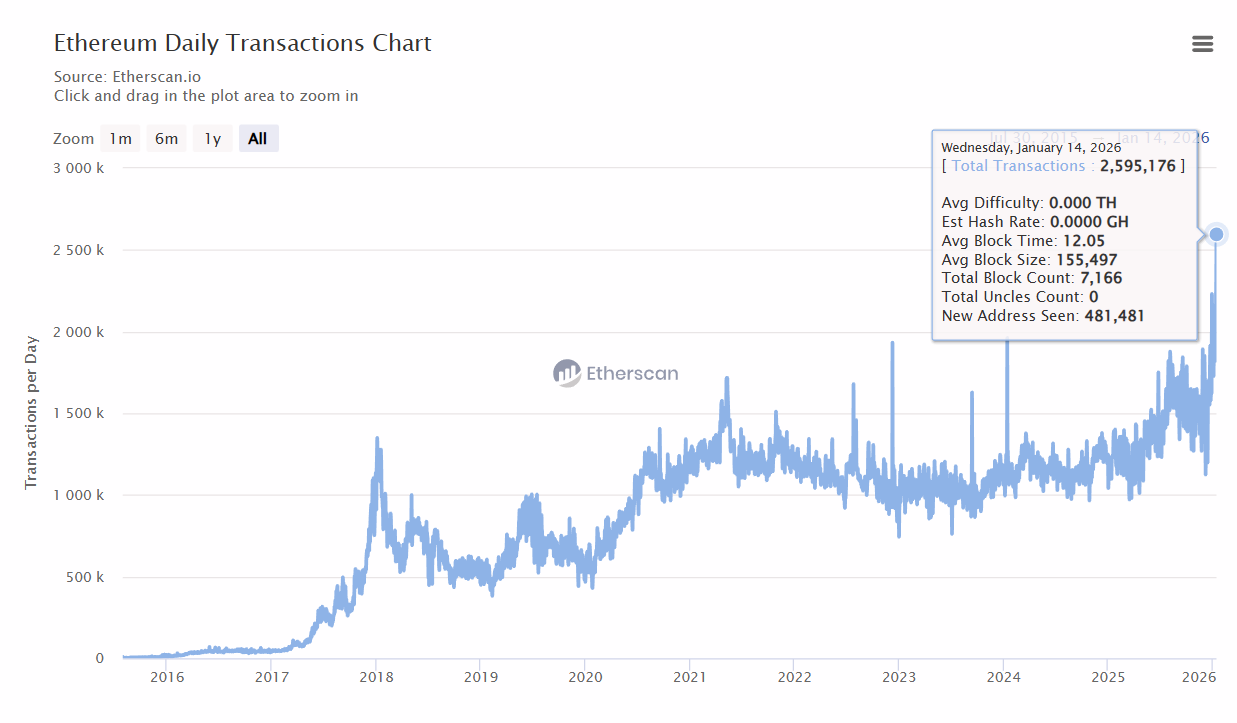

- Ethereum recorded its highest-ever daily transaction count with 2.59 million transactions on January 14, 2026, representing an 11.86% increase from recent averages.

- The surge in on-chain activity signals growing network usage and demand for decentralized applications, stablecoin transfers, and Layer 2 interactions.

- ETH has broken out of an asymmetrical triangle pattern above $3,280 resistance, confirming bullish momentum and pushing to a local high of $3,405.

- The cryptocurrency has gained nearly 8% over the past week and 14% over 30 days, with price now trading above the 100-day moving average.

Key Takeaway

- Ethereum (ETH) recorded its highest-ever daily transaction count, surpassing 2.59 million transactions.

- The surge in on-chain activity signals growing network usage and demand.

- ETH has broken out of an asymmetrical triangle pattern, confirming bullish momentum.

Ethereum (ETH) has quietly been building momentum, and the latest on-chain and technical signals suggest the market may be entering a decisive phase. Over the past week, ETH has climbed nearly 8%, extending its 30-day gain to around 14%, supported by a sharp rise in network activity and a technically significant breakout on the daily chart.

With Ethereum posting record-breaking transaction counts and price compressing into a bullish structure before breaking higher, traders are now watching closely to see whether this move can extend into a broader rally.

Ethereum (ETH) Hits Record Daily Transactions

Ethereum’s network activity just reached an all-time high. According to on-chain data from Etherscan, the blockchain processed 2,595,176 transactions on Wednesday, January 14, 2026, marking the highest daily transaction count in its history.

This milestone represents an 11.86% jump in daily transactions compared to recent averages and signals a notable increase in real usage across the Ethereum ecosystem. Rising transaction counts often reflect growing demand for decentralized applications, stablecoin transfers, Layer 2 interactions, and on-chain trading — all of which tend to strengthen the fundamental case for ETH.

Historically, sustained increases in transaction activity have preceded periods of price expansion, as higher usage translates into greater demand for block space and ETH itself.

Could This Breakout Trigger ETH Higher?

From a technical perspective, Ethereum’s price action is aligning with the surge in on-chain activity.

On the daily chart, ETH has successfully broken out of an asymmetrical triangle pattern, a structure that typically signals trend continuation after a period of consolidation. The breakout occurred as ETH pushed decisively above the triangle’s descending resistance near $3,280, confirming buyer control.

Following the breakout, Ethereum rallied to a local high of approximately $3,405 on January 14, reinforcing the validity of the move. Importantly, price is now trading just above the 100-day moving average, a level that often acts as dynamic support during early trend reversals.

A short period of consolidation or a modest retest of the breakout zone would be considered technically healthy. As long as ETH holds above the former resistance area, the broader bullish structure remains intact.

What’s Next for Ethereum (ETH)?

Looking ahead, the technical outlook remains constructive.

If Ethereum continues to hold above the breakout region and maintains strength above the 100-day moving average, the next major test lies at the 200-day moving average near $3,643. A successful reclaim of this level would likely attract additional momentum buyers and strengthen bullish conviction.

Beyond that, the measured move from the triangle pattern points toward a potential upside target near $4,300, representing roughly 27% upside from current price levels.

However, downside risk remains if ETH fails to sustain the breakout. A decisive move back below the former consolidation zone would weaken the bullish setup and increase the likelihood of a deeper pullback, potentially turning the recent surge into a failed breakout.

Bottom Line

Ethereum’s combination of record-setting network activity and a confirmed technical breakout places it at a critical inflection point. While short-term consolidation is possible, the broader structure favors the bulls as long as key support levels hold.

With on-chain usage accelerating and price breaking out of compression, Ethereum appears well-positioned for further upside — provided market conditions remain supportive.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.