Key Takeaways

- Binance maintained its dominance in 2025, capturing 39.2% of total spot trading volume among the top centralized exchanges, despite a slight year-over-year decline.

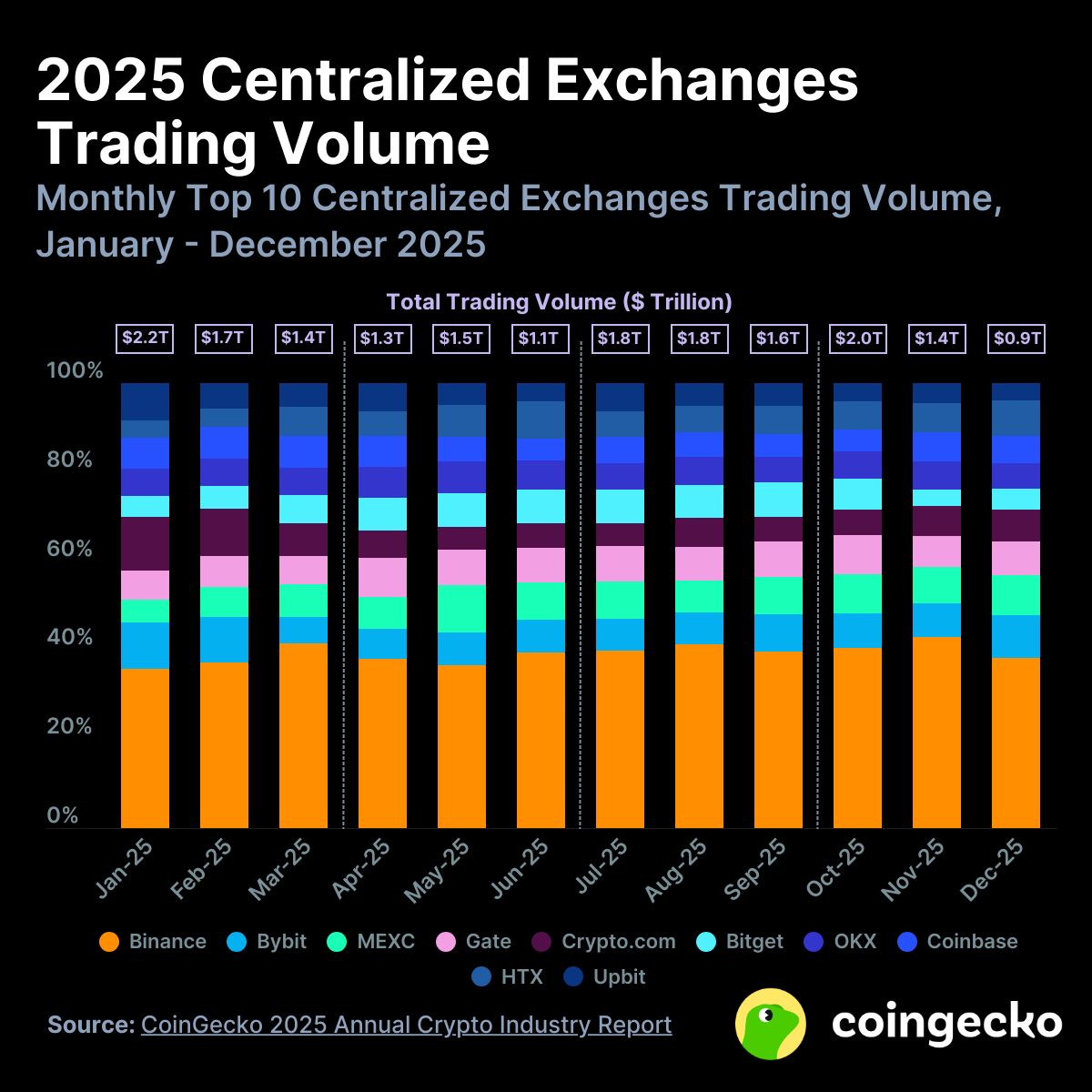

- Total CEX spot volume reached $18.7 trillion, marking a +7.6% YoY increase, showing resilience in centralized trading despite market volatility.

- MEXC emerged as the fastest-growing exchange, posting an impressive +90.9% YoY growth, driven largely by its zero-fee spot trading strategy.

