Key Takeaways

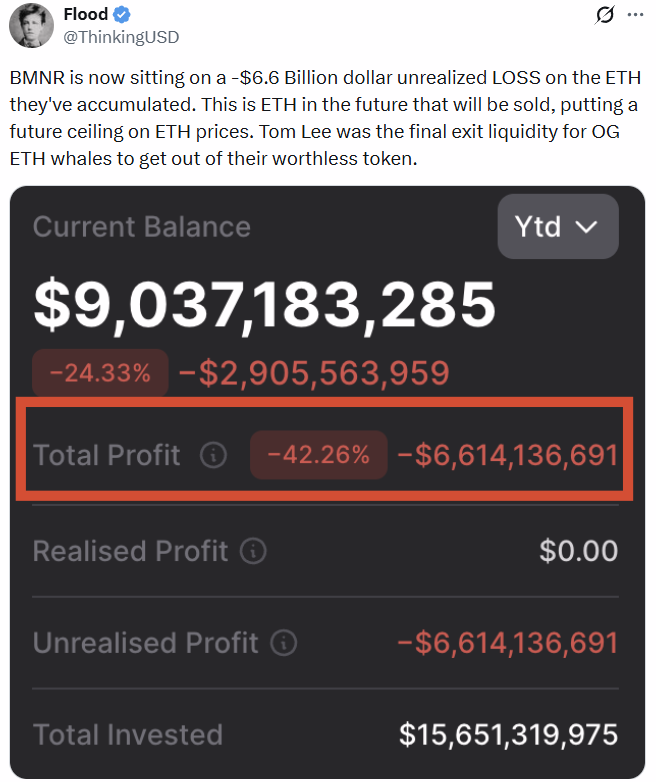

- BitMine Immersion Technologies is currently facing around $6.6 billion in unrealized ETH losses amid the broader crypto market downturn.

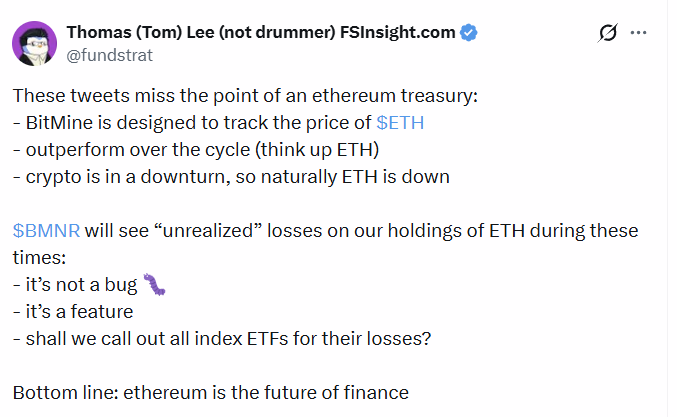

- Chairman Tom Lee says these drawdowns are “a feature, not a bug,” comparing them to temporary losses seen in traditional index ETFs.

- Despite ETH’s price weakness, on-chain activity remains strong, with record daily transactions and active addresses.

The broader crypto market is under heavy pressure this week, with Ethereum (ETH) sliding sharply alongside Bitcoin’s recent dip. Amid this downturn, BitMine Immersion Technologies (NYSE American: BMNR) — one of the largest publicly traded Ethereum treasury companies — is now facing massive unrealized losses on its ETH holdings.

According to recent estimates, BitMine is sitting on roughly $6.6 billion in paper losses, following ETH’s drop toward the $2,200–$2,400 range. However, BitMine chairman and well-known market strategist Tom Lee says this is not a failure of strategy — it’s exactly how their model is designed to work.

“It’s a Feature, Not a Bug”

Responding to criticism on social media, Lee explained that BitMine’s treasury approach mirrors how traditional index funds operate.

“Seeing unrealized losses during a crypto downturn is a feature, not a bug,” Lee said, adding that no one questions index ETFs when markets pull back.

He emphasized that BitMine is built to track Ethereum’s price over time while aiming to outperform across full market cycles, using tools like staking, DeFi participation, and long-term accumulation.

In short, temporary drawdowns are expected — especially during broader market sell-offs.

BitMine Expands ETH Holdings Despite Market Weakness

Despite the volatility, BitMine recently added 41,788 ETH worth roughly $96 million, bringing its total holdings to approximately 4.28 million ETH. That represents more than 3.5% of Ethereum’s circulating supply.

At current prices, BitMine’s ETH treasury is valued around $9–10 billion, down from a total investment cost exceeding $15 billion, with earlier purchases reportedly averaging near $4,000 per ETH.

Critics argue that such a massive position could act as a future “price ceiling” for Ethereum if BitMine ever sells. Some have even suggested the company is providing exit liquidity for early holders.

Lee pushed back strongly against that narrative.

Ethereum Fundamentals Remain Strong

While ETH price action looks weak, Lee pointed to improving on-chain metrics as a key positive signal.

Ethereum recently hit:

- All-time highs in daily transactions (around 2.5 million)

- Over 1 million active addresses

Lee noted that this kind of divergence — falling prices alongside rising network activity — did not appear during previous bear markets in 2018–2019 or 2021–2022.

In his view, current price weakness reflects temporary market conditions rather than deteriorating fundamentals.

BitMine’s Long-Term ETH Strategy Continues

BitMine is also pushing toward its ambitious “Alchemy of 5%” goal, targeting ownership of 5% of Ethereum’s total supply. The company is backed by major institutional names including Cathie Wood’s ARK Invest, Pantera Capital, Founders Fund, Galaxy Digital, Kraken, and Digital Currency Group.

More than 2.87 million ETH is already staked, and BitMine plans to launch its Made-in-America Validator Network (MAVAN) in Q1 2026 — a move that could generate recurring revenue from Ethereum validation.

Meanwhile, BMNR stock has dropped to multi-month lows amid the broader crypto sell-off.

Final Outlook

BitMine’s ETH-heavy strategy remains under intense scrutiny as the market deleverages. While skeptics question the risks of such concentrated exposure, Tom Lee remains confident in Ethereum’s long-term future.

His message is simple: volatility and unrealized losses are part of the process.

For BitMine, this downturn isn’t a warning sign — it’s a built-in phase of a long-term bet on Ethereum becoming the backbone of global finance.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.