Date: Sun, Dec 15, 2024, 08:11 AM GMT

In the cryptocurrency market today, we are witnessing a correction phase in major altcoins following their strong rallies over the past month.

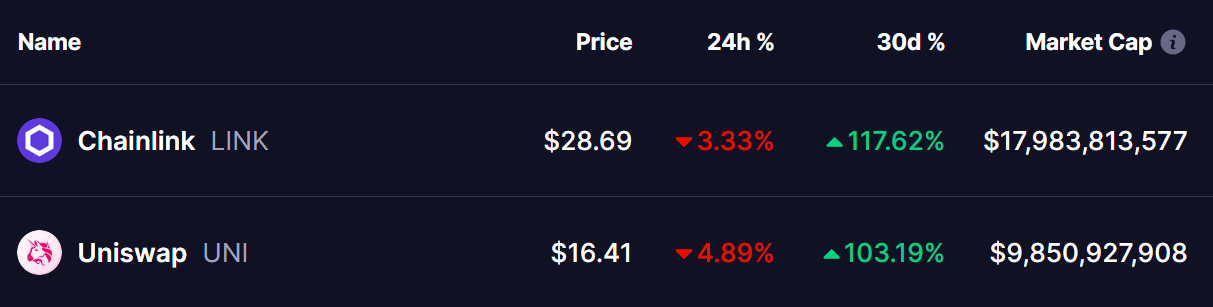

Chainlink (LINK) and Uniswap (UNI), which posted impressive gains of 117% and 103% respectively in the last 30 days, are now trading in the red as they undergo a healthy correction. Both tokens are retesting key support levels after successfully breaking through major resistance zones

Chainlink (LINK):

Chainlink (LINK) recently delivered an impressive 117% monthly rally, with price jumping from its monthly low of $14 to a recent high of $30.94. This breakout gained momentum following accumulation news linked to Donald Trump’s World Liberty Financial, which fueled investor interest.

Currently, LINK is retesting its key resistance zone near $28.60, which is acting as support. This correction phase is a healthy sign, allowing LINK to confirm its breakout before potentially heading higher.

What’s Next for LINK?

- If LINK manages to reverse from this support level, it could approach its next major resistance at $38.30, marking a 34% gain from current levels.

- The RSI (Relative Strength Index) indicates slightly overbought conditions, so a bounce with strength will be critical for continuation.

Uniswap (UNI):

Uniswap (UNI) has followed a similar trajectory, breaking out of its multi-year resistance zone to rally 108% in the last 30 days. UNI’s price surged to a high of $19.35 before facing correction, with the broader market cooling down.

At present, UNI is retesting its former resistance level near $16.40, now turned into support. A successful retest here could act as a springboard for further gains.

What’s Next for UNI?

- If UNI reverses from this support zone, it could aim for the next resistance levels at $20.26 and $23.30, representing a potential 41% upside from the current price.

- The RSI for UNI remains neutral, offering room for a recovery bounce in the coming sessions.

What To Expect Ahead?

Both LINK and UNI are showing resilience as they confirm their recent breakouts with retests. This is often seen as a bullish continuation pattern, suggesting the tokens may be gearing up for another move higher. However, Bitcoin dominance and overall market sentiment will play a pivotal role in determining whether these reversals materialize.

For investors, watching these critical support levels—$28.60 for LINK and $16.40 for UNI—will be essential. A bounce with strong volume could mark the beginning of another leg up in their bullish trends.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.