Key Takeaways

- AAVE bounced strongly from channel support near $92.23, sparking a 13% rebound.

- Price is now testing the $129 area, with the 200-week MA at $137 as the next key hurdle.

- Holding above support keeps the bullish reversal in play.

- A move toward the $350–$360 zone becomes possible if momentum builds.

- A breakdown below channel support would invalidate the bullish setup.

The broader crypto market is finally showing signs of relief after the recent sell-off. Bitcoin has reclaimed the $70,000 level, while Ethereum surged above $2,100 this week — helping spark renewed risk appetite across altcoins.

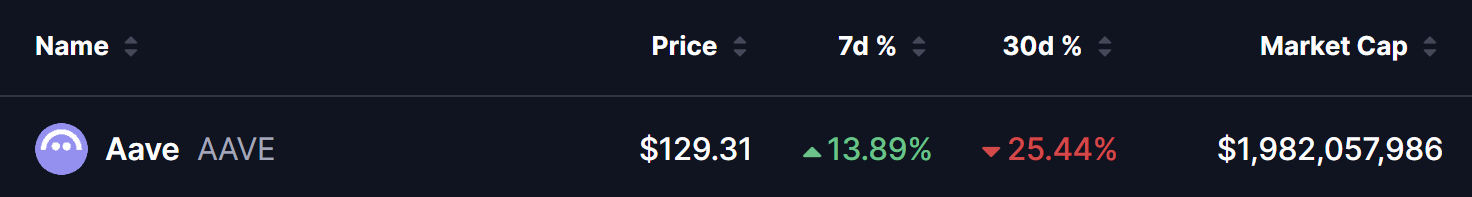

Riding that wave, Aave (AAVE) jumped nearly 13%, trimming its monthly decline to around 25%. More importantly, its weekly chart is now flashing a potentially meaningful bullish setup that could shape the next leg of price action.

Descending Channel Pattern in Play

On the weekly timeframe, AAVE is trading inside a descending channel — a structure formed by two parallel, downward-sloping trendlines that often appears during extended corrective phases.

Recently, price swept the lower boundary of the channel near $92.23, where buyers stepped in aggressively to defend support. That reaction sparked the current rebound, pushing AAVE back toward the $129 zone and signaling a possible shift in short-term momentum.

This type of move is typical for descending channels: selling pressure weakens near the lower trendline, volatility starts to expand, and price begins rotating higher inside the structure — setting the stage for a potential recovery rally.

What’s Next for AAVE?

If bullish momentum continues, AAVE could soon challenge its 200-week moving average around $137. A successful reclaim of this level would be an important technical confirmation and could open the door for a move toward the upper boundary of the channel, which currently aligns near the $350–$360 region.

A breakout above that channel would significantly strengthen the bullish reversal thesis and likely attract fresh buyers looking for confirmation.

That said, this is still a technical bounce for now.

If AAVE fails to hold above current levels and slips back below the channel’s lower boundary, the bullish setup would be invalidated — potentially sending price back into consolidation or extending the broader downtrend.

Big Picture

With Bitcoin back above $70K and market sentiment slowly improving, AAVE’s bounce from long-term support comes at a critical moment. The descending channel suggests the token may be entering a volatility expansion phase, where sharper moves — especially to the upside — become more likely.

For now, bulls will be closely watching whether AAVE can reclaim the 200-week MA and continue rotating higher inside the channel. Until then, expect choppy price action — but the technical groundwork for a stronger recovery is clearly starting to form.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.