Key Takeaways

- Pudgy Penguins (PENGU) is down short term but showing a familiar bottoming structure.

- PENGU’s chart closely mirrors PEPE’s pre-breakout fractal from late 2024.

The broader cryptocurrency market has once again slipped into a corrective phase after a strong start to the year. Bitcoin (BTC), which recently surged above the $95,000 mark, has pulled back sharply and is now trading below $88,000. Ethereum (ETH) has faced even heavier pressure, sliding more than 10% over the past week — a move that has weighed on major altcoins across the board.

Pudgy Penguins (PENGU) hasn’t been spared either. The token is currently down around 7% on the week. However, beneath the surface, PENGU’s price action is beginning to show a familiar and potentially bullish setup — one that closely resembles PEPE’s structure before its explosive breakout.

PENGU Mirrors PEPE’s Pre-Rally Structure

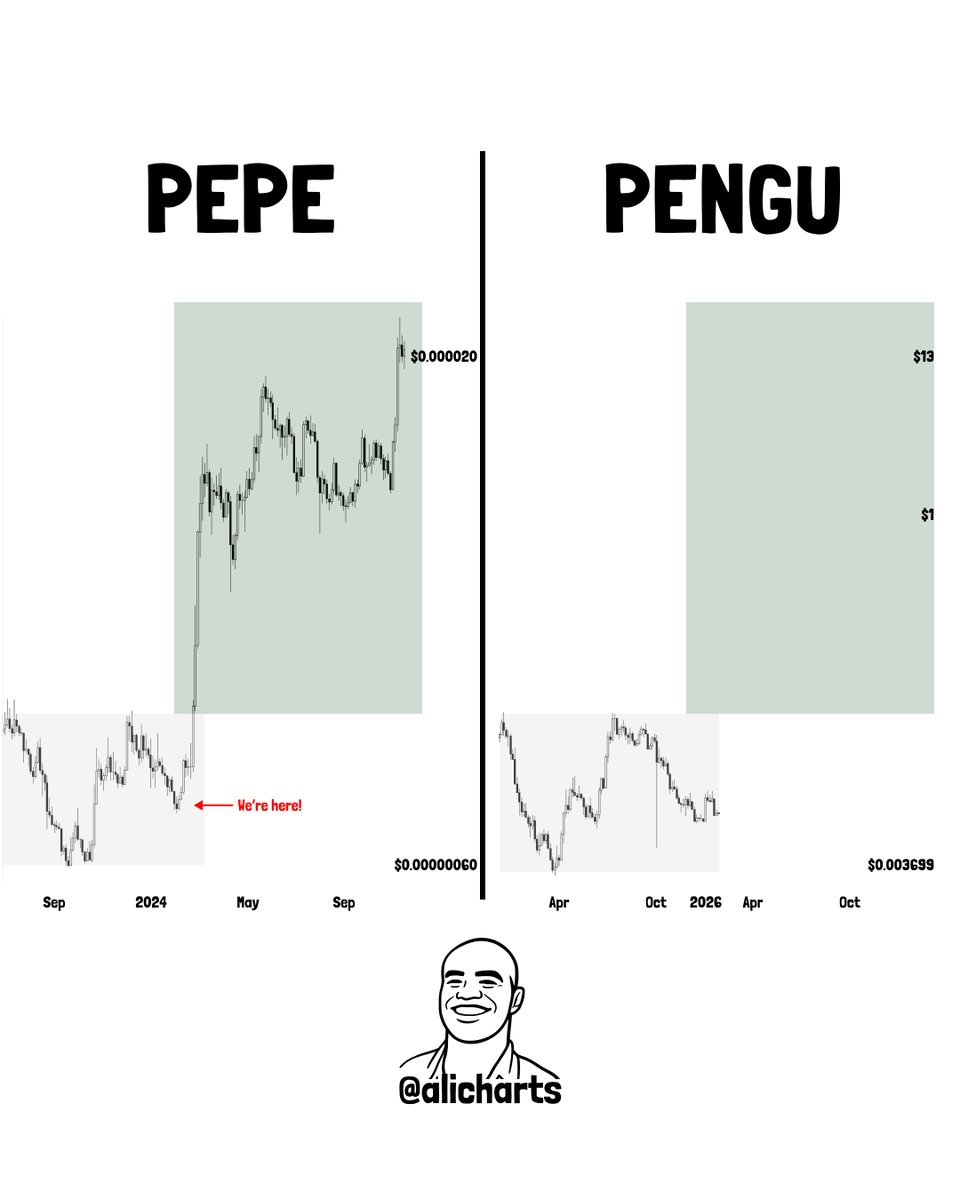

A side-by-side comparison of the PEPE and PENGU charts reveals striking similarities.

Back in late 2024, PEPE went through a sharp decline that eventually led to a bottoming formation. During this phase, price consolidated for an extended period inside a gray accumulation zone while forming a potential bearish Butterfly harmonic pattern. At the time, sentiment was muted and volatility remained compressed.

Once PEPE finally broke above that gray range, momentum flipped aggressively. The breakout triggered a powerful bullish reversal, sending PEPE more than 100% higher into December 2024.

Now, PENGU appears to be following a remarkably similar path.

As shown on the right side of the chart, PENGU has also experienced a strong drop followed by a basing structure inside a gray consolidation zone. The price action suggests a potential bearish Butterfly harmonic pattern forming near the bottom — a setup that closely mirrors PEPE’s behavior just before its reversal.

What’s Next for PENGU?

If the PEPE fractal continues to play out, PENGU may be approaching the early stages of a trend reversal.

A decisive breakout above the gray zone resistance near $0.01382 would be a key confirmation signal. Such a move could open the door for a bullish continuation toward higher levels, with a potential upside target near $0.034, similar to PEPE’s post-breakout expansion.

That said, fractals are not guarantees — they are historical analogs, not certainties.

On the downside, a sustained drop below the $0.0084 support level would invalidate the fractal comparison and suggest that PENGU needs more time to build a durable base before any meaningful upside can materialize.

For now, PENGU sits at a technical crossroads. While broader market weakness continues to apply pressure, the chart hints that smart money may be quietly positioning ahead of a possible reversal. If momentum returns and the gray zone gives way, Pudgy Penguins could be setting up for its next major move — just as PEPE once did.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.