Key Takeaways

- Bitcoin whales holding 1,000+ BTC have added over 104,000 BTC, signaling strong accumulation.

- Large BTC transactions have surged to two-month highs, reflecting renewed institutional activity.

- A bullish fractal pattern is forming, similar to Bitcoin’s late-2023 setup.

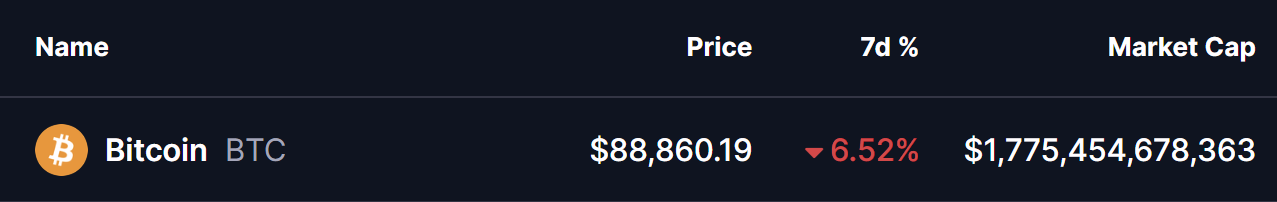

The broader cryptocurrency market has seen a mild pullback this week following a strong start to the year. Bitcoin (BTC), which recently rallied above the $95,000 level, has cooled off and is now trading below $89,000, marking a weekly decline of around 7.6%.

While short-term price action reflects profit-taking and consolidation, on-chain activity beneath the surface tells a very different story. Large holders appear to be quietly positioning for the next move, and a familiar fractal structure on the chart is once again starting to stand out.

Large Bitcoin Whales Are Accumulating

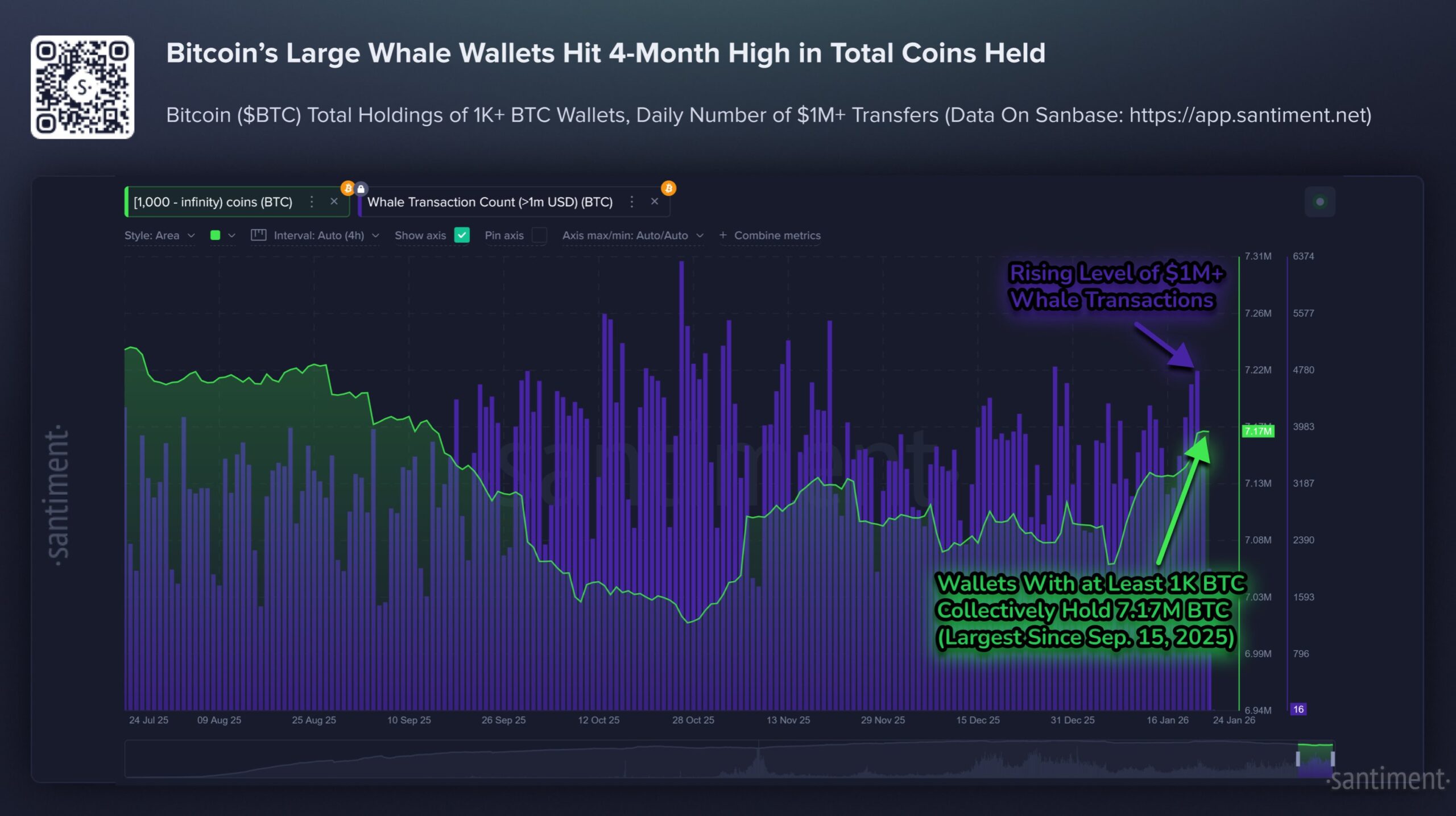

According to the latest data from Santiment, large Bitcoin whale wallets are accumulating at an encouraging pace. Wallets holding at least 1,000 BTC have collectively added 104,340 BTC, representing a 1.5% increase in total holdings.

