- Bitcoin is trading flat near $116K as the cryptocurrency market awaits the US Federal Reserve rate cut decision scheduled for today at 2 p.m. ET.

- BTC is forming a bullish rounding bottom pattern on the 4H chart after recovering from a pullback to $107,700 following rejection at $117,800.

- A breakout above the neckline resistance zone of $116,700-$117,800 could confirm the bullish setup and target the next resistance at $119,500.

- The rounding bottom pattern projects a potential rally toward $127,900, with a positive Fed rate cut decision potentially serving as the breakout catalyst.

Date: Tue, Sept 16, 2025 | 01:10 PM GMT

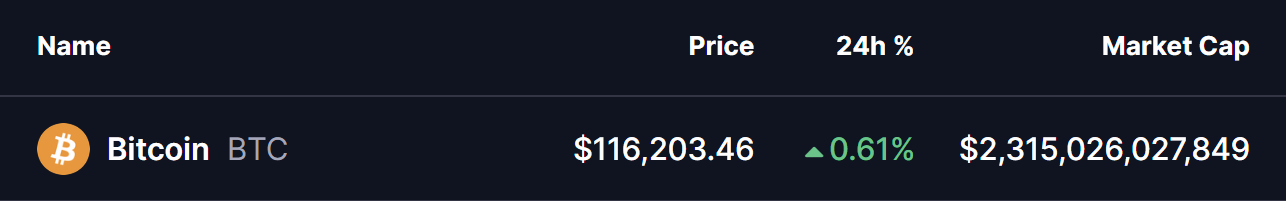

The cryptocurrency market is trading cautiously ahead of the US Federal Reserve meeting today, which is scheduled to take place in less than 5 hours from now at 2 p.m. ET. Traders are waiting for the anticipated Fed rate cut decision, and Bitcoin (BTC) is currently moving flat, reflecting the cautious sentiment.

BTC is hovering near the $116K level, trading in green. But beyond the calm price action, the chart is showing a key technical development — a bullish pattern that could trigger a breakout in the coming sessions.

Rounding Bottom in Play?

On the 4H chart, BTC appears to be forming a rounding bottom, a classic bullish reversal pattern that typically indicates accumulation before a strong upward move.

The pattern began to take shape after BTC was rejected from the $117,800 zone, which triggered a pullback to as low as $107,700. Strong buyer support emerged at that level, driving a steady recovery. Now, BTC has reclaimed ground and is trading above $116K, approaching the neckline resistance.

What’s Next for BTC?

If the pattern continues to play out as expected, a breakout above the neckline resistance zone of $116,700–$117,800 would confirm the bullish setup. Such a move could set BTC on course for the next resistance at $119,500. Clearing that level would further strengthen the breakout signal.

According to the rounding bottom breakout projection, BTC could rally toward the $127,900 target. Interestingly, a positive Fed decision on rate cuts today could serve as the catalyst that sparks this breakout move.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.