/ Crypto markets plunge after Matrixport’s bearish report on delayed SEC approval for Bitcoin ETFs. Bitcoin and Ethereum prices hit hard.

Author: Nilesh Hembade.

Date: 03 Jan 2024, 20:15 PM IST

In a surprising turn of events today, the cryptocurrency market experienced a significant downturn as Matrixport, a prominent financial services platform, released a report casting doubt on the approval of Bitcoin Exchange-Traded Funds (ETFs) by the U.S. Securities and Exchange Commission (SEC).

Earlier in the day, the price of Bitcoin (BTC) was on the verge of surpassing the $46,000 mark, driven by growing anticipation surrounding the potential approval of a Bitcoin Spot ETF. However, Matrixport’s report altered the landscape dramatically.

Matrixport’s Bearish Report:

According to Matrixport’s analysis, the SEC is unlikely to greenlight any of the 14 Bitcoin ETF applications submitted by a major asset management company. Their forecast suggests that approval may only materialize in the second quarter of 2024. Notably, the report also predicted a potential decline in Bitcoin’s price, projecting a range between $36,000 and $38,000 from its current level of $45,000. Matrixport even recommended that investors consider protective measures such as buying put options or directly shorting Bitcoin.

Bitcoin and Ethereum Prices Plummets:

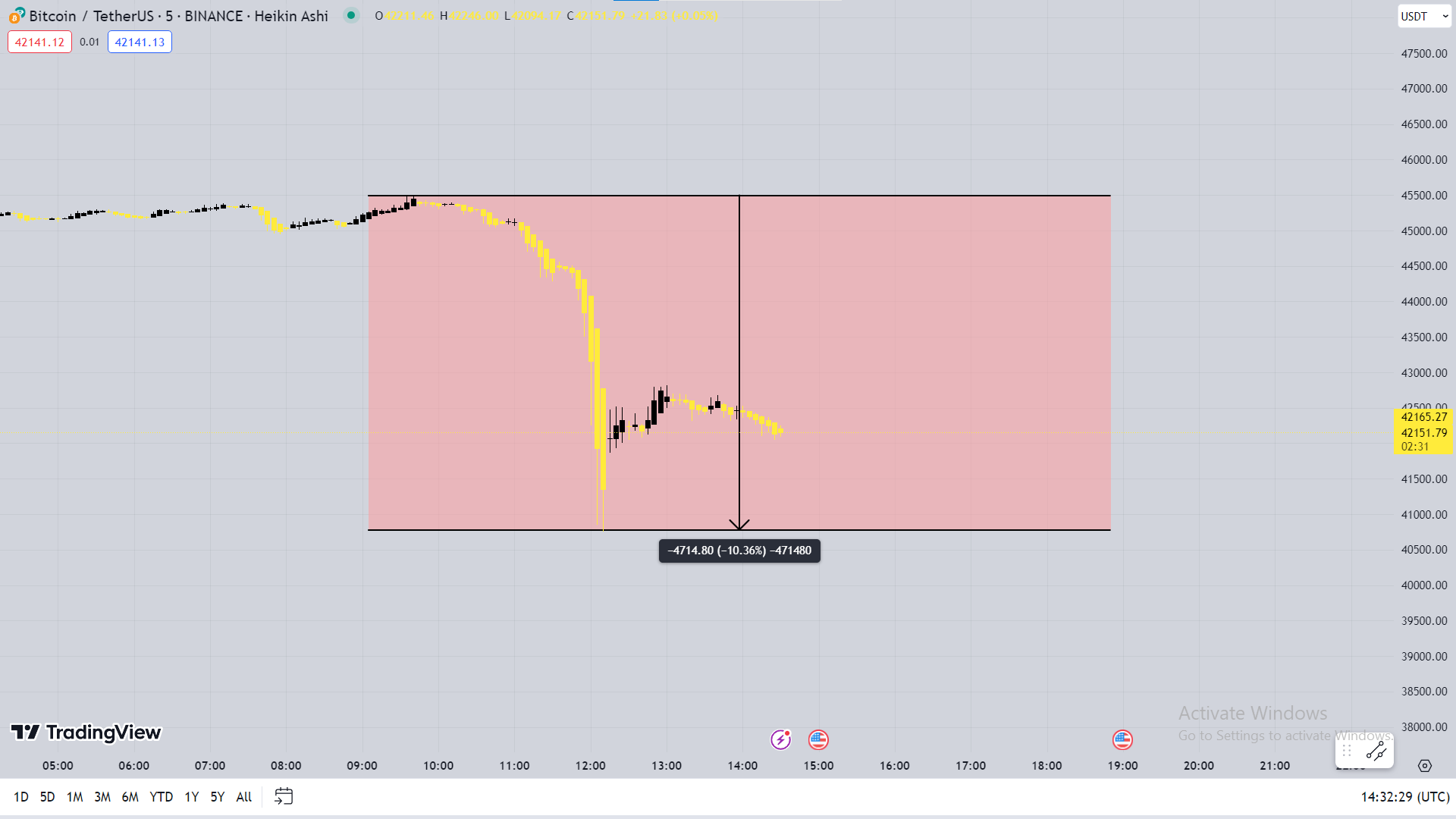

Following the release of this report, the cryptocurrency market experienced a sudden and sharp decline, colloquially referred to as a “Crypto Flash Sell.” Within minutes, major cryptocurrencies saw substantial drops in value. Bitcoin (BTC) plummeted from $45,514 to $40,750, marking a -10.36% decrease. Ethereum, the second-largest cryptocurrency by market capitalization, was not spared, as its price tumbled from $2,381 to $2,100, reflecting an -11.0% change.

Matrixport’s report also dives into the political space, suggesting that the current leadership of the SEC, under the direction of Chair Gary Gensler, may play a pivotal role in the delayed approval of Bitcoin ETFs. Gensler’s alignment with the Democratic Party and his advocacy for stricter compliance within the crypto space raise concerns about his support for legitimizing Bitcoin as a store of value. This potential political influence could be a decisive factor in the SEC’s decision-making process regarding ETF approval.

As the cryptocurrency market grapples with this unexpected setback, investors are left to assess the implications of Matrixport’s report and navigate the heightened uncertainty surrounding the future of Bitcoin and other major cryptocurrencies.