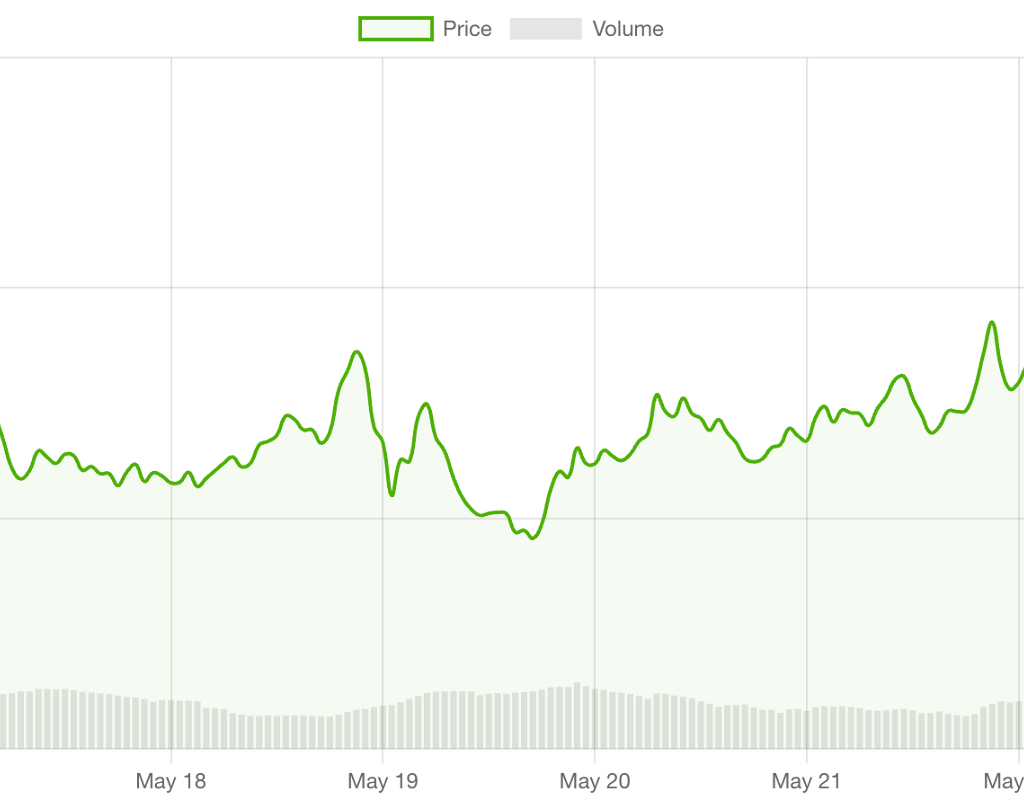

Ondo Finance has steadily become a central player in the growing world of real-world asset (RWA) tokenization. After launching its token (ONDO) in January 2024 and reaching an all-time high of $2.13 within the year, the project has continued to attract both institutional partners and attention from the broader crypto market. As of May 2025, ONDO is priced at $1.01 and boasts a market cap of over $1.4 billion.

Given its strong foundation, high-profile partnerships with BlackRock and PayPal, and active development of products like Ondo Chain and USDY, market analysts are now asking: what’s next for ONDO? The projections suggest 2026 could be a breakout year, but several macro and sector-specific variables will play defining roles.

Ondo Price Prediction 2026: $2 or $8?

According to analysts, the Ondo price prediction for 2026 is optimistic but dependent on a few critical factors. Bullish scenarios suggest ONDO could reach between $5 and $8 if tokenization sees wider adoption and if institutional demand accelerates. This aligns with the vision BlackRock CEO Larry Fink projected, estimating the RWA tokenization sector could be worth over $1 trillion by the decade’s end.

Should the 2025 uptrend hold into 2026, Ondo’s price could double from its current levels and challenge the $8 mark. Regulatory clarity in the United States would provide a strong tailwind, especially if favorable frameworks are implemented for issuing tokenized securities. The launch of Ondo Chain and successful expansion of the Nexus platform, which simplifies treasury trading, could serve as major catalysts.

However, if bears regain control, ONDO may consolidate below $2. This would likely occur in a scenario where regulation becomes more restrictive or if competitors in the RWA tokenization space—such as Ripple or Tether Holdings—pull ahead in institutional integrations.

The Role of Partnerships and Institutional Adoption

What differentiates Ondo Finance is its deep institutional focus. In Q1 and Q2 of 2025, the platform made strategic alliances with Google Cloud and custody providers like Copper and Komainu. These moves aim to simplify access to tokenized treasuries for large asset managers, trading firms, and fintech platforms.