The centralized exchange (CEX) landscape went through another defining year in 2025, shaped by volatility, security challenges, and shifting trader preferences. According to CoinGecko’s latest report on centralized exchange market share, Binance once again emerged as the clear industry leader—while MEXC stole the spotlight as the fastest-growing platform.

The report, published on January 29, 2026, analyzes spot trading volume across the top centralized exchanges from January to December 2025, offering a detailed look at how market power evolved during a turbulent year.

A Growing Market Despite Volatility

Collectively, the top 10 centralized exchanges processed $18.7 trillion in spot trading volume throughout 2025. That figure represents a 7.6% year-over-year increase, showing that overall trading activity expanded despite bearish phases and a noticeable slowdown toward the end of the year.

While the broader crypto market faced headwinds—particularly in the final quarter—leading platforms managed to defend their positions or, in some cases, accelerate growth through aggressive strategies.

Binance Maintains Its Lead

Binance remained firmly on top in 2025, capturing 39.2% of the total market share among the top 10 exchanges. Over the full year, the exchange processed $7.3 trillion in spot trading volume, maintaining its dominance despite a modest 0.5% year-over-year decline.

The final month of the year highlighted some of the challenges facing even the largest platforms. In December 2025, Binance recorded $361.8 billion in spot volume, down 40.6% month-on-month from November’s $609.0 billion. Its market share for the month stood at 38.3%.

Analysts attribute the late-year slowdown to lingering bearish sentiment and the fallout from a major liquidation event on October 10, 2025, which triggered widespread deleveraging and reduced trading appetite across the market.

Bybit’s Comeback Year

Bybit secured second place both annually and in December, despite a difficult start to the year. For 2025, the exchange posted $1.5 trillion in spot volume, translating to an 8.1% market share, even as its annual volume declined 13.7% year-over-year.

A major security breach in February 2025 caused Bybit’s market share to drop sharply—from 10% in February to 6% in March. However, CoinGecko notes that the exchange mounted a “slow but steady comeback,” gradually restoring user confidence through the remainder of the year.

In December, Bybit processed $90.0 billion in volume, holding a 9.5% monthly market share, despite a 16.7% month-on-month decline from November.

MEXC Leads the Growth Race

While Binance dominated in size, MEXC emerged as 2025’s fastest-growing centralized exchange. The platform ended the year with $1.5 trillion in spot trading volume, matching Bybit in absolute terms and securing a 7.8% annual market share.

What truly set MEXC apart was its growth rate. The exchange recorded a 90.9% year-over-year increase in volume, up from $766.7 billion in 2024—the strongest growth among all top 10 platforms.

In December alone, MEXC ranked as the third-largest exchange, posting $86.0 billion in volume and a 9.1% market share, even after a 24.9% month-on-month pullback. CoinGecko points to MEXC’s aggressive zero-fee spot trading policy as a key driver behind its surge, attracting both retail traders and high-frequency participants.

Broader Trends Across the Top 10

The report highlights that six of the top 10 exchanges increased trading volume in 2025, with four posting double-digit growth. Beyond MEXC, notable performers included:

- Bitget, up 45.5% YoY

- Gate, up 39.7% YoY

- HTX, up 35.6% YoY

These gains were driven by a mix of product expansion, user acquisition campaigns, and improved trading incentives.

The full 2025 annual market share rankings among the top 10 centralized exchanges are:

- Binance – 39.2%

- Bybit – 8.1%

- MEXC – 7.8%

- Gate – 7.5%

- Crypto.com – 7.2%

- Bitget – 6.4%

- OKX – 6.3%

- Coinbase – 6.1%

- HTX – 6.0%

- Upbit – 5.5%

In December 2025, the combined dominance of the top 10 exchanges reached 43.1%, reflecting continued fragmentation across the broader CEX ecosystem even as leaders like Binance held firm.

Looking Ahead to 2026

CoinGecko’s findings underline how competitive the centralized exchange market has become. While Binance continues to set the pace, 2025 demonstrated that fee innovation, recovery from security incidents, and targeted growth strategies can meaningfully shift market share.

As the crypto industry moves into 2026, investors and traders will be watching closely to see whether fast-growing challengers like MEXC can sustain momentum—and whether macroeconomic and regulatory developments introduce new dynamics into an already evolving exchange landscape.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.