- Solana ranks as the second most active blockchain with over 40 million monthly users, trailing only BNB Chain and highlighting strong on-chain adoption.

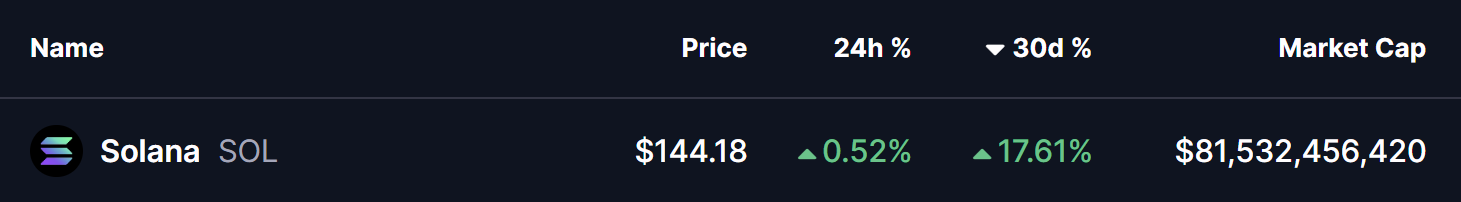

- SOL price has gained nearly 17% in the past 30 days, supported by improving market sentiment in early 2026.

- Technical analysis shows a Bearish Shark harmonic pattern that still allows room for short-term upside before potential reversal.

- A reclaim of the 50-day moving average could push SOL toward the $166-$178 resistance zone, offering around 23% upside from current prices.

Key Takeaways

- Solana (SOL) ranks as the second most active blockchain with over 40 million monthly users, highlighting strong on-chain adoption.

- SOL price has gained nearly 17% in the past 30 days, supported by improving market sentiment in 2026.

- The daily chart shows a Bearish Shark harmonic pattern, which still allows room for short-term upside.

- A reclaim of the 50-day moving average could push SOL toward the $166–$178 resistance zone.

- The $166.18 and $178.44 levels mark the potential reversal zone, offering around 23% upside from current prices.

As the cryptocurrency market continues to regain momentum in early 2026, Solana (SOL) is once again standing out as one of the strongest performers among major blockchains. Over the past 30 days, SOL has climbed nearly 17%, and the rally is not being driven by price speculation alone. On-chain data and user activity suggest that the network’s fundamentals are strengthening alongside the recovery.