Moreover, its integration with Pendle has enabled more dynamic strategies such as yield trading on tokenized RWAs. By unbundling yield and principal exposure, Ondo is positioning itself as not just a tokenization provider but also a liquidity and financial engineering innovator. Such features could attract more DeFi-native and TradFi participants in 2026.

If Ondo can continue this pace of development and institutional onboarding, hitting the $8 price target may not be out of reach. On the other hand, any delay in product rollouts or declining macroeconomic confidence could dampen momentum.

Regulatory Developments and Market Conditions

2026 will likely be shaped by the evolving stance of U.S. regulators on crypto assets and tokenized securities. In April 2025, Ondo representatives met with the SEC Crypto Task Force to discuss forming a comprehensive framework for RWAs. Should these dialogues lead to concrete guidelines, it could remove one of the last barriers preventing large institutions from jumping into RWA tokenization full-throttle.

Additionally, macroeconomic indicators such as interest rates and inflation will influence market behavior. If the Federal Reserve maintains elevated interest rates, tokenized treasuries like those offered through OUSG and USDY may gain appeal, further boosting ONDO’s ecosystem. Conversely, a drop in yields might dampen tokenization demand and curb ONDO’s potential upside.

Qubetics: The Rising Power Behind the Curtain

While Ondo captures headlines, Qubetics is quietly assembling what could be one of the most robust blockchain infrastructures of 2025–2026. Its focus on interoperability, especially through its Non-Custodial Multi-Chain Wallet, positions it as a unique alternative in the Web3 space. This wallet enables seamless interaction across major chains, granting users full custody and fluid control over their digital assets in one intuitive dashboard.

For developers, enterprises, and general users, the implications are profound. A startup in Toronto, for example, can now interact with both Ethereum smart contracts and Solana DeFi protocols without switching platforms. Or consider a logistics company in Southeast Asia needing secure access to private data across several blockchains—Qubetics’ interoperable design addresses these real-world pain points.

More than just a wallet, this multi-chain tool could become the default interface for the cross-chain economy. As other wallets focus narrowly on singular ecosystems, Qubetics’ approach supports broad participation in the next-generation internet without friction. Its identity as the first Web3 aggregator across leading blockchain platforms only adds to its appeal.

Qubetics Presale: The Best Crypto for Huge Gains?

Qubetics’ crypto presale continues to gain momentum. In Stage 36, tokens are priced at $0.3064, with more than 514 million $TICS tokens sold and over 27,100 wallets holding the asset. With a tally surpassing $17.4 million, this is one of the most actively funded presales in 2025. Each 7-day round ends with a 10% price bump, reinforcing structured entry incentives. For those analyzing upside potential, the projections are strong: $TICS at $1 yields 226.32% ROI, at $5 equals 1,531.58%, and at $15 following the Q2 2025 mainnet launch, returns may exceed 4,794.74%. With institutional-grade tooling and a maturing ecosystem, Qubetics has clearly emerged as the best crypto to watch now for those interested in real-world asset rails and advanced development tools.

Unlike many presales, Qubetics’ approach is highly structured. Each stage runs only for 7 days, with a 10% price increase implemented every Sunday at midnight. This cadence encourages commitment and timing precision from participants, helping the platform maintain both scarcity and excitement.

Conclusion: Diversifying for the Win

Both Ondo and Qubetics are taking very different roads, yet both aim to redefine how blockchain integrates into the global financial fabric. Ondo’s success is deeply tied to the institutional world’s embrace of tokenized assets, while Qubetics is building a framework for everyday and enterprise-level use through interoperability and decentralized wallet access.

From a portfolio perspective, those tracking Ondo Price Prediction 2026 should remain watchful of regulatory shifts and partnership momentum. But for those seeking a high-reward presale with bold projections and a real product roadmap, Qubetics could be the dark horse with serious potential.

In this context, it wouldn’t be far-fetched to consider Qubetics not just as a presale, but as the best crypto presale currently active—one that’s increasingly viewed as the best crypto for huge gains over the next market cycle.

For More Information:

Qubetics: https://qubetics.com

Presale: https://buy.qubetics.com/

Telegram: https://t.me/qubetics

Twitter: https://x.com/qubetics

Disclaimer: This article is a sponsored press release for informational purposes only. Coinsprobe does not endorse or guarantee the accuracy, quality, or reliability of any content, products, or services mentioned. The views expressed do not reflect those of Coinsprobe and are not financial, legal, or investment advice. Investing in crypto assets carries significant risk. Readers should conduct their own research and act at their own risk. Coinsprobe is not liable for any losses or damages arising from reliance on this content.