Date: Mon, Dec 30, 2024, 11:02 AM GMT

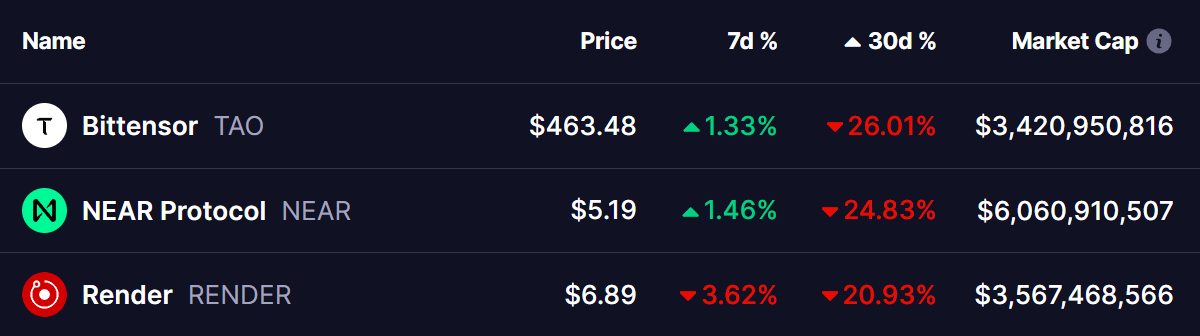

In the cryptocurrency market, the past two weeks have seen significant corrections in altcoins, with Bitcoin (BTC) dropping from its recent all-time high (ATH) of $108,000 to now trading above $93,000. This downward trend has also affected top AI tokens, including Bittensor (TAO), Near Protocol (NEAR), and Render (RENDER), which have each experienced losses of over 20% in the last 30 days.

Amid this corrective phase, these tokens have made some recovery in weekly performance and are positioned at critical resistance levels, hinting at potential breakouts.

Bittensor (TAO):

Currently trading at $463, Bittensor (TAO) is showing signs of recovery as it approaches the upper resistance of its falling wedge pattern, as seen in the 4-hour chart.

A breakout above the wedge’s resistance could open the door for a rally toward its next target at $523, representing an upside potential of approximately 12%. If bullish momentum continues, TAO could aim for higher resistance levels at $641 and $747, completing its falling wedge trajectory.

On the downside, a rejection at the resistance could see TAO revisiting its support level at $442, extending the consolidation phase.

Near Protocol (NEAR):

Near Protocol (NEAR) is currently priced at $5.18 and is similarly trading within a falling wedge pattern. The token has shown resilience and is now inching closer to breaking out of its resistance level.

Should NEAR successfully breach this resistance, it could target $5.49, a 6% gain from current levels. Continued bullish momentum might see the token pushing toward higher levels at $7.00 and $8.27, completing the bullish pattern.

However, if NEAR fails to break the resistance, it risks a pullback toward the immediate support level of $5.00.

Render (RENDER):

Render (RENDER), priced at $6.89, is following a similar trajectory to TAO and NEAR. The token is trading within a falling wedge pattern and is advancing toward its upper resistance level.

A successful breakout above the wedge’s resistance could propel RENDER to its next target at $7.99, offering a potential upside of 15%. If the bullish trend persists, the token may aim for higher targets at $9.77 and $12.00, marking a significant recovery from current levels.

Conversely, failure to break out may result in RENDER testing its support level around $6.80 before attempting another rally.

Is A Rebound On the Horizon?

While all three tokens are consolidating within falling wedge patterns—historically bullish structures—their Relative Strength Index (RSI) indicates improving momentum near oversold levels, and the MACD shows early signs of potential bullish crossovers, suggesting a rebound could be imminent if key resistances are broken.

Bitcoin’s performance will play a crucial role in determining whether these tokens can sustain a rally or face further consolidation.

For traders, these setups present opportunities for significant gains if breakouts occur. However, caution is advised as the market remains volatile.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consider your risk tolerance before making investment decisions.