape

On the daily timeframe, PUMP has carved out a well-defined inverse head and shoulders pattern, one of the most widely followed bullish reversal formations in technical analysis.

- The left shoulder formed in early December near the $0.00247 region.

- This was followed by a deeper pullback toward $0.00167, creating the head of the structure.

- Price then recovered and found support again near $0.00225, completing the right shoulder.

Following the formation of this structure, PUMP rebounded steadily and has successfully reclaimed the 50-day moving average, which is now acting as dynamic support. The token is currently consolidating just below the neckline resistance around $0.003025, a level clearly highlighted on the chart.

This tightening price action near resistance often precedes a volatility expansion, suggesting a decisive move could be approaching.

What’s Next for PUMP?

For bullish momentum to gain confirmation, PUMP needs a strong daily close above the $0.003025 neckline, ideally followed by a successful retest of this zone as support. Such a move would validate the inverse head and shoulders breakout and signal a shift in short-term market structure.

Based on the measured move from the inverse head and shoulders pattern, a confirmed breakout could open the door for a price target near $0.004612 — representing a potential 53% upside from the breakout zone.

On the downside, failure to clear the neckline could lead to further consolidation. In that scenario, holding above the 50-day moving average and the $0.002367 support zone will be critical to keep the broader bullish setup intact.

Bottom Line

PUMP’s recent rally appears to be supported by a constructive chart pattern and improving momentum. As long as price continues to coil beneath neckline resistance while holding key support levels, the probability of a breakout remains elevated.

A decisive move above $0.003025 could mark the start of a fresh upside leg, while rejection would likely extend the current consolidation.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.