Key Takeaways

- Cronos (CRO) has recorded a massive spike in whale activity, with $100K+ transactions jumping over 1,100% week-over-week.

- On-chain data suggests renewed interest from large holders, often seen ahead of major price moves.

- The daily chart shows CRO forming a descending triangle pattern, signaling volatility compression.

Cronos (CRO), the native token of the Crypto.com ecosystem, has stepped back into the spotlight this week as on-chain data reveals a sharp surge in whale activity, while the price chart itself is beginning to hint at a potential technical reaction ahead.

Cronos (CRO) Sees Huge Increase in Whale Activity

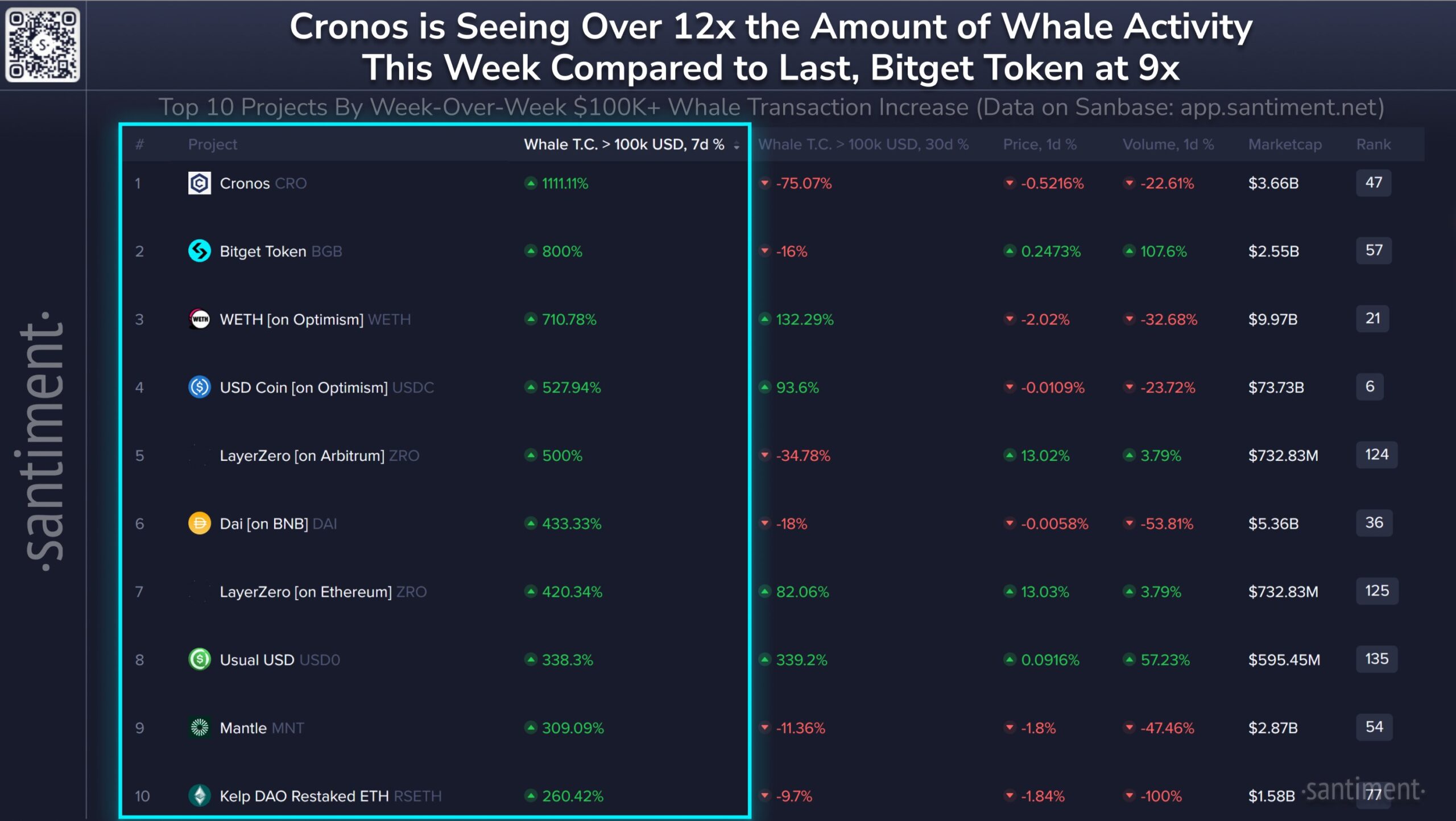

According to the latest data from Santiment, Cronos has recorded one of the largest week-over-week increases in whale transactions across the crypto market.

In the past 7 days, $100,000+ CRO transactions surged by over 1,100%, making Cronos the top-ranked project in terms of weekly whale activity growth. This spike significantly outpaced other large-cap tokens, with even Bitget Token (BGB) — ranked second — showing a comparatively smaller increase.

Such a sharp jump in whale activity often signals renewed interest from large holders, whether for accumulation, strategic positioning, or preparation ahead of a volatility expansion. While whale activity alone does not guarantee an immediate price rally, it frequently precedes key market moves, especially when aligned with technical structures on the chart.

What Could Come Next for $CRO?

Looking at the daily timeframe, CRO appears to be forming a descending triangle pattern, a structure that typically develops during periods of consolidation after a strong trend.

Price action shows CRO repeatedly making lower highs along a descending trendline, while buyers continue to defend a relatively flat support zone near $0.08833. This compression between sellers and buyers suggests that a decisive move may be building as volatility tightens.

If the pattern continues to play out, the current support region could once again act as a launchpad, pushing CRO toward the upper boundary of the triangle near the $0.105–$0.107 zone. From there, a pullback toward support would complete the classic triangle structure before a clearer directional move emerges.

A confirmed daily close above the descending trendline would invalidate the bearish pressure and shift momentum in favor of bulls, potentially opening the door for a stronger recovery move.

On the flip side, failure to hold the $0.088 support would weaken the structure and could expose CRO to deeper downside before any sustainable reversal attempt.

Bottom Line

The combination of explosive whale activity and a tightening technical structure puts Cronos at an important inflection point. While price remains range-bound for now, large players appear to be increasingly active behind the scenes.

If CRO can defend its key support and break above descending resistance, the current setup may evolve into a meaningful upside move. Until then, traders should closely monitor how price reacts around the $0.088 support zone, as the next breakout — or breakdown — is likely to define CRO’s near-term direction.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.