Date: Tue, March 25, 2025 | 08:10 AM GMT

The cryptocurrency market is showing strong signs of a rebound as Bitcoin (BTC) and Ethereum (ETH) both surged by 4% and 8% over the past seven days. This has provided much-needed relief to altcoins that suffered sharp corrections following the late 2024 rallies.

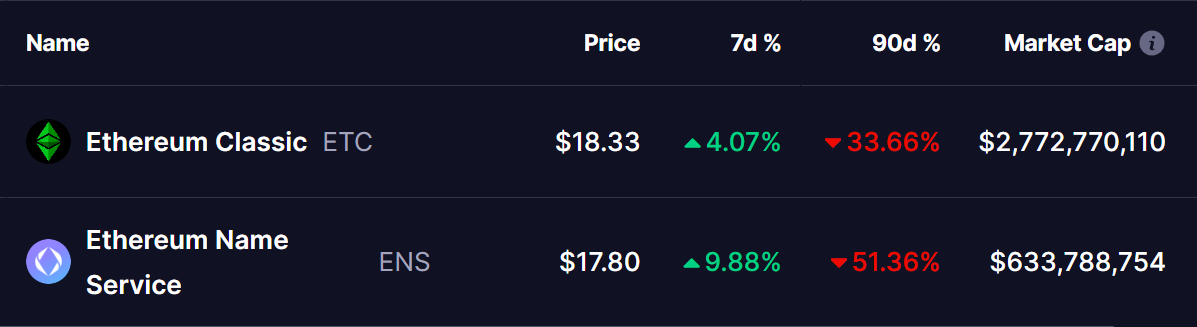

As sentiment gradually improves, tokens like Ethereum Classic (ETC) and Ethereum Name Service (ENS) are beginning to stir after a facing sharp correction over the past 90 days.

Ethereum Classic (ETC) Breaks Out of Falling Wedge

ETC has decisively broken out of a falling wedge pattern, a bullish technical formation that typically signals a trend reversal. After weeks of consolidation, the token surged past the upper trendline of the wedge around $17.71, confirming renewed buying interest.

Following this breakout, ETC has climbed to $18.24, and if it maintains this bullish momentum, the next key resistance levels lie at the 50-day moving average and the $21.90 price zone. A strong push above these levels could open the doors for a rally toward the $29.00 region, representing a potential 58% upside from current levels.

ENS Gearing Up for a Potential Breakout

ENS has followed a similar structure to ETC, trading inside a falling wedge since reaching its all-time high of $50.50 on January 16. The token recently bounced off its lower trendline support at $15.14 and is now trading at $17.76, approaching a critical breakout zone.

A confirmed breakout and successful retest of the wedge’s upper boundary could drive ENS towards its 50-day moving average and the $24.59 resistance zone. A sustained rally from there could lead to a push toward the $29.00 level and the 100-day moving average, marking a potential 64% upside from current levels.

Final Thoughts

ETC’s breakout has set the stage for further upside, while ENS remains at a crucial decision point. If ENS follows ETC’s trajectory, traders could witness a strong bullish move in the coming days.

As always, market participants should closely monitor price action, volume confirmation, and key resistance levels before making investment decisions.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.