Date: Tue, Dec 02, 2025 | 03:40 PM GMT

The broader cryptocurrency market is showing signs of a relief bounce following yesterday’s heavy selloff. Both Bitcoin (BTC) and Ethereum (ETH) have posted strong 8% 24-hour gains, helping several beaten-down memecoins recover, including Fartcoin (FARTCOIN).

FARTCOIN has surged more than 30% today, but what makes this move particularly interesting is the emerging technical structure on its chart — one that could indicate a much larger upside move ahead.

Harmonic Pattern Hints at Potential Upside

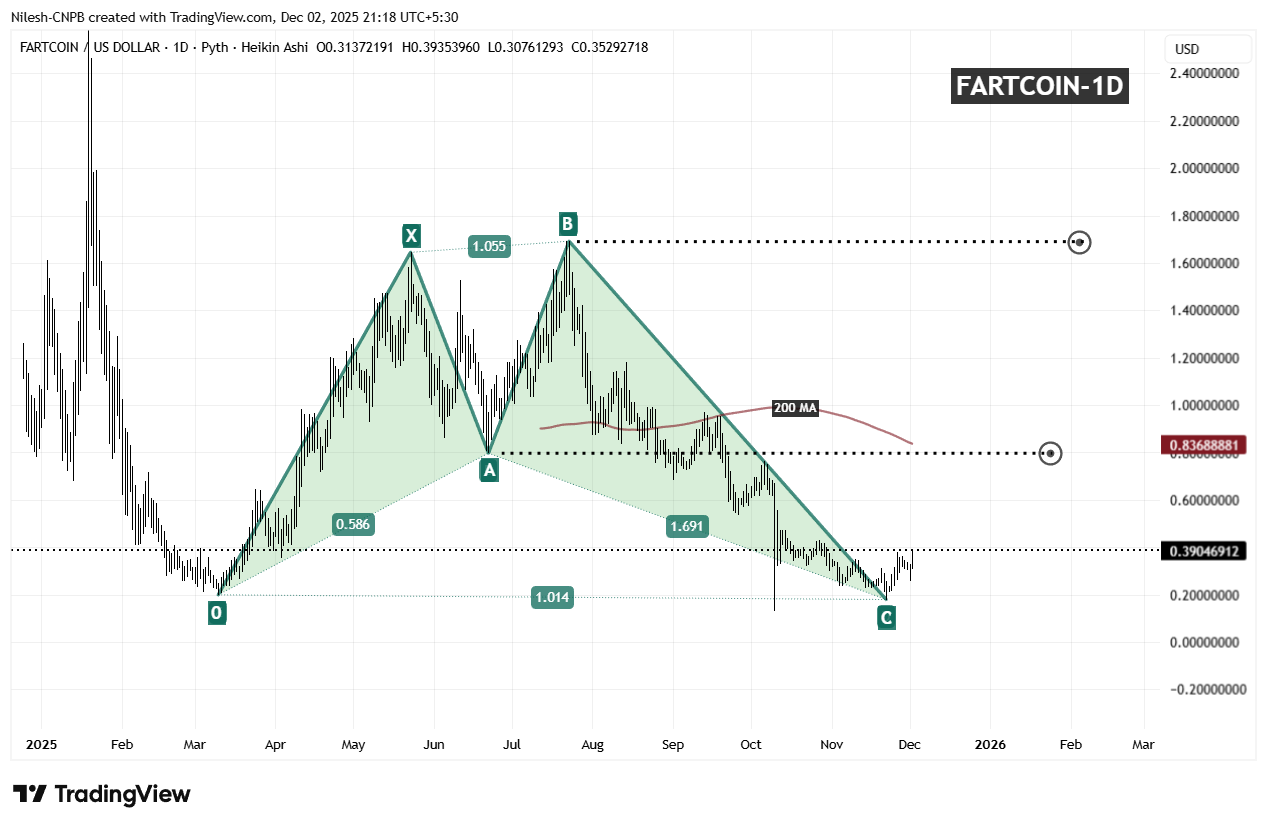

On the daily chart, FARTCOIN appears to be completing a Bullish Shark harmonic pattern, a formation often associated with strong reversal phases when price exhausts its downside momentum.

The pattern began with the initial O-X impulse around $0.1990, followed by a sharp rise to point X near $1.055. Price then retraced toward point A, climbed again to form point B around $1.691, and has since declined steadily into point C, forming near the $0.17–$0.18 range.

This C-leg completion is crucial, as it typically marks the reversal zone for a Shark pattern. And right on cue, buyers have stepped back in, pushing FARTCOIN higher and establishing early signs of recovery. The token now trades around $0.3904, showing renewed strength off its harmonic support zone.

What’s Next for FARTCOIN?

If this harmonic structure continues to play out as expected, FARTCOIN may be gearing up for a more extended upside move. The first major level to watch sits near $0.83, which aligns with a previous supply zone as well as the 200-day moving average. A breakout above this zone could open the doors for a larger upside target around the $1.69 region — the same area where the B-leg previously peaked.

However, failure to hold above the C-leg region could invalidate the harmonic setup and expose the price to a deeper pullback. For now, though, the pattern remains intact, and momentum is beginning to shift back in favor of the bulls.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.