Key Takeaways

- AXS surged 16%+ in the last hour and 177% in 30 days thanks to Jeff Zirlin’s bAXS explanation.

- bAXS introduces reputation-based mechanics (Axie Score) to reward real players and curb dumps.

- Structural changes aim to make the economy sustainable, reducing bot activity and inflation.

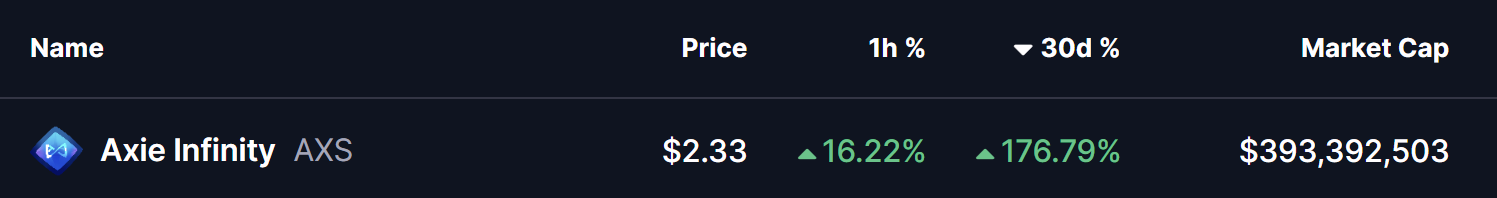

The Axie Infinity ecosystem is buzzing again, and $AXS holders are feeling the momentum. As of January 26, 2026, the token is trading around $2.33, up sharply by about 16% in the last hour and riding a massive 177% gain over the past 30 days. Market cap sits at roughly $393 million. While the broader crypto market is under presssure, today’s fresh spike appears tied directly to renewed excitement sparked by a detailed tweet from co-founder Jeff Zirlin (better known as Jihoz) explaining the upcoming bAXS system.

In his recent post, Jihoz laid out how bAXS — an “app token” version of AXS — is set to reshape the game’s economy and bring AXS back to its roots as a true player-owned asset rather than just quick-flip liquidity.

Here’s the breakdown of what he shared and why it’s lighting a fire under the price:

- bAXS is coming as an app token built for in-game economies

The concept draws from innovations by @limitbreak, designed specifically to fix common headaches in managing tokens inside games (and beyond). Instead of regular AXS flooding out as instant-sell rewards, bAXS keeps value circulating longer within the Axie universe. - Aligning AXS with its original vision

Jihoz emphasized that bAXS gives players a genuine stake in the ecosystem — think ownership and long-term alignment — rather than treating the token purely as a source of fast cash. This shift aims to reward committed players and discourage the kind of bot-driven farming that hurt the game in the past. - Exchange rate tied to reputation (Axie Score)

bAXS won’t trade 1:1 forever. Its conversion rate back to regular AXS will depend on a player’s Axie Score — a reputation system earned through owning rare Axies, active gameplay, governance participation, and more. Check the full details here: Axie Score explanation. Higher reputation = better rate. - Staking, spending, but selling comes with a fee

Players can stake bAXS for rewards or spend it directly in-game. Selling it back to AXS triggers a variable fee that flows straight to the treasury — and crucially, that fee shrinks for users with stronger Axie Scores. It’s a clever mechanic to reward loyalty and genuine engagement while adding friction to mass dumping.

This isn’t just talk — it’s part of a bigger 2026 roadmap. Earlier announcements already halted SLP gameplay emissions to kill hyperinflation and bot incentives, and the team has hinted at more structural supply tweaks ahead. The market seems to be pricing in the potential for a healthier, more sustainable economy that could drive real user growth and retention.

Of course, crypto remains unpredictable. Pullbacks can happen fast, especially after such a vertical run. But if today’s surge is any indication, Jeff Zirlin’s clear explanation of bAXS has given traders fresh conviction that Axie Infinity is finally tackling its old problems head-on.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.