(11 June 2024, 23:49 PM IST):

In the cryptocurrency market today, we are witnessing a major dip in the last 48 hours. Bitcoin prices fell to $66,000 from $70,000, and Ethereum dropped to $3,450 from $3,700. This fall has also affected major altcoins and meme coins. Trending tokens like Notcoin (NOT) dipped by 23%, Jamsycoin is down by 16%, Pepecoin by 9%, and Worldcoin by 16%.

The Primary Reasons Behind This Fall

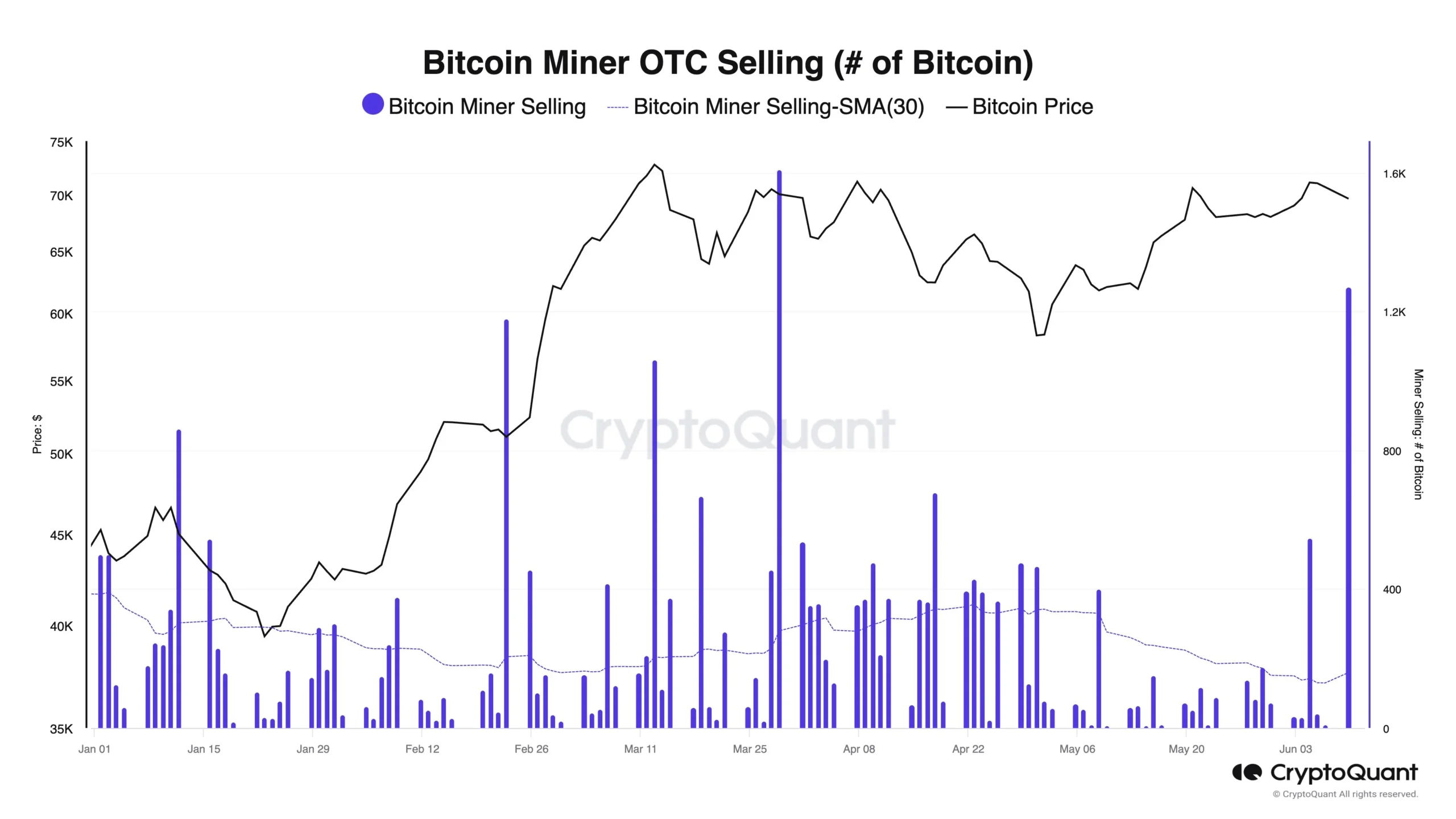

1.Sell-Off by Bitcoin Miners:

According to CryptoQuant, yesterday saw the largest daily miner-selling volume since late March, with 1,200 Bitcoin being sold. Some big mining companies have been offloading a portion of their reserves.

2.US Bitcoin ETF Outflow:

Eleven U.S. spot bitcoin exchange-traded funds saw a daily net outflow of $64.93 million on Monday, ending their longest inflow streak of 19 days.

3.FOMC Meeting:

This sell-off in the cryptocurrency market can be attributed to Federal Open Market Committee (FOMC) meeting. This is an important week for investors in both the equities and crypto markets, with the FOMC meeting expected to commence during US business hours on Tuesday. Additionally, the Bureau of Labor Statistics (BLS) will release the Consumer Price Index (CPI) on Wednesday.

How to Handle Sudden Crashes and Dips?

1. Hold is Gold

The first instinct during a crash might be to panic sell, but fire sales rarely benefit anyone but bargain hunters. If you invested in a solid project with strong fundamentals, a temporary dip shouldn’t be a reason to jump ship. Remember, you haven’t lost money unless you sell at a loss. Holding on to your investments can often be the best strategy during a market downturn.

2. Stop-Loss Orders:

Imagine you’re on a dream vacation but you set a budget before you leave. Stop-loss orders work the same way. You set a price point where your coins automatically sell if the market dips below that level. It’s like having a safety net to prevent you from falling too far during a crash. Just be careful not to set it too tight, or normal market fluctuations might trigger a sale you didn’t intend.

3. Lose Only What You Can Afford

Investing in cryptocurrencies can be highly volatile, so it’s crucial to only invest what you can afford to lose. This mindset can help you stay calm during market dips and avoid making impulsive decisions that could lead to significant losses.

Conclusion

Handling sudden crashes and dips in the cryptocurrency market requires a steady hand and a clear strategy. By holding onto solid investments, setting smart stop-loss orders, and only risking what you can afford to lose, you can weather market downturns more effectively. Remember, the crypto market is volatile, but with patience and planning, you can navigate through its fluctuations with confidence.

Add a Comment