Key Takeaways

- The U.S. Senate Banking Committee has postponed its scheduled vote on the digital asset market structure bill.

- The delay followed Coinbase CEO Brian Armstrong’s withdrawal of support for the current draft.

- Chairman Tim Scott confirmed negotiations will continue, but no new vote date has been set

The U.S. Senate Banking Committee has abruptly postponed today’s scheduled markup and vote on the long-awaited digital asset market structure legislation. The decision follows Coinbase CEO Brian Armstrong’s public declaration that the company can no longer support the current draft of the bill.

Why the Senate Crypto Bill Vote Was Cancelled

The postponement came just hours after Coinbase — one of the cryptocurrency industry’s most prominent voices and a major political spender — withdrew its backing. Committee Chairman Tim Scott (R-SC) confirmed the delay, stating that “good-faith negotiations will continue” among bipartisan lawmakers, industry stakeholders, and traditional finance groups. No new vote date has been announced.

The proposed legislation, often referred to as the Digital Asset Market Clarity Act, seeks to create a clear regulatory framework by dividing oversight between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). It also addresses tokenized assets, decentralized finance (DeFi), stablecoins, and user protections.

Coinbase’s Key Concerns With the Current Crypto Bill Draft

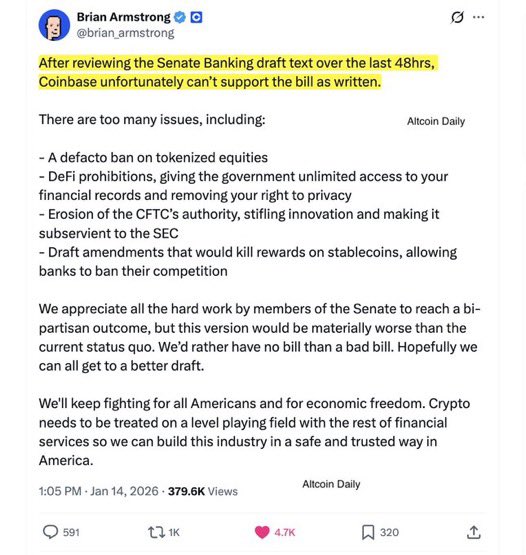

In a detailed thread posted on X, Brian Armstrong explained why Coinbase believes the Senate version is “materially worse than the status quo.” The company’s primary objections include:

- De facto ban on tokenized equities — potentially blocking blockchain-based stocks and securities innovation

- Heavy restrictions on DeFi protocols, including rules that could seriously undermine user privacy through expanded government access to transaction data

- Significant power shift from CFTC to SEC — moving more spot crypto market authority to the SEC, which many in the industry view as enforcement-first rather than innovation-friendly

- Elimination or severe limitation of stablecoin rewards/yields — a move that would hand a competitive advantage to traditional banks by reducing one of the most popular consumer features in crypto

Armstrong’s blunt assessment:

“This bill is worse than having no bill at all.”

Brian Armstrong’s Statement:

“We’d Rather Have No Bill Than a Bad Bill”The Coinbase CEO emphasized that while the company strongly supports the need for regulatory clarity, the current draft would stifle innovation, harm U.S. competitiveness, and tilt the playing field toward legacy financial institutions.“We appreciate the bipartisan effort in the Senate,” Armstrong wrote, “but crypto needs rules that put it on a level playing field — not ones that choke innovation and drive activity offshore.”

Impact on Crypto Industry

The delay highlights the intense lobbying battle surrounding stablecoin yields, DeFi oversight, and the SEC vs. CFTC jurisdictional divide. Traditional banks have pushed hard against features that could draw deposits away from conventional accounts, while crypto advocates argue that overly restrictive rules will push innovation — and jobs — to jurisdictions like Singapore, Dubai, and the EU. For now, the U.S. crypto sector remains in regulatory limbo, relying on enforcement actions and patchwork state-level rules rather than comprehensive federal legislation.

Frequently Asked Questions (FAQ)

Why did the Senate Banking Committee postpone the crypto bill vote?

The vote was postponed after Coinbase CEO Brian Armstrong publicly withdrew support for the current draft, prompting lawmakers to continue negotiations.

What is the Digital Asset Market Clarity Act?

It is proposed U.S. legislation aimed at creating a clear regulatory framework for cryptocurrencies by dividing oversight between the SEC and CFTC.

What are Coinbase’s concerns with the Senate crypto bill?

Coinbase argues the draft could restrict DeFi, limit stablecoin rewards, ban tokenized equities, and shift excessive authority to the SEC.

Does the delay mean the crypto bill is dead?

No. Senate leaders said negotiations will continue, but no new date has been announced for the vote.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.