/ Discover the impact of BlackRock tokenizing Money Market Fund on Hedera Hashgraph, leading to an 85% surge in HBAR price.

Author: Nilesh Hembade

Date: 24 Apr 2024, 08:37 AM IST

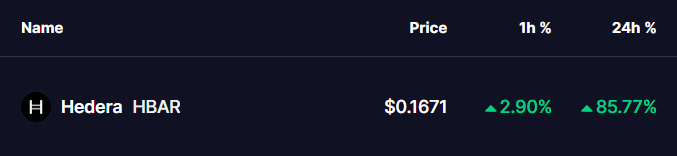

Hedera Hashgraph (HBAR) experiences a remarkable surge in price, witnessing an 85% jump, driven by a huge announcement within its ecosystem, the Real World Assets (RWA) era.

One of the defining features of the Hedera network is its focus on facilitating the tokenization of institutional RWAs on a large scale. In a significant stride towards asset management, the platform has successfully onboarded the world’s largest asset manager, BlackRock, onto its blockchain.

Today we witness #RWA history as @BlackRock’s ICS US Treasury money market fund (MMF) is tokenized on @Hedera with @ArchaxEx and @OwneraIO, marking a major milestone in asset management by bringing the world’s largest asset manager on-chain 🏦 pic.twitter.com/1Kye8cjAJx

— HBAR Foundation (@HBAR_foundation) April 23, 2024

The groundbreaking innovation comes as Archax, a London-based digital asset exchange, collaborates with Ownera and The HBAR Foundation to tokenize BlackRock’s money market fund (MMF) on the Hedera network. This milestone marks the first-ever tokenization of a MMF on Hedera, signifying a significant advancement in the real-world assets industry.

Previously, abrdn plc, the UK’s largest active wealth manager and a prominent member of the Hedera Council, had tokenized its MMFs on Hedera in 2023, marking another pivotal moment in asset management.

The @Hedera network is purpose built for institutional #RWA tokenization at scale 🏦

— HBAR Foundation (@HBAR_foundation) April 23, 2024

That's why #Hedera Governing Council @abrdn_plc, the UK's largest active wealth manager, tokenized its flagship Lux Sterling MMF on the network 👇https://t.co/eEF3yagXnK

For traders and investors, tokenized MMFs offer an attractive investment avenue, providing a safe, liquid, and stable option to preserve capital and manage cash effectively. Additionally, tokenization enables users to trade shares on platforms like Archax, with added benefits such as expedited transfers and collateral deployment.

Shayne Higdon, CEO of The HBAR Foundation, stated the significance of MMF tokenization on Hedera, emphasizing the platform’s unmatched speed, security, and low-cost infrastructure, which aligns with BlackRock CEO Larry Fink’s recent remarks on the tokenization of financial assets enabling instantaneous settlement.

The news of BlackRock’s entry into the Hedera ecosystem propels HBAR’s price to surge by 85%, reaching $0.1695 at the time of reporting. The market cap also witnesses a substantial increase of 88% over the past 24 hours. Strong trading activity at current price levels indicates robust support, suggesting the potential for further price gains. However, profit-taking could lead to a temporary downturn in HBAR’s price.

In essence, the tokenization of BlackRock’s MMF on Hedera marks a significant milestone in the evolution of blockchain-based asset management, highlighting the platform’s growing prominence in the realm of real-world asset tokenization.