Date: Sun, Nov 17, 2024

Predicting precise prices for cryptocurrencies is a daunting task due to the inherent volatility and complex factors at play. However, historical trends and current developments offer a clear roadmap for future market sentiment. With this report, we present a detailed outlook for the crypto market, leveraging insights from key historical patterns and the latest developments.

Historical Bull Run Patterns

2013: The First Major Bull Run

Bitcoin experienced its first significant rally, reaching over $1,000 by the end of the year. This surge was fueled by increasing media attention and early adoption as an alternative investment, establishing Bitcoin as a disruptive financial asset.

2017: The ICO Frenzy

The 2017 bull market remains one of the most iconic in crypto history. Bitcoin surged from below $1,000 to nearly $20,000, driven by Initial Coin Offerings (ICOs), speculative trading, and heightened mainstream interest. This cycle also introduced Ethereum and altcoins to the broader public, marking a turning point in crypto adoption.

2020-2021: The Institutional Era

Post the 2020 Bitcoin halving, the market saw a massive rally, with Bitcoin climbing from $8,800 to an all-time high of $68,000 in November 2021. This phase was characterized by institutional adoption, economic uncertainty from the COVID-19 pandemic, and an influx of retail investors. Companies like MicroStrategy and Tesla embraced Bitcoin, further legitimizing the asset in the eyes of the global financial market.

2024-2025 Outlook: A New Era of Institutional Dominance

The cryptocurrency market is poised for another transformative period, underpinned by pivotal developments:

Bitcoin Halving (2024)

Historically, Bitcoin halvings have been precursors to bull runs, as they reduce the asset’s inflation rate and create a supply shock. The 2024 halving has already triggered increased optimism, with historical patterns suggesting a new price peak could be reached within 12-18 months post-halving.

Spot ETFs Approval

The approval of Bitcoin and Ethereum spot ETFs has unlocked significant institutional liquidity. These products allow traditional investors to gain exposure to cryptocurrencies without directly holding them, boosting market credibility and adoption. Analysts have noted that the entry of ETFs could drive billions of dollars into the crypto market, solidifying Bitcoin and Ethereum as foundational assets in investment portfolios.

Donald Trump’s Election Victory (November 2024)

On November 5, 2024, Donald J. Trump won the U.S. presidential election, reiterating his pro-crypto stance. During his campaign, Trump pledged to retain the U.S. government’s Bitcoin holdings of approximately 200,000 BTC.

In addition, Sen. Cynthia Lummis introduced a proposal to gradually increase the U.S. Bitcoin reserves to 1 million BTC over five years. While the bill is still in its early stages, Trump’s administration has created a favorable regulatory climate, fueling investor confidence. This optimism has already propelled Bitcoin to a new all-time high of $93,000, with analysts predicting even higher targets in 2025.

Chart Insights: Technical Outlook for Bitcoin

Halving Cycle Analysis

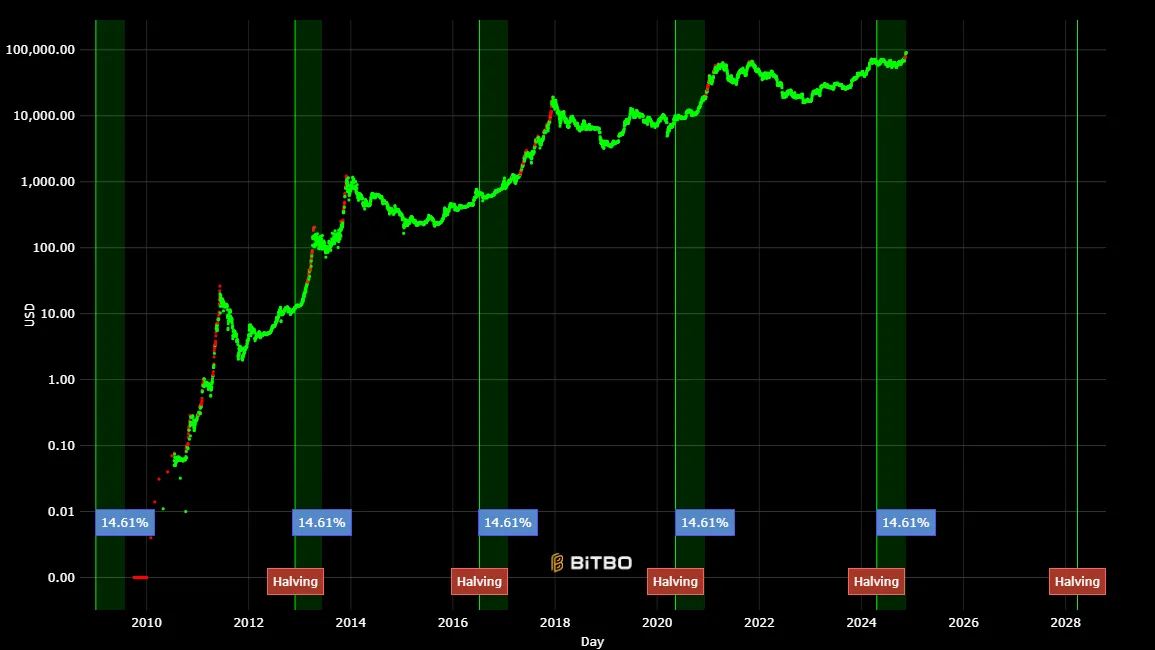

The Bitcoin halving cycle chart provides a clear perspective on the correlation between halving events and price surges:

- 2012 Halving: Following the first halving, Bitcoin surged from $12 to over $1,000 within a year, marking its entry into mainstream consciousness.

