Date: Wed, Jan 08, 2025, 12:22 PM GMT

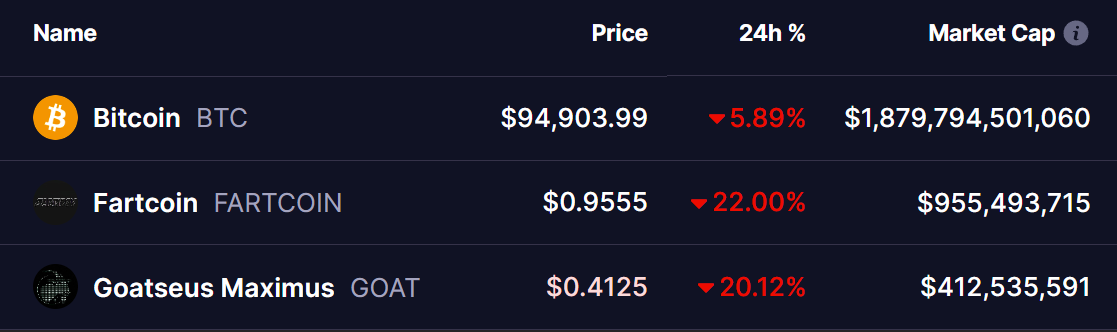

The cryptocurrency market has been reeling from a sharp downturn over the past 24 hours, with Bitcoin (BTC) experiencing a 5% decline. This dip triggered liquidations amounting to $690 million, as reported by Coinglass. Alongside this, BTC dominance has risen to 58% from yesterday’s low of 57.52%.

This bearish wave has extended to the broader market, significantly affecting altcoins and memecoins. Among the hardest-hit are Fartcoin (FARTCOIN) and Goatseus Maximus (GOAT), which have both seen double-digit losses of over 20% each, pushing them to key support levels..

Fartcoin (FARTCOIN)

FARTCOIN’s downtrend began on January 3rd, shortly after reaching an all-time high of $1.61. The subsequent decline accelerated, with today’s 16% drop driving the token into a critical support zone around $0.95.

Technical Indicators:

- MACD: The MACD is showing signs of bottoming out, similar to its behavior before last month’s rally.

- RSI: The Relative Strength Index (RSI) has entered oversold territory, hinting at potential reversal signals.

If this $0.95 support level holds, FARTCOIN could stage a recovery rally, with the next major resistance sitting at $1.30. However, failure to defend this zone may lead to further declines, with the next support target near $0.80.

Goatseus Maximus (GOAT)

GOAT has been trapped within a falling wedge pattern and recently faced rejection at the wedge’s resistance near $0.60. Today’s additional losses pushed the price down to its key support level at $0.41, marking a significant test for the memecoin.

Technical Indicators:

- RSI: The RSI is deep in oversold territory, mirroring conditions observed before last month’s price bounce.

- MACD: Bearish momentum appears to be waning, hinting at a potential shift if buyers step in.

If the $0.42 support zone holds, GOAT could initiate a recovery move toward the wedge’s upper resistance level. On the flip side, a breakdown below this support may open the door for further losses.

Key Takeaways:

Both FARTCOIN and GOAT are at pivotal levels. Traders and investors should keep a close eye on whether these supports hold. If so, a relief rally could be in store. However, the broader market sentiment, dictated largely by Bitcoin’s performance, will likely play a crucial role in determining the next moves for these memecoins.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments are highly speculative and involve significant risk. Always do your own research before investing.