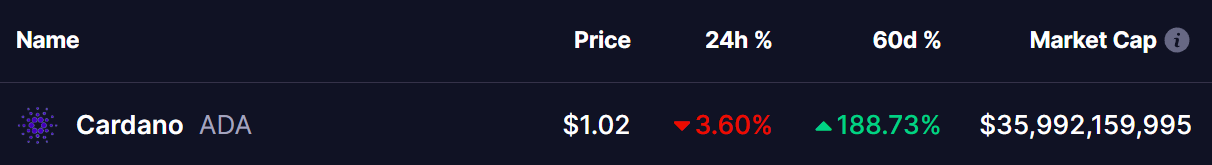

- Cardano (ADA) surged 188% over the last 60 days, reaching a high of $1.32 before correcting to $1.02 in a descending triangle pattern.

- Whales accumulated 160 million ADA tokens during the recent dip after the price fell to $0.91 on December 9, showing increased confidence among large investors.

- ADA is currently consolidating in a bearish descending triangle pattern with resistance at $1.11 and potential downside toward support at $0.90.

- While whales buying the dip signals long-term confidence, short-term technical analysis suggests continued downward pressure with the $0.90 support level being critical.

Date: Wed, Dec 18, 2024, 05:34 AM GMT

The cryptocurrency market has been on fire following a series of bullish rallies since November. Bitcoin (BTC) has smashed its previous records, reaching a new all-time high of $108K. Riding this momentum, Cardano (ADA) has emerged as one of the top-performing altcoins, surging by 188% over the last 60 days.

However, after hitting a recent high of $1.32, Cardano is now experiencing a healthy correction and consolidating in a Descending Triangle pattern, currently cooling off to a price of $1.02.

Whale Inflows During the Recent Dip

On-chain data from crypto analyst @ali_charts reveals a strategic move by whales. While whales took profits as ADA surged from $1.15 to $1.32, the scenario quickly shifted when ADA corrected. After ADA fell to $0.91 on December 9, whales jumped back into accumulation mode.

In fact, 160 million $ADA have been accumulated since the dip, highlighting increased confidence among large investors.

What To Expect Ahead?

Cardano (ADA) has delivered an impressive 190% rally, but it is now undergoing a correction phase after retracing from its high of $1.32. On the 4-hour chart, ADA is consolidating within a Descending Triangle, a bearish pattern that signals potential weakness in the short term.

Yesterday, ADA faced a rejection from the upper resistance at $1.11, which has added downward pressure. Now trading below the resistance zone, Cardano could see further downside movement toward the lower support level of the descending triangle at $0.90.

This support zone will be critical. However, if buyers step in $0.90 level, ADA could see a rebound.

Conclusion

While Cardano remains one of the strongest altcoin performers of the recent bull market, short-term price action suggests caution. Whales accumulating during the dip is a positive sign for long-term investors, but ADA’s immediate price movement indicating downside momentum.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.