- 2016 Halving: Bitcoin rallied from $600 to nearly $20,000 in the year after the second halving, highlighting the asset’s scarcity-driven price appreciation.

- 2020 Halving: After the third halving, Bitcoin climbed from $8,800 to an all-time high of $68,000, driven by institutional adoption and increased demand during the global pandemic.

- 2024 Halving Outlook:

The 2024 halving is already showing signs of mimicking prior patterns, as Bitcoin reached $93,000 shortly after the event. Historical data suggests a continuation of this bullish trend, with potential price targets of $150,000 to $250,000 by 2025.

Bitcoin Rainbow Chart

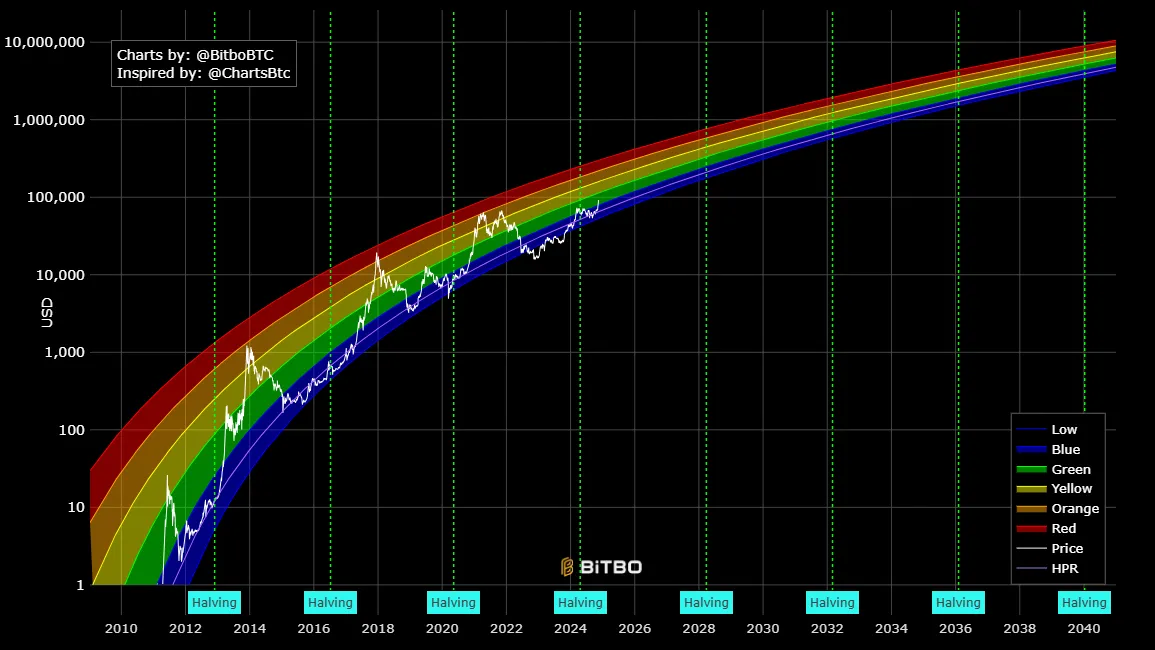

The Bitcoin Rainbow Chart uses a logarithmic regression model to classify Bitcoin’s price zones, offering a simple yet effective visual of market sentiment:

- Historic Patterns:

- 2013: Bitcoin entered the “green zone” (accumulation) before peaking above $1,000.

- 2017: Bitcoin hit the “red zone” (euphoria) at $20,000.

- 2020-2021: Bitcoin again reached the “red zone,” peaking at $68,000.

- Current Market Cycle:

As of now, Bitcoin has entered the “green zone” after surpassing $93,000. Historical patterns suggest that the market could move into the “red zone” (euphoria), with potential highs between $200,000 and $300,000 during this cycle.

Conclusion: The Road Ahead

The cryptocurrency market is on the cusp of a historic bull run, driven by a combination of cyclical trends, institutional adoption, and a favorable political climate. Bitcoin’s new all-time high of $93,000 is just the beginning, with predictions pointing to a potential peak between $200,000 and $300,000 during this cycle.

The overall picture is looking promising, with a bullish future for the entire crypto market. This momentum could lead tokens across the board to achieve new highs, fueled by strong institutional participation and regulatory clarity. While the road ahead will have its ups and downs, the long-term outlook for the crypto industry remains bright and full of potential.

Disclaimer: This report is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.