Date: Fri, March 21, 2025 | 05:15 AM GMT

In the cryptocurrency market, one of the strongest performers from the RWA narrative, Mantra (OM), which has surged 70% over the last 90 days despite the broader bearish conditions, is now gaining attention with massive accumulation. Recent on-chain data reveals that large holders have been aggressively accumulating OM, hinting at a potential major move ahead.

Massive Accumulation Detected

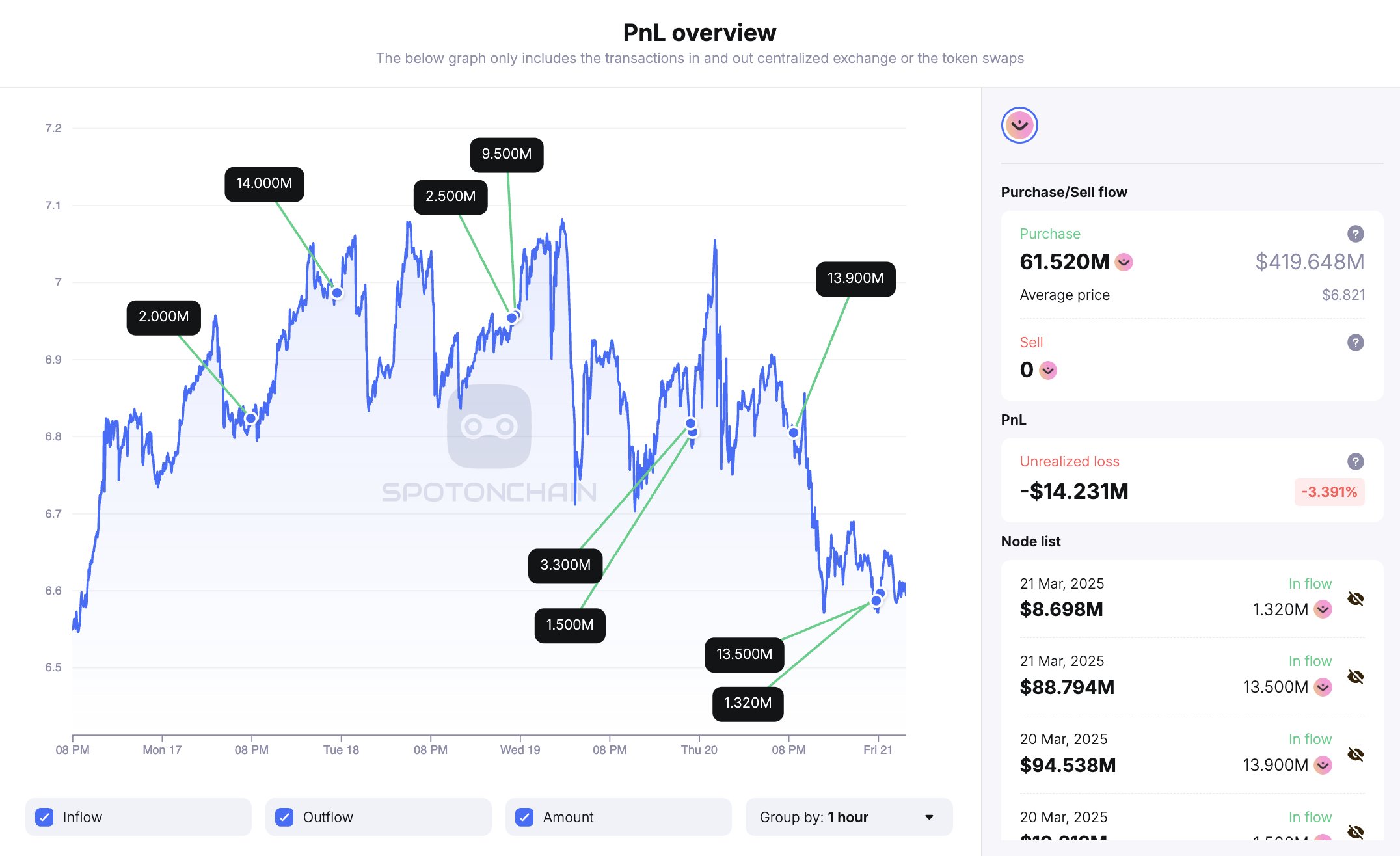

According to SpotOnChain, a major accumulation event has occurred over the past four days. A total of 61.52 million OM tokens, representing 3.4% of the total supply, were withdrawn from Binance by 19 fresh wallets, which may belong to a single entity. The purchases took place at an average price of $6.82, amounting to a staggering $420 million.

Despite this massive accumulation, the entity currently holds an unrealized loss of $14.2 million, reflecting a 3.39% decline. The size and timing of this accumulation indicate that large investors are positioning themselves for a potential bullish move in OM, even as the market experiences short-term corrections.

Double Bottom Formation?

The technical chart of OM suggests that a classic double bottom pattern may be forming, a structure often associated with bullish reversals. This pattern occurs when an asset finds support at a key level twice, signaling that sellers are losing strength while buyers begin to step in.

OM initially bounced from the $6 support level to its neckline of $7.06, but a second bottom test of this zone may be underway as it loses its 50-day moving average (MA) support.

If the price successfully holds this level and reverses upward, it could confirm the double bottom pattern, setting the stage for a breakout above the neckline at $7.06. If this breakout occurs with strong volume, it could lead to a significant recovery rally targeting the next major resistance levels at $8.19 and $9.08.

However, if OM fails to hold the $6 support zone, this pattern would be invalidated, increasing the likelihood of further downside. Traders will need to closely watch how price action develops in the coming days.

Final Thoughts

OM is at a critical juncture where both accumulation data and technical indicators point to a potential bullish reversal. If large buyers continue to accumulate and OM successfully defends the $6 support zone, the probability of a double bottom breakout increases. However, broader market factors, including Bitcoin’s performance and Ethereum’s price action, will play a crucial role in determining whether OM can sustain its momentum or face further downside pressure.

The coming days will be pivotal in deciding whether OM can establish a strong uptrend or if sellers will regain control.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.