At the same time, the number of $1 million+ BTC transfers has surged back to two-month high levels, signaling increased activity from high-net-worth participants. Historically, rising whale accumulation during market pullbacks has often preceded major trend continuation phases rather than deeper corrections.

This steady build-up suggests that large players are using the current dip as an opportunity to strengthen their positions rather than exit the market.

Could This Bullish Fractal Play Out Next?

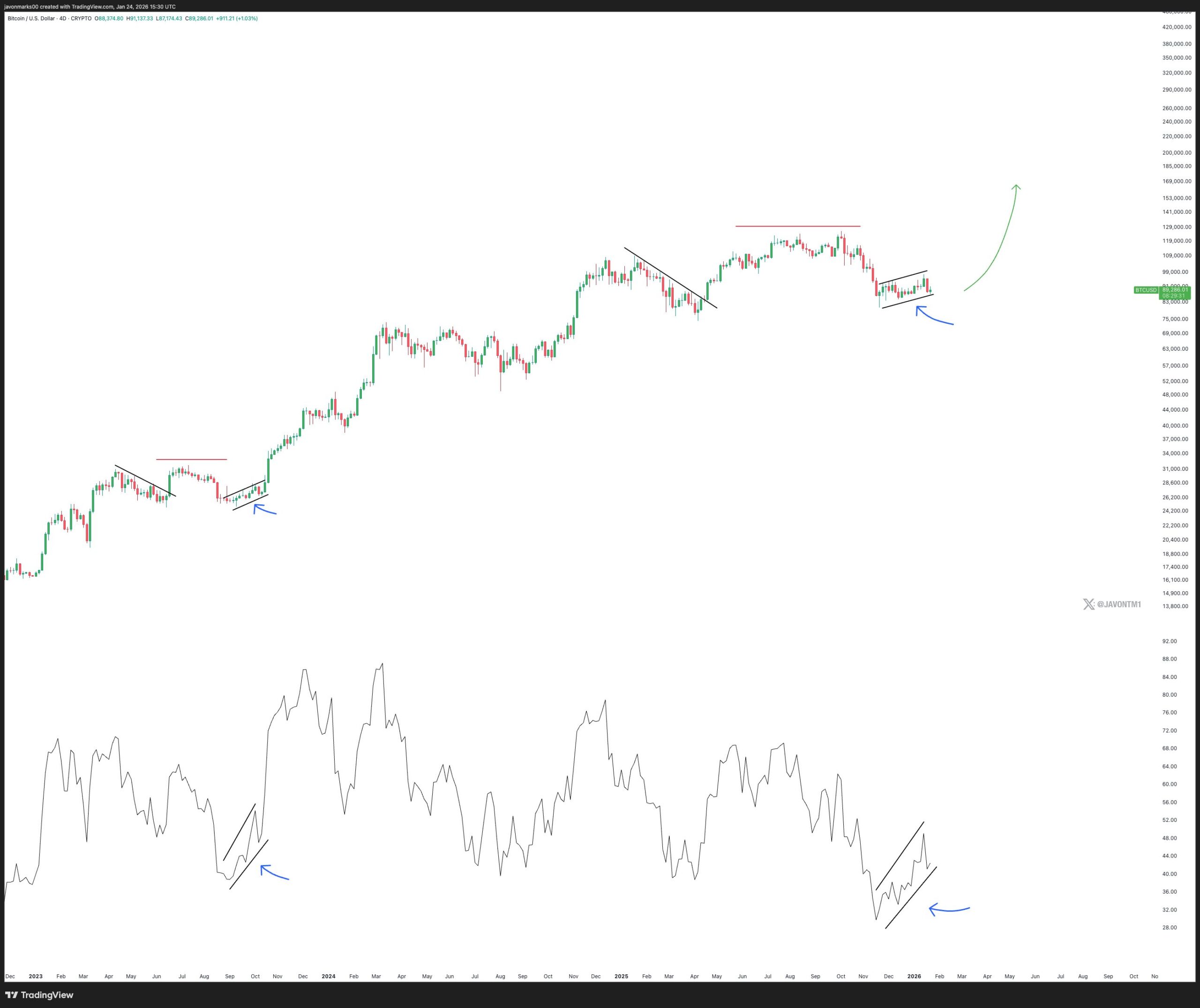

A fractal chart shared by crypto analyst Javon Marks highlights a repeating structure that closely resembles Bitcoin’s price behavior from late 2023.

Back then, BTC first broke out of a falling wedge, surged to new highs, faced a temporary rejection, and then entered an ascending channel. That consolidation phase eventually resolved to the upside, triggering another strong rally toward fresh all-time highs.

Currently, Bitcoin appears to be following a similar path. After correcting from its recent all-time high near $126,000 to the $80,000 region, BTC has begun forming an ascending channel, characterized by higher highs and higher lows. This structure closely mirrors the consolidation phase seen before the previous breakout.

What’s Next for BTC?

The combination of rising whale accumulation and this emerging bullish fractal points toward a potentially constructive phase ahead for Bitcoin.

If BTC manages a decisive breakout above the ascending channel, particularly with a sustained move above the $100,000 level, it could confirm the fractal continuation and open the door for a renewed push toward new all-time highs.

Until then, some short-term volatility and consolidation remain possible. However, as long as whales continue accumulating and price holds within the current structure, the broader trend bias remains tilted to the upside.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.