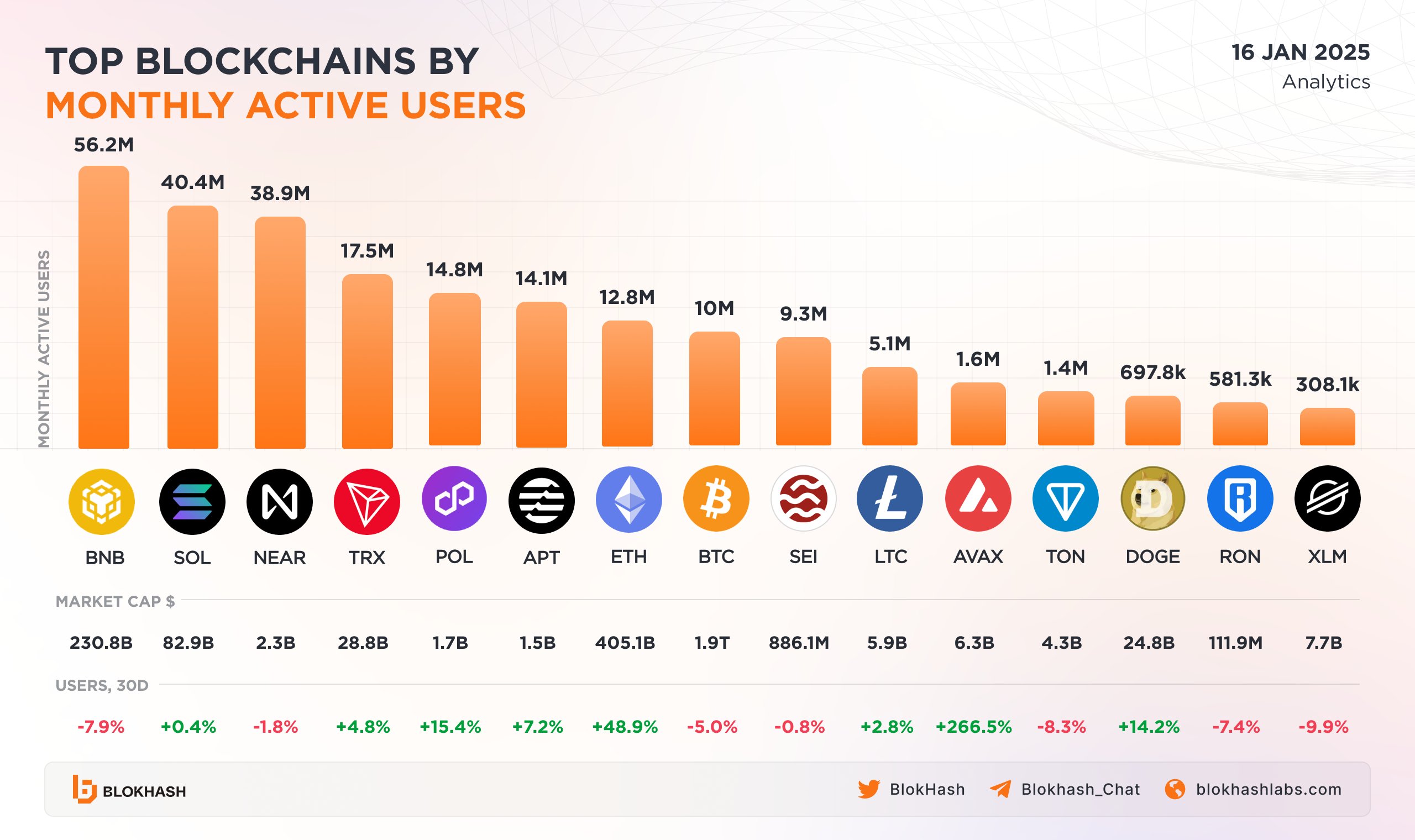

Top Blockchains by Active Users

Solana is currently ranked as the second most active blockchain, recording around 40.4 million monthly active users, trailing only BNB Chain. This surge in activity highlights growing adoption across DeFi, NFTs, and on-chain applications, reinforcing Solana’s position as a leading Layer-1 ecosystem in the current market cycle.

Technical Patterns Hint at Further Upside

From a technical perspective, SOL’s daily chart presents an interesting setup. The price action has formed a Bearish Shark harmonic pattern, a structure often associated with trend exhaustion at its completion point. However, before that reversal zone is reached, the pattern typically allows room for continued upside.

At present, SOL is trading near $144, consolidating just below a critical technical level. A successful reclaim of the 50-day moving average, which sits slightly above the current price, could act as a trigger for the next leg higher.

Based on the harmonic structure visible on the chart, SOL’s price is projected to move toward the $166.18 to $178.44 range, which represents the Potential Reversal Zone (PRZ) of the Shark pattern. These levels align closely with the 0.886 and 1.13 Fibonacci extensions, commonly used to estimate the completion of the pattern’s final “C” leg.

If this scenario plays out, SOL could see an upside move of roughly 23% from current levels, assuming broader market conditions remain supportive.

Importantly, the higher-low structure formed since the December bottom suggests improving momentum, while the steady slope toward the PRZ indicates controlled, healthy buying pressure rather than a parabolic move.

Bottom Line

Solana’s strong user growth, combined with a technically constructive chart setup, places the token in a favorable position as 2026 unfolds. While the Bearish Shark pattern signals caution near the $166–$178 zone, the path toward that level remains open as long as SOL holds above recent support and reclaims its key moving average. For now, Solana appears well-positioned to extend its recovery before facing its next major technical test.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.