Date: Wed, Nov 12, 2025 | 12:20 PM GMT

The cryptocurrency market is showing signs of a rebound in the last few hours as Ethereum (ETH) climbed from its 24-hour low of $3,404 to around $3,533. This short-term recovery has lifted overall market sentiment, pushing several altcoins into the green — including Aster (ASTER).

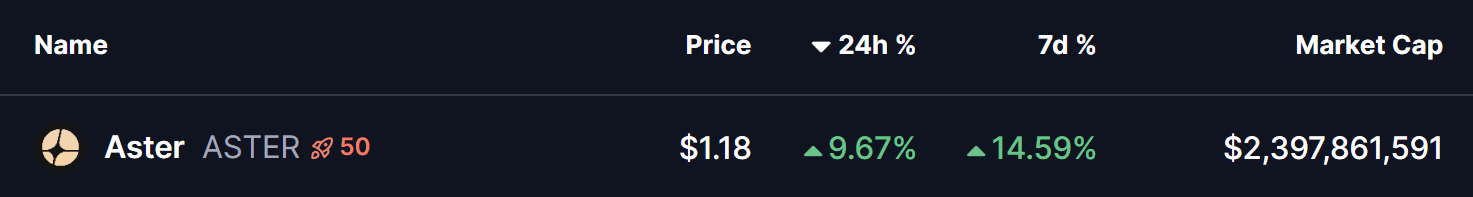

ASTER has surged by nearly 9% today, extending its weekly gains to around 14%. More importantly, the latest price structure indicates that the token may be preparing for a stronger move ahead.

Ascending Triangle Breakout

On the 4-hour chart, ASTER had been consolidating within an ascending triangle pattern, showing a steady formation of higher lows while repeatedly facing rejection near the $1.17 resistance level.

Today, bulls managed to push ASTER beyond this crucial resistance, confirming a breakout that sent prices toward a local high of $1.1923. This breakout highlights the growing bullish strength and signals that momentum has shifted clearly in favor of buyers.

Additionally, ASTER has reclaimed the 200 moving average (200 MA) near $1.1408, a key dynamic level that could act as fresh support if the price retests this region in the short term.

What’s Next for ASTER?

From the current momentum, ASTER may revisit the $1.17–$1.14 zone to retest its breakout structure and confirm it as new support. A successful retest could open the door for an upside continuation toward $1.36, marking a potential 14% gain from current prices.

However, if ASTER fails to hold above its breakout zone or slips back below the moving averages, the bullish outlook could weaken — potentially leading to a deeper correction before any renewed upside attempt.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.