Date: Sun, Oct 26, 2025 | 07:35 AM GMT

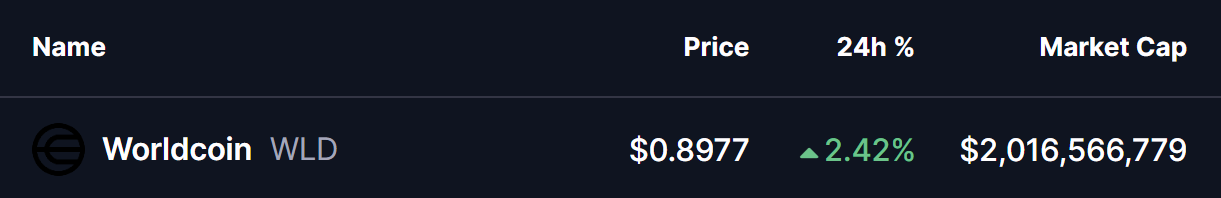

The broader cryptocurrency market is trading with a steady upside tone today, as both Bitcoin (BTC) and Ethereum (ETH) post modest gains. This improving sentiment is also lifting several altcoins including — Worldcoin (WLD)

WLD is currently up 2% today, and more importantly, its latest chart structure is revealing a harmonic formation that may set the stage for a potential bullish move in the coming sessions.

Cypher Harmonic Pattern in Play

On the 4-hour chart, Worldcoin (WLD) is forming a Bearish Cypher harmonic pattern. Despite its “bearish” name, this setup often involves a strong bullish rally in the CD leg before the price reaches the Potential Reversal Zone (PRZ) — the point where the overall pattern typically completes.

The pattern began at Point X ($1.050), dropped to Point A, rebounded toward Point B, and then sharply declined to Point C ($0.810). From there, WLD started to recover and is now trading around $0.897, successfully reclaiming the 50-hour moving average (MA) at $0.888 — a positive sign that buyers are gradually regaining control.

The next key test lies at the 100-hour MA, currently around $0.932. A confirmed breakout above this level could signal the start of a stronger bullish continuation, pushing WLD toward higher Fibonacci extension zones.

What’s Next for WLD?

If bulls continue to defend the 50-hour MA and manage a sustained push above the 100-hour MA, the harmonic pattern projects a potential upside target between $1.00 (0.786 Fibonacci extension) and $1.05 (1.0 extension). This range marks the completion zone of the Bearish Cypher, which typically acts as a major resistance area where traders may look to secure profits.

However, if WLD fails to hold support at the 50-hour MA, short-term momentum could soften, leading to sideways consolidation before any new bullish attempt emerges.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.