- Dogecoin whales accumulated approximately 470 million DOGE worth $155 million over the past 48 hours, signaling strong confidence despite the broader market downturn.

- DOGE dropped over 14% in the past week and is currently trading at $0.33, following Bitcoin's decline from $102K to $94K which triggered widespread altcoin corrections.

- Dogecoin is trading near the critical 0.618 Fibonacci retracement level at $0.33, a zone that has historically preceded explosive rallies in previous cycles.

- Any potential DOGE rally depends heavily on Bitcoin stabilizing its support zone between $91K-$94K, as BTC's movements continue to drive broader market sentiment.

Date: Sat, Jan 11, 2025, 03:46 AM GMT

In the cryptocurrency market, after a bearish December, January has proven to follow its historically challenging trend. This week, Bitcoin (BTC) experienced a sharp drop from $102K to its current level near $94K. The rise in BTC dominance above 58.15% triggered a broader altcoin and memecoins decline, causing notable corrections across the market.

Among the top memecoin, Dogecoin (DOGE) faced significant pressure, dropping over 14% in the past seven days. As of today, DOGE is trading at $0.33, showing resilience amid the ongoing market downturn.

Whale Activity Soars

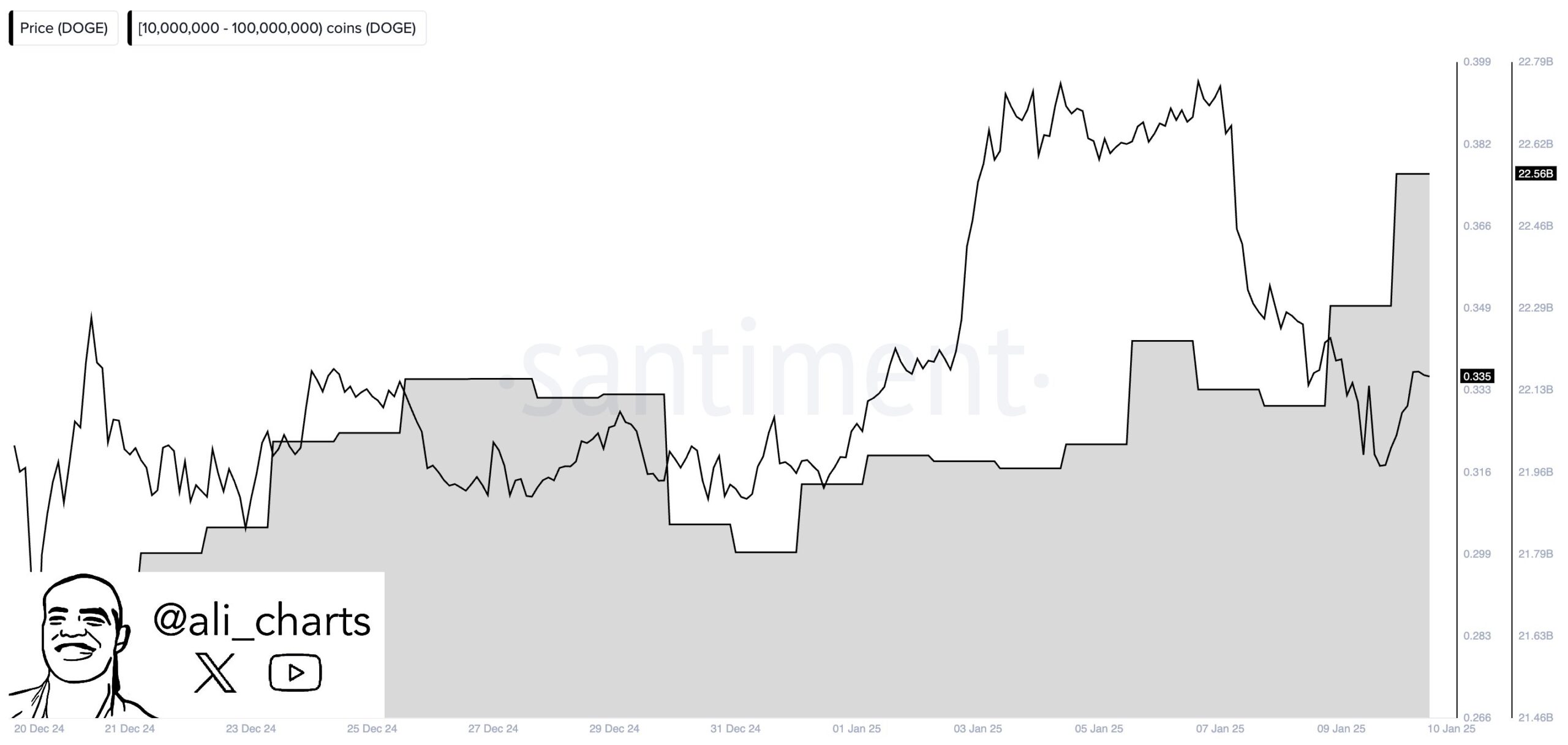

Despite the market corrections, Dogecoin whales have shown strong confidence in the token’s recovery. According to crypto analyst @ali_charts, over the past 48 hours, large wallets have accumulated approximately 470 million DOGE, valued at $155 million at the current price of $0.33.

This surge in whale activity signals optimism for DOGE’s long-term potential and recovery prospects.

Fibonacci Levels Signaling Major Rally

Dogecoin’s recent price action aligns closely with its historical patterns. After a strong rally from $0.15 to $0.48 in late 2024, DOGE is now undergoing a healthy correction. This pullback mirrors previous cycles in which the token consolidated near key Fibonacci retracement levels before initiating another breakout.

Crypto analyst @_CryptoSurf highlights that DOGE is currently trading near the 0.618 Fibonacci retracement level at $0.33, a critical zone for reversals. Historically, Dogecoin has exhibited explosive rallies from similar levels. If this pattern repeats, DOGE could see a major upside move in coming months.

However, for this bullish scenario to materialize, the broader cryptocurrency market must stabilize. Bitcoin’s ability to maintain its support zone between $91K and $94K will play a crucial role in determining DOGE’s next direction.

Conclusion

Dogecoin’s whale accumulation and proximity to key Fibonacci levels suggest the potential for a major rally. However, the broader market sentiment, heavily influenced by Bitcoin, remains a determining factor. Traders and investors should watch BTC’s movements closely while keeping an eye on DOGE’s ability to hold above $0.33.

If Bitcoin stabilizes and Dogecoin breaks out of its current consolidation phase, the memecoin could regain momentum and test its December highs. Until then, cautious optimism is warranted as the market navigates through January’s volatility.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

The opinions and market insights shared on CoinsProbe represent the views of individual authors based on prevailing market conditions at the time of publication. Cryptocurrency investments carry significant risk and volatility. Readers are encouraged to conduct their own research and seek professional financial advice before making investment decisions. CoinsProbe and its contributors do not accept responsibility for financial losses or decisions made based on published content.

CoinsProbe may publish sponsored articles, affiliate links, or promotional collaborations. All sponsored material is clearly labeled to maintain transparency with our audience. Our editorial decisions remain fully independent, and advertising partnerships do not influence reviews, rankings, or published opinions.

Since 2023, CoinsProbe has delivered reliable insights on cryptocurrency, blockchain, and digital assets. Our content is created by experienced researchers and analysts who follow strict editorial standards focused on accuracy, transparency, and credibility. Every article is carefully reviewed and verified using trusted sources and current market data. We provide unbiased analysis and timely updates covering everything from emerging crypto projects to major industry